Answered step by step

Verified Expert Solution

Question

1 Approved Answer

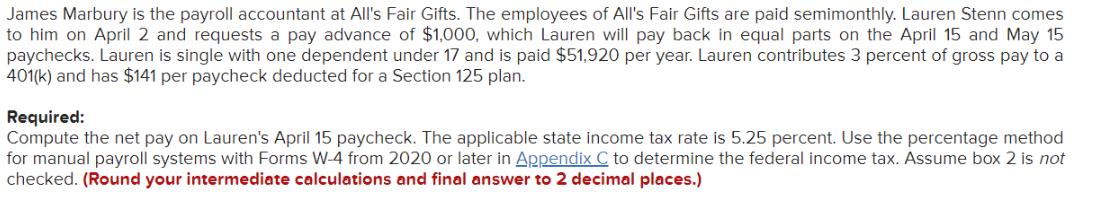

James Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Lauren Stenn comes to him

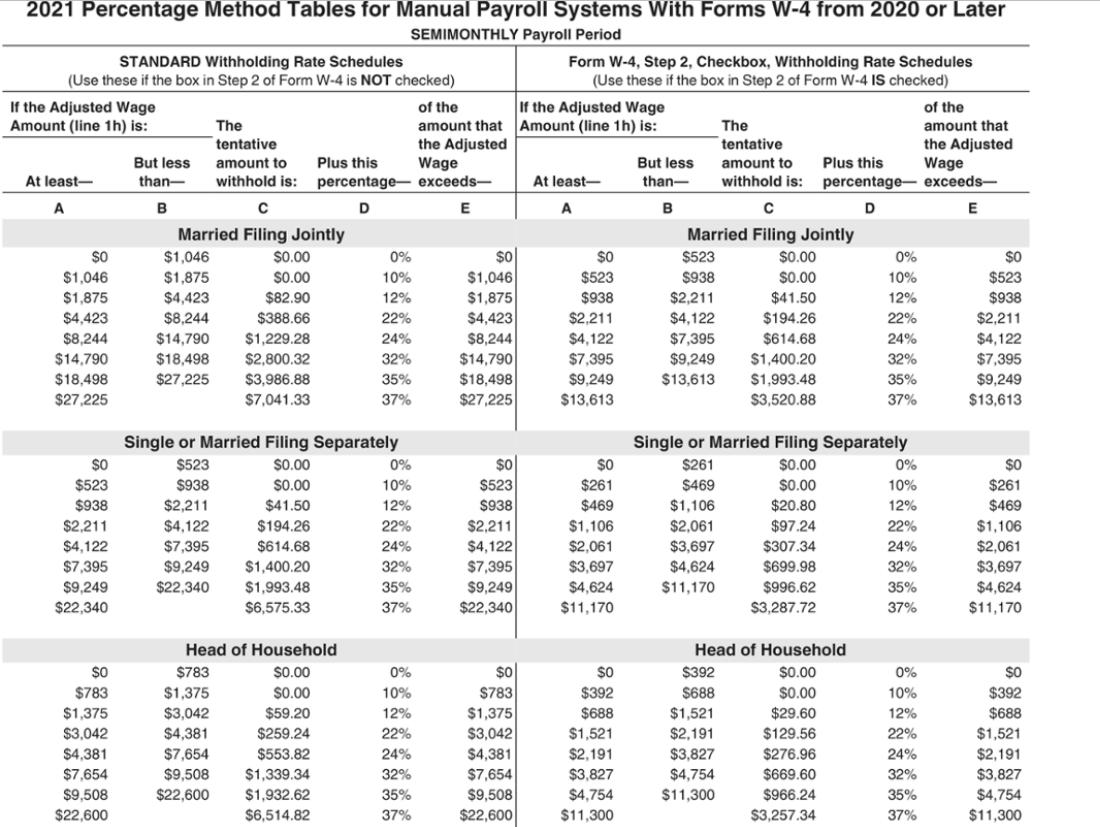

James Marbury is the payroll accountant at All's Fair Gifts. The employees of All's Fair Gifts are paid semimonthly. Lauren Stenn comes to him on April 2 and requests a pay advance of $1,000, which Lauren will pay back in equal parts on the April 15 and May 15 paychecks. Lauren is single with one dependent under 17 and is paid $51,920 per year. Lauren contributes 3 percent of gross pay to a 401(k) and has $141 per paycheck deducted for a Section 125 plan. Required: Compute the net pay on Lauren's April 15 paycheck. The applicable state income tax rate is 5.25 percent. Use the percentage method for manual payroll systems with Forms W-4 from 2020 or later in Appendix C to determine the federal income tax. Assume box 2 is not checked. (Round your intermediate calculations and final answer to 2 decimal places.) 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 from 2020 or Later SEMIMONTHLY Payroll Period STANDARD Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) If the Adjusted Wage Amount (line 1h) is: At least- A SO $1,046 $1,875 $4,423 $8,244 $14,790 $18,498 $27,225 $0 $523 $938 $2,211 $4,122 $7,395 $9,249 $22,340 $O $783 $1,375 $3,042 $4,381 $7,654 $9,508 $22,600 But less than- B The tentative amount to withhold is: Married Filing Jointly $1,046 $1,875 $4,423 $8,244 $14,790 $1,229.28 $18,498 $2,800.32 $27,225 $3,986.88 $7,041.33 $0.00 $0.00 $82.90 $388.66 $7,395 $9,249 $22,340 Plus this percentage D 0% 10% 12% 22% 24% Single or Married Filing Separately $523 $0.00 $938 $0.00 $2,211 $41.50 $4,122 $194.26 $614.68 $1,400.20 $1,993.48 $6,575.33 Head of Household $783 $0.00 $1,375 $0.00 $3,042 $59.20 $4,381 $259.24 $7,654 $553.82 $9,508 $1,339.34 $22,600 $1,932.62 $6,514.82 32% 35% 37% 0% 10% 12% 22% 24% 32% 35% 37% 0% 10% 12% 22% 24% 32% 35% 37% of the amount that the Adjusted Wage exceeds- E $0 $1,046 $1,875 $4,423 $8,244 $14,790 $18,498 $27,225 $0 $523 $938 $2,211 $4,122 $7,395 $9,249 $22,340 $0 $783 $1,375 $3,042 $4,381 $7,654 $9,508 $22,600 Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: At least- A $0 $523 $938 $2,211 $4,122 $7,395 $9,249 $13,613 $0 $261 $469 $1,106 $2,061 $3,697 $4,624 $11,170 $0 $392 $688 $1,521 $2,191 $3,827 $4,754 $11,300 But less than- B $523 $938 Married Filing Jointly $0.00 $0.00 $41.50 $194.26 $7,395 $614.68 $9,249 $1,400.20 $13,613 $1,993.48 $3,520.88 $2,211 $4,122 The tentative amount to withhold is: $469 $1,106 $2,061 $3,697 $4,624 $11,170 Plus this percentage- D Single or Married Filing Separately $261 $0.00 $0.00 $20.80 $97.24 $307.34 $699.98 $996.62 $3,287.72 $392 $688 $1,521 $2,191 $3,827 $4,754 $11,300 Head of Household $0.00 $0.00 $29.60 $129.56 $276.96 $669.60 $966.24 $3,257.34 0% 10% 12% 22% 24% 32% 35% 37% 0% 10% 12% 22% 24% 32% 35% 37% 0% 10% 12% 22% 24% 32% 35% 37% of the amount that the Adjusted Wage exceeds- E $0 $523 $938 $2,211 $4,122 $7,395 $9,249 $13,613 $0 $261 $469 $1,106 $2,061 $3,697 $4,624 $11,170 SO $392 $688 $1,521 $2.191 $3,827 $4,754 $11,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the net pay on Laurens April 15 paycheck we need to follow these steps considering the pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started