Answered step by step

Verified Expert Solution

Question

1 Approved Answer

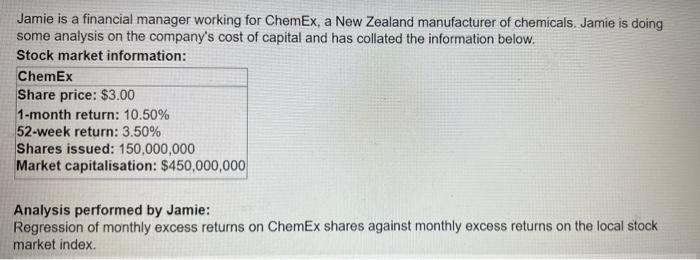

Jamie is a financial manager working for ChemEx, a New Zealand manufacturer of chemicals. Jamie is doing some analysis on the company's cost of

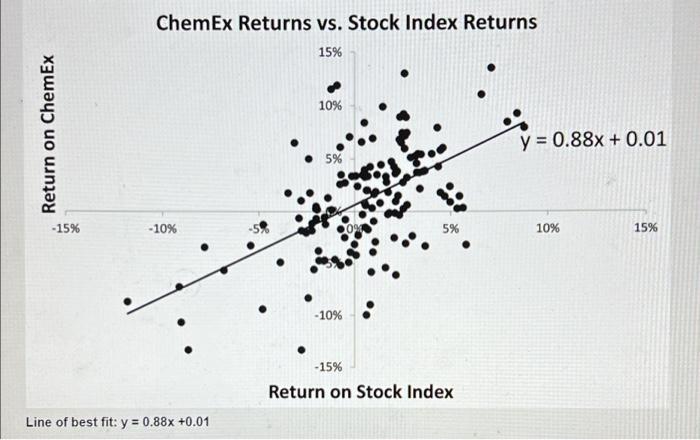

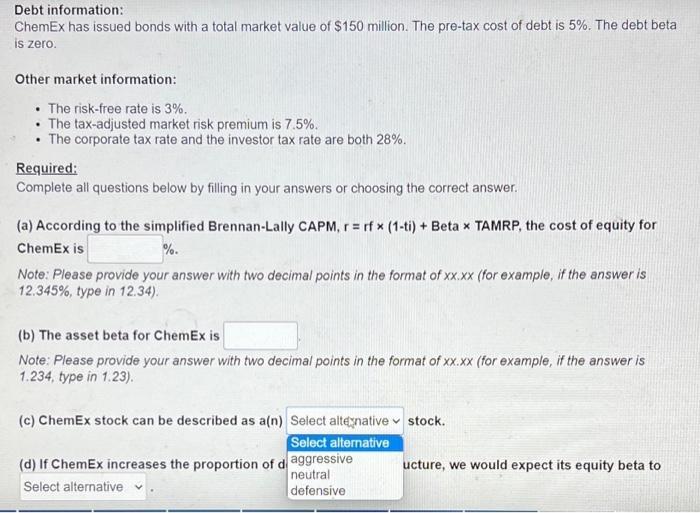

Jamie is a financial manager working for ChemEx, a New Zealand manufacturer of chemicals. Jamie is doing some analysis on the company's cost of capital and has collated the information below. Stock market information: ChemEx Share price: $3.00 1-month return: 10.50% 52-week return: 3.50% Shares issued: 150,000,000 Market capitalisation: $450,000,000 Analysis performed by Jamie: Regression of monthly excess returns on ChemEx shares against monthly excess returns on the local stock market index. Return on ChemEx -15% -10% ChemEx Returns vs. Stock Index Returns 15% -10% 10% Line of best fit: y = 0.88x +0.01 -15% Return on Stock Index y=0.88x+0.01 5% 10% 15% Debt information: ChemEx has issued bonds with a total market value of $150 million. The pre-tax cost of debt is 5%. The debt beta is zero. Other market information: The risk-free rate is 3%. The tax-adjusted market risk premium is 7.5%. . The corporate tax rate and the investor tax rate are both 28%. Required: Complete all questions below by filling in your answers or choosing the correct answer. (a) According to the simplified Brennan-Lally CAPM, r = rf x (1-ti) + Beta x TAMRP, the cost of equity for ChemEx is %. Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 12.345%, type in 12.34). (b) The asset beta for ChemEx is Note: Please provide your answer with two decimal points in the format of xx.xx (for example, if the answer is 1.234, type in 1.23). (c) ChemEx stock can be described as a(n) Select alternative stock. Select alternative (d) If ChemEx increases the proportion of di aggressive Select alternative neutral defensive ucture, we would expect its equity beta to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started