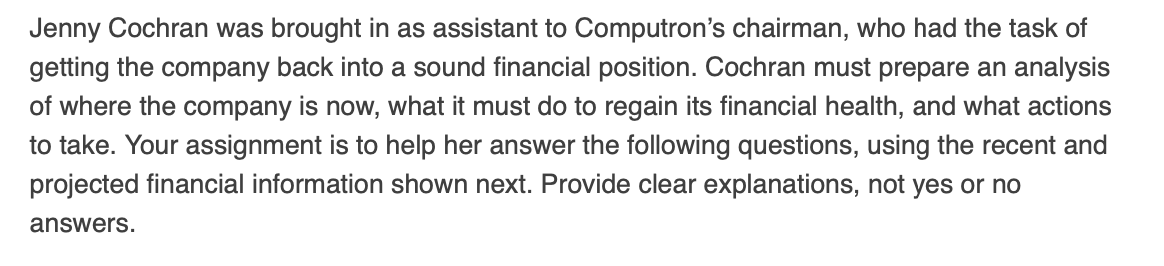

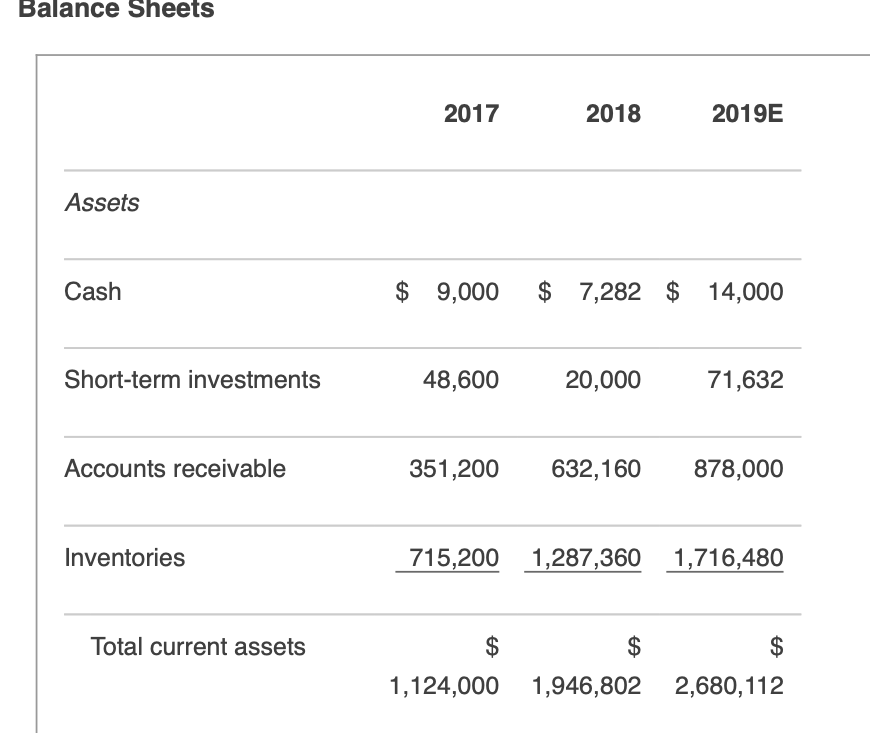

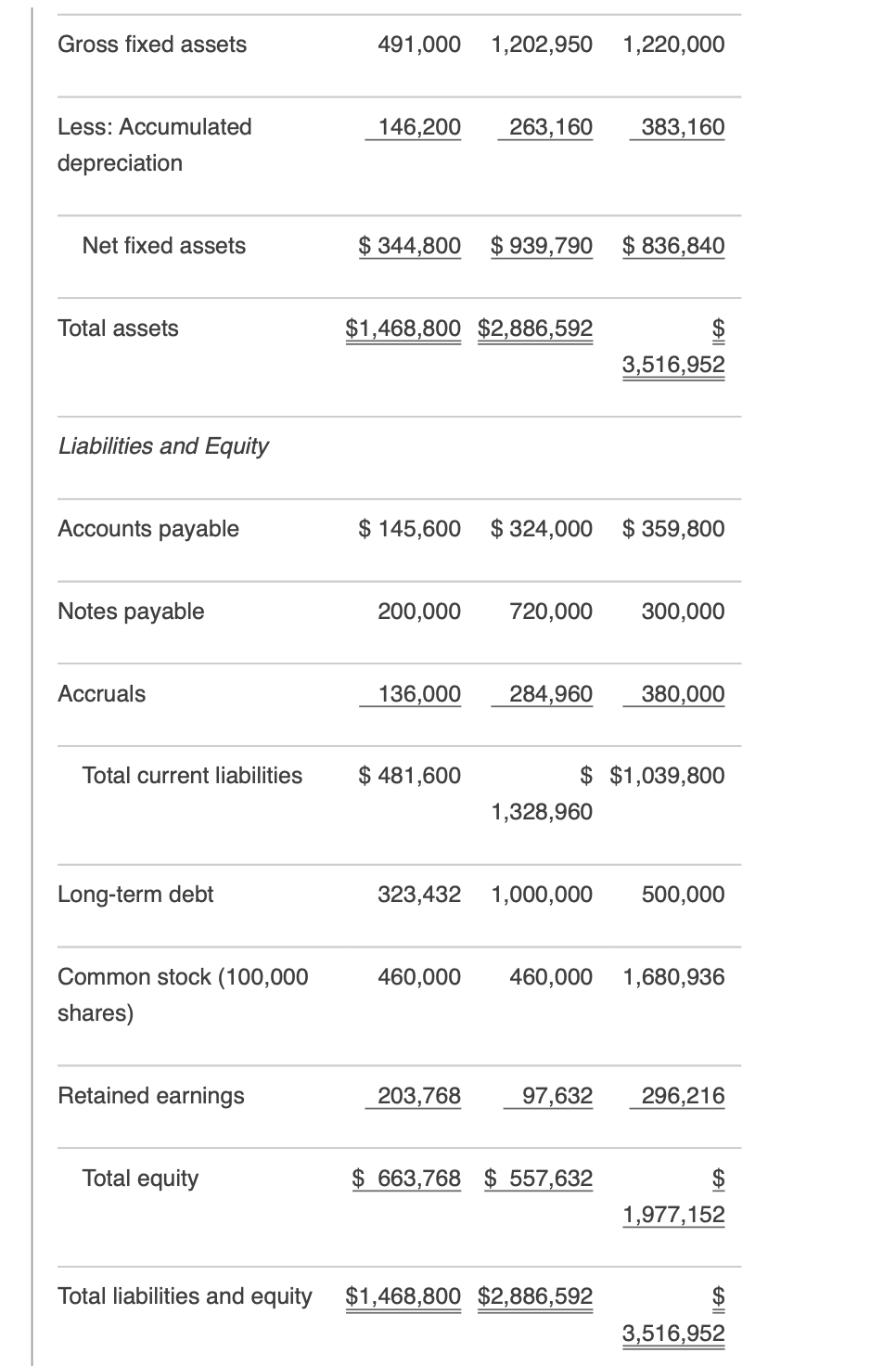

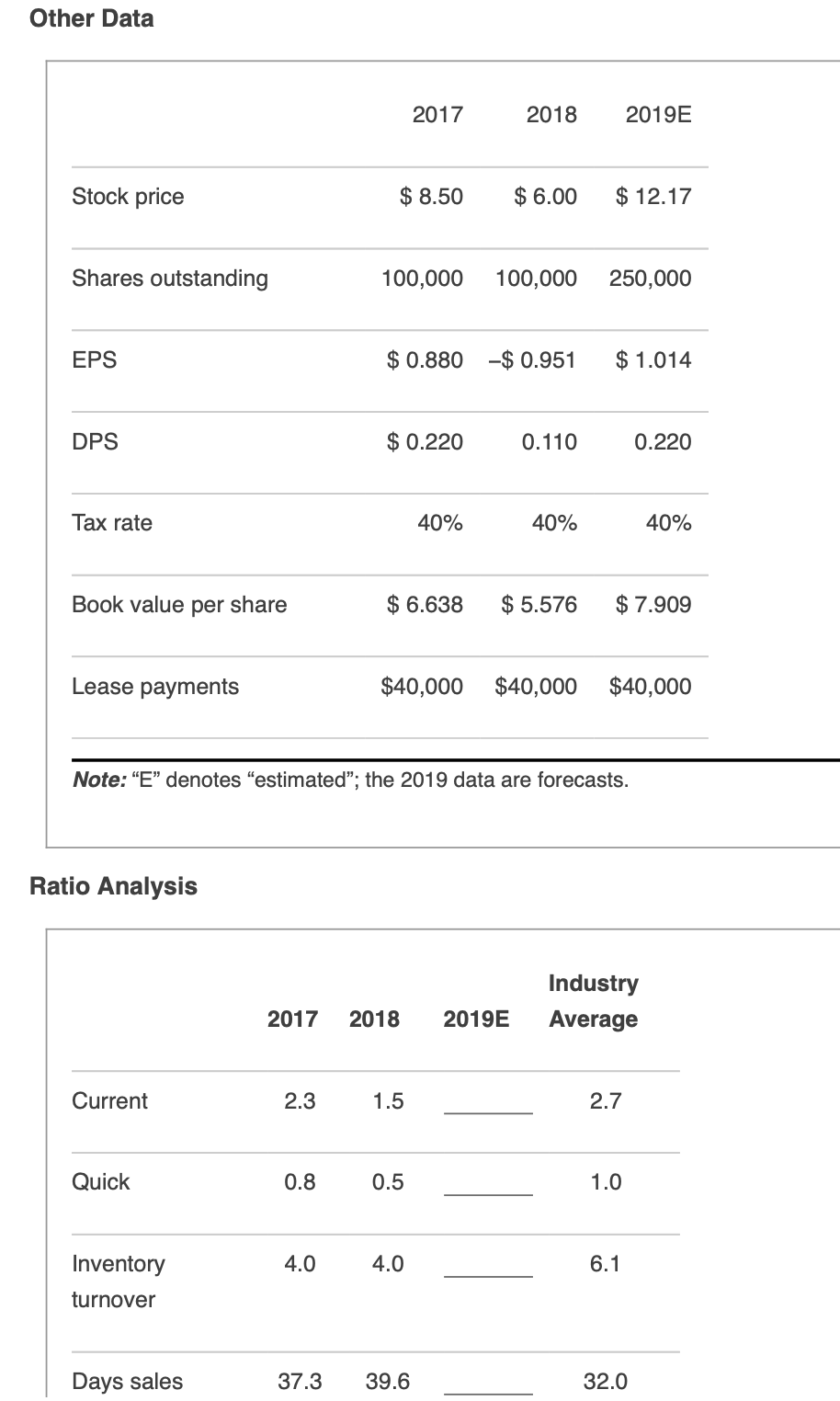

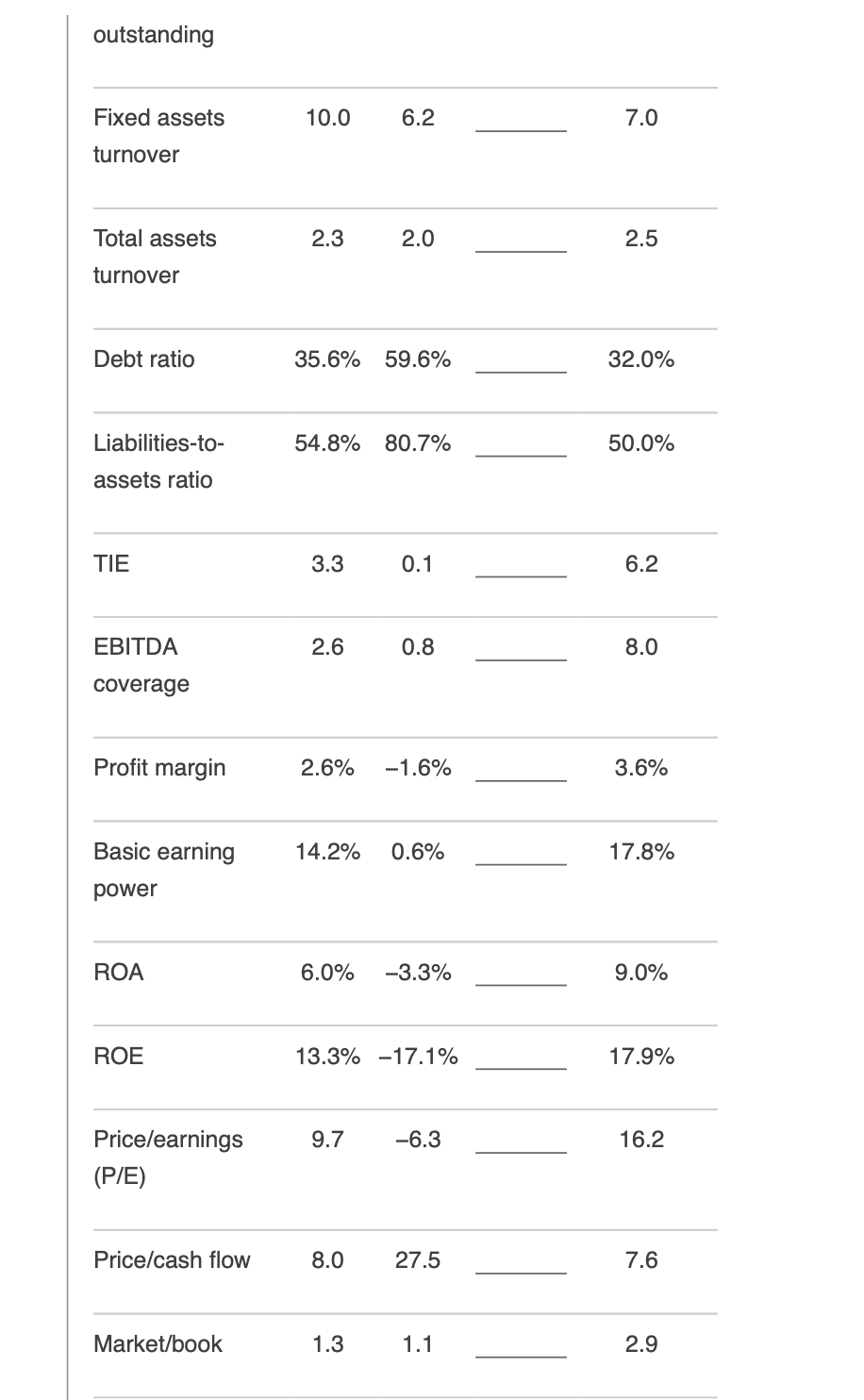

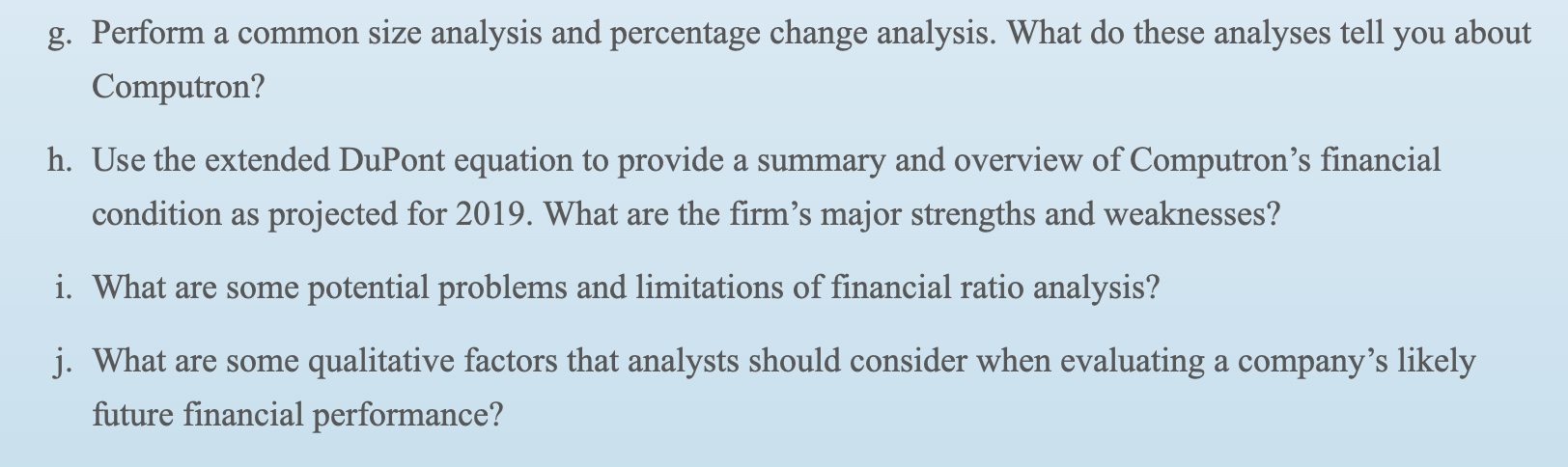

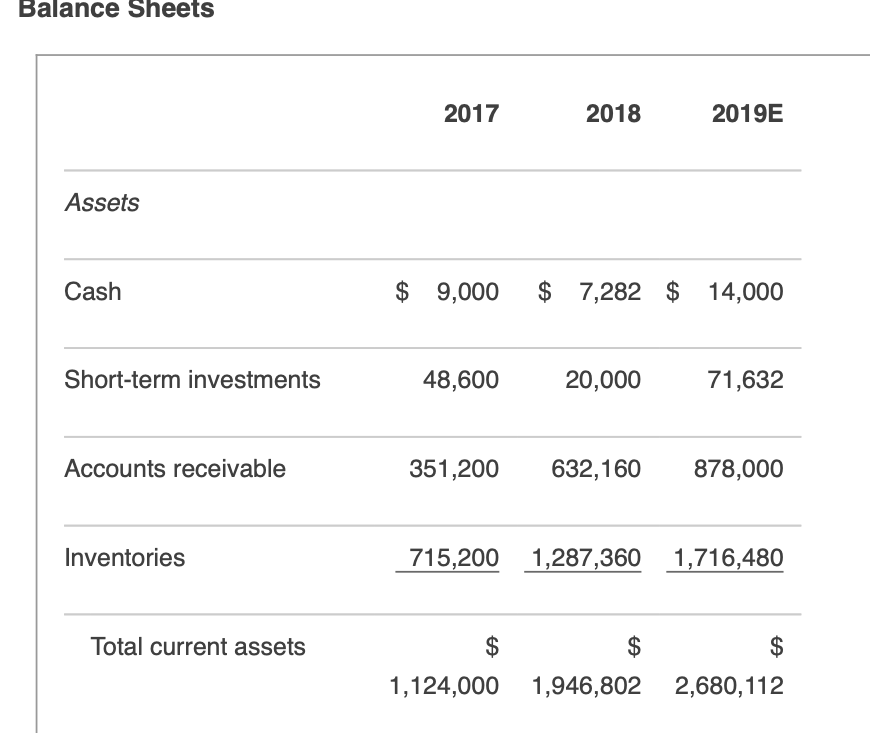

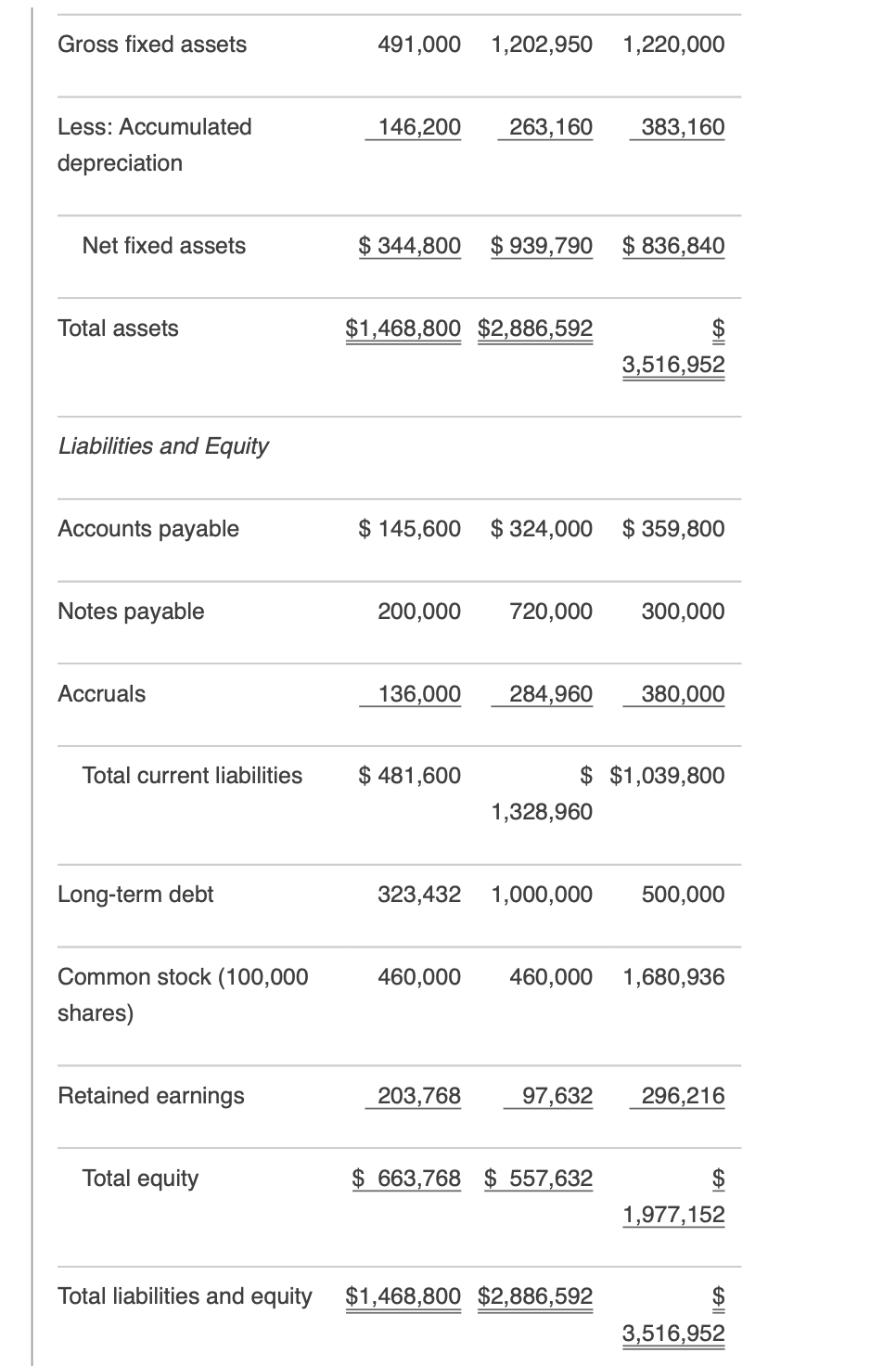

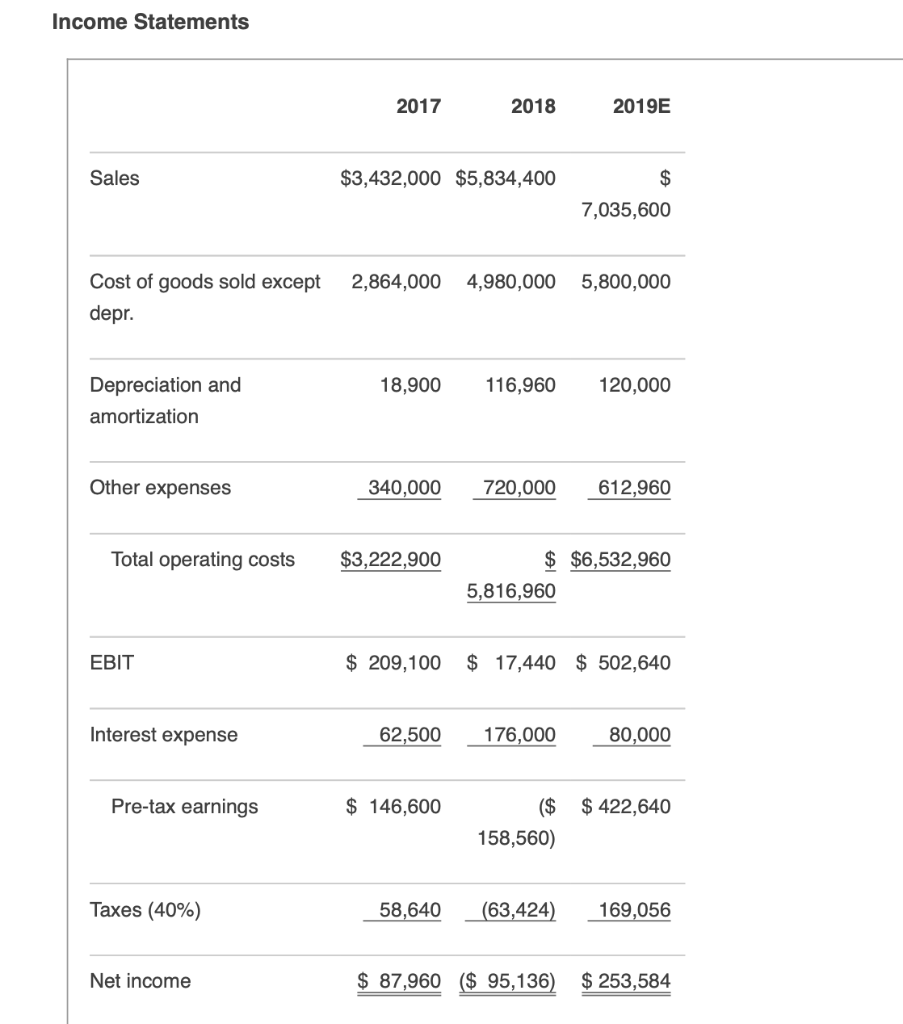

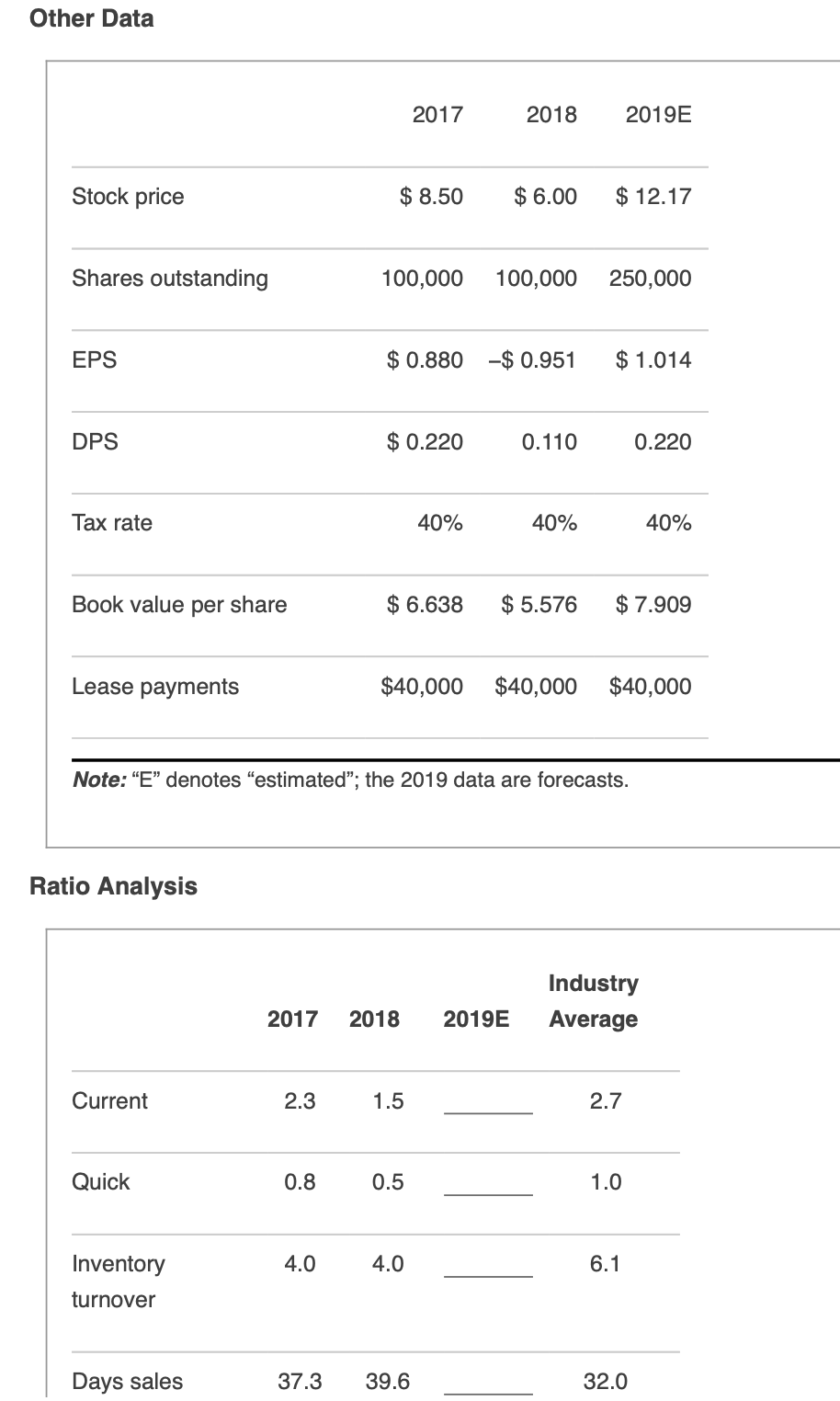

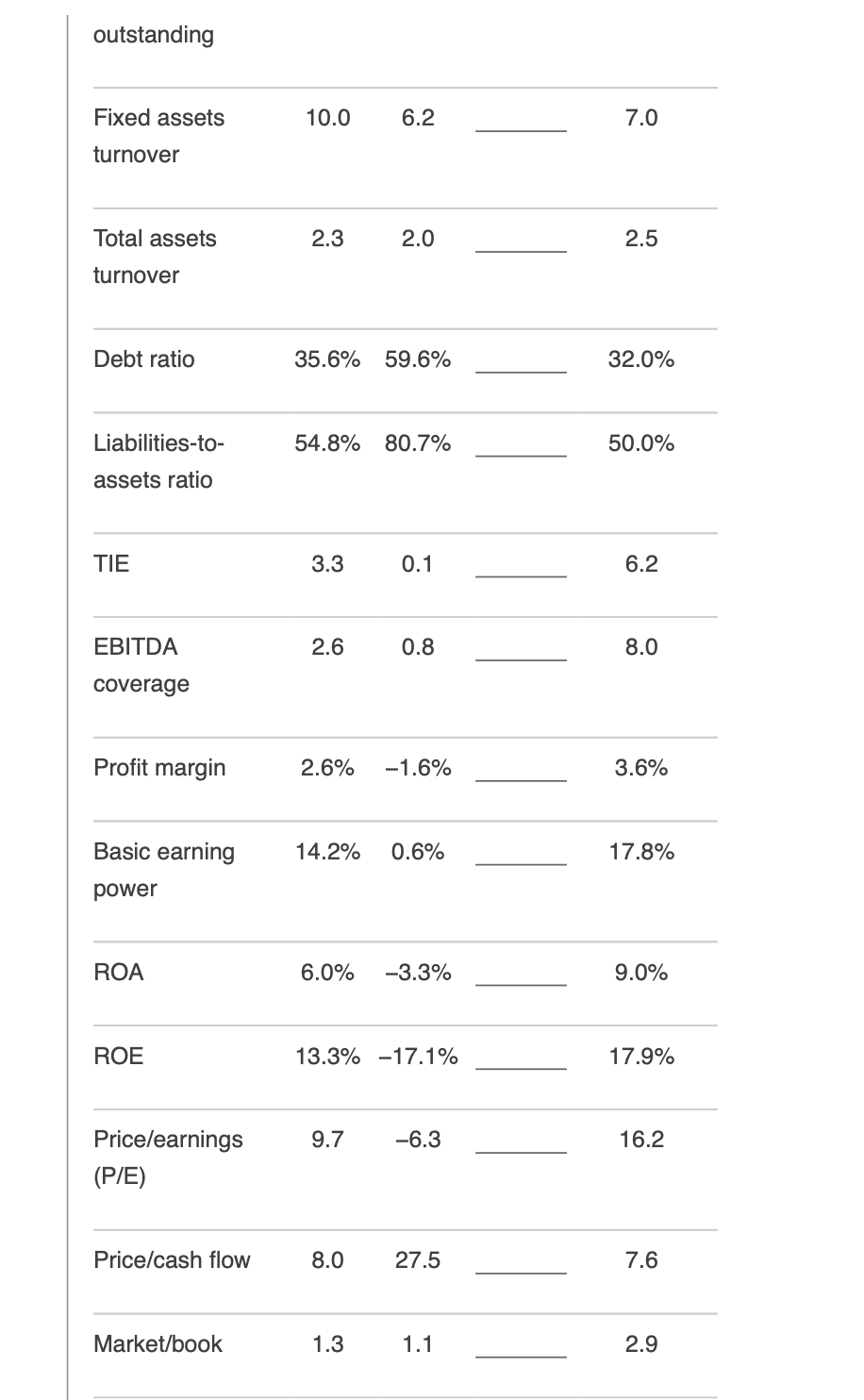

Jenny Cochran was brought in as assistant to Computron's chairman, who had the task of getting the company back into a sound financial position. Cochran must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions to take. Your assignment is to help her answer the following questions, using the recent and projected financial information shown next. Provide clear explanations, not yes or no answers. Balamanachanta Gross fixed assets 491,0001,202,9501,220,000 depreciation Liabilities and Equity Accounts payable $145,600$324,000$359,800 Notes payable 200,000720,000300,000 Accruals 136,000380,000284,960 Total current liabilities $481,600$1,039,800 1,328,960 Long-term debt 323,4321,000,000500,000 Common stock (100,000460,000460,0001,680,936 shares) Total equity $3,516,952 Ine Other Data Note: "E" denotes "estimated"; the 2019 data are forecasts. Ratio Analysis outstanding Fixed assets 10.06.27.0 turnover Total assets 2.32.0.5 turnover \begin{tabular}{lcccc} \hline Debt ratio & 35.6% & 59.6% & 32.0% \\ \hline Liabilities-to- & 54.8% & 80.7% & 5 \\ \hline \end{tabular} assets ratio TIE3.30.16.2 EBITDA2.60.88.0 coverage Profit margin 2.6%1.6%3.6% Basic earning 14.2%0.6%_17.8% power ROA 6.0%3.3%9.0% ROE 13.3%17.1%17.9% Price/earnings 9.76.316.2 (P/E) Price/cash flow 8.027.57.6 Market/book 1.31.12.9 g. Perform a common size analysis and percentage change analysis. What do these analyses tell you about Computron? h. Use the extended DuPont equation to provide a summary and overview of Computron's financial condition as projected for 2019. What are the firm's major strengths and weaknesses? i. What are some potential problems and limitations of financial ratio analysis? j. What are some qualitative factors that analysts should consider when evaluating a company's likely future financial performance? Jenny Cochran was brought in as assistant to Computron's chairman, who had the task of getting the company back into a sound financial position. Cochran must prepare an analysis of where the company is now, what it must do to regain its financial health, and what actions to take. Your assignment is to help her answer the following questions, using the recent and projected financial information shown next. Provide clear explanations, not yes or no answers. Balamanachanta Gross fixed assets 491,0001,202,9501,220,000 depreciation Liabilities and Equity Accounts payable $145,600$324,000$359,800 Notes payable 200,000720,000300,000 Accruals 136,000380,000284,960 Total current liabilities $481,600$1,039,800 1,328,960 Long-term debt 323,4321,000,000500,000 Common stock (100,000460,000460,0001,680,936 shares) Total equity $3,516,952 Ine Other Data Note: "E" denotes "estimated"; the 2019 data are forecasts. Ratio Analysis outstanding Fixed assets 10.06.27.0 turnover Total assets 2.32.0.5 turnover \begin{tabular}{lcccc} \hline Debt ratio & 35.6% & 59.6% & 32.0% \\ \hline Liabilities-to- & 54.8% & 80.7% & 5 \\ \hline \end{tabular} assets ratio TIE3.30.16.2 EBITDA2.60.88.0 coverage Profit margin 2.6%1.6%3.6% Basic earning 14.2%0.6%_17.8% power ROA 6.0%3.3%9.0% ROE 13.3%17.1%17.9% Price/earnings 9.76.316.2 (P/E) Price/cash flow 8.027.57.6 Market/book 1.31.12.9 g. Perform a common size analysis and percentage change analysis. What do these analyses tell you about Computron? h. Use the extended DuPont equation to provide a summary and overview of Computron's financial condition as projected for 2019. What are the firm's major strengths and weaknesses? i. What are some potential problems and limitations of financial ratio analysis? j. What are some qualitative factors that analysts should consider when evaluating a company's likely future financial performance