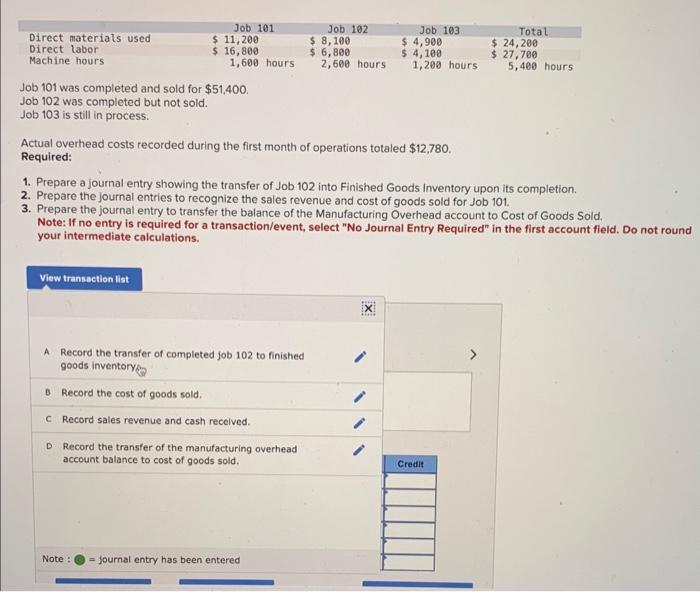

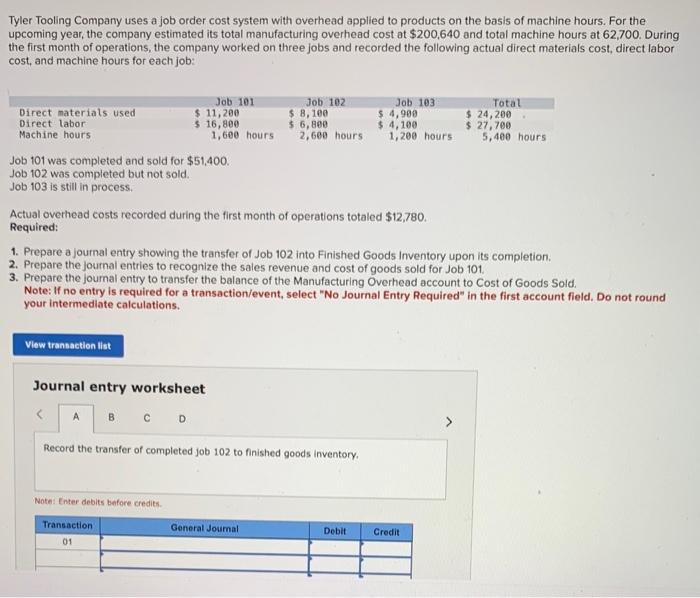

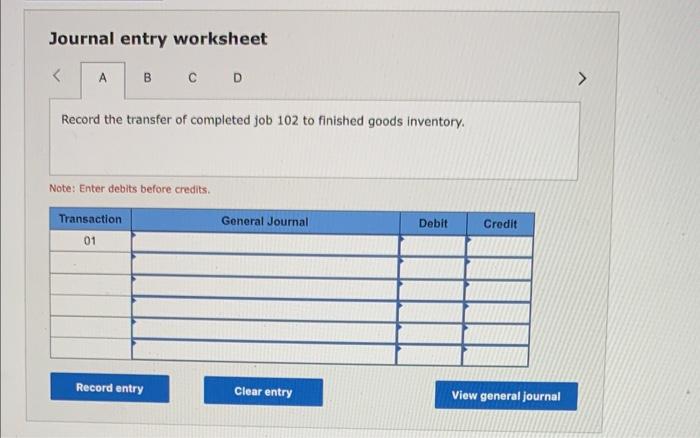

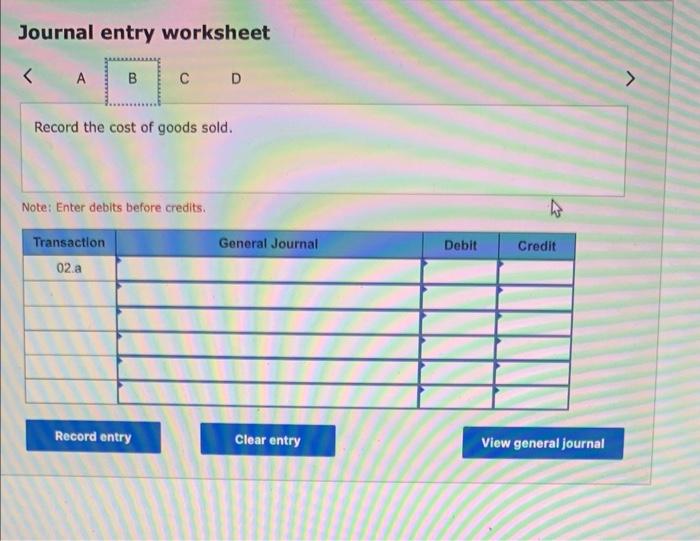

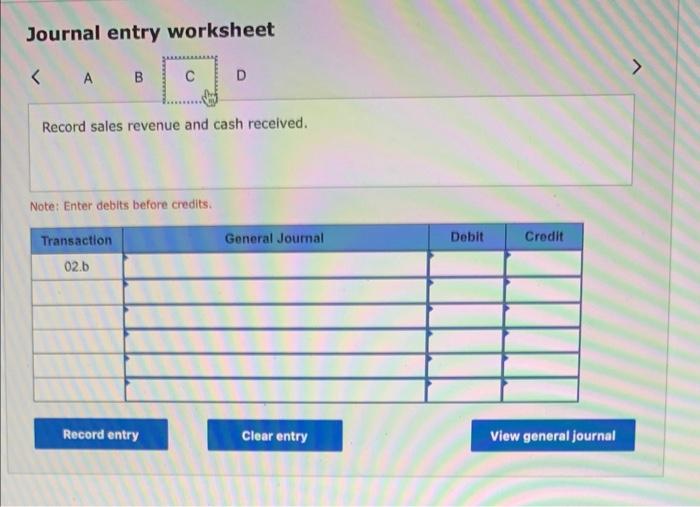

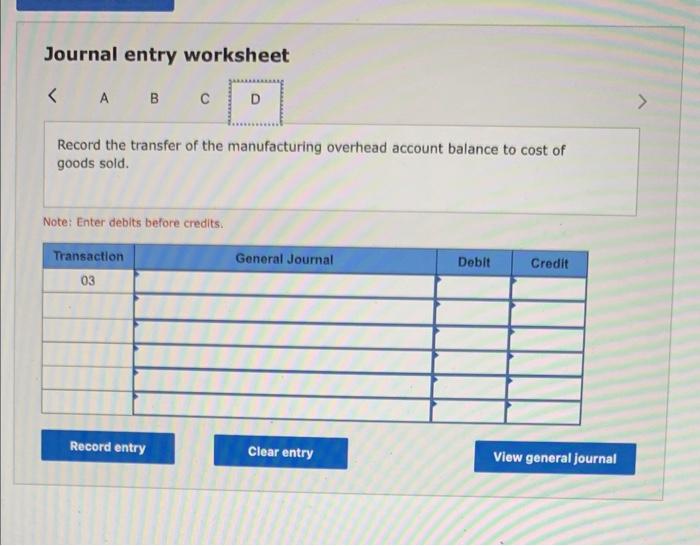

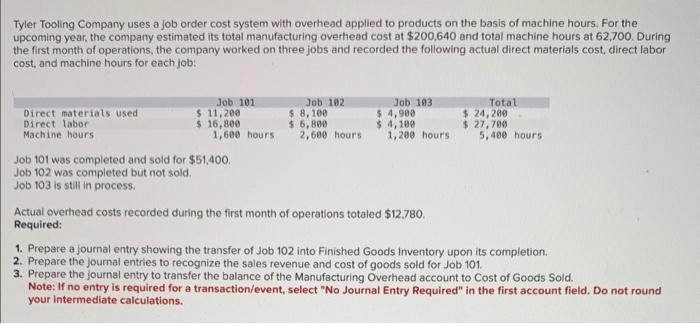

Job 101 was completed and sold for $51,400. Job 102 was completed but not sold. Job 103 is still in process. Actual overhead costs recorded during the first month of operations totaled $12,780. Required: 1. Prepare a journal entry showing the transfer of Job 102 into Finished Goods inventory upon its completion. 2. Prepare the journal entries to recognize the sales revenue and cost of goods sold for Job 101 . 3. Prepare the journal entry to transfer the balance of the Manufacturing Overhead account to Cost of Goods Sold. Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not rour your intermediate calculations. A Record the transfer of completed job 102 to finished goods inventorye B Record the cost of goods sold, C Record sales revenue and cash received. D Record the transfer of the manufacturing overhead account balance to cost of goods sold. Tyler Tooling Company uses a job order cost system with overhead applied to products on the basis of machine hours. For the upcoming year, the company estimated its total manufacturing overhead cost at $200,640 and total machine hours at 62,700 . During the first month of operations, the company worked on three jobs and recorded the following actual direct materials cost, direct labor cost, and machine hours for each job: Job 101 was completed and sold for $51,400. Job 102 was completed but not sold. Job 103 is still in process. Actual overhead costs recorded during the first month of operations totaled $12,780. Required: 1. Prepare a journal entry showing the transfer of Job 102 into Finished Goods Inventory upon its completion. 2. Prepare the journal entries to recognize the sales revenue and cost of goods sold for Job 101 . 3. Prepare the joumal entry to transfer the balance of the Manufacturing Overhead account to Cost of Goods Sold. Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations. Journal entry worksheet Record the transfer of completed job 102 to finished goods inventory. Noten Enter debits before credits. Journal entry worksheet Record the transfer of completed job 102 to finished goods inventory. Note: Enter debits before credits. Journal entry worksheet Record the cost of goods sold. Note: Enter debits before credits. Journal entry worksheet Record sales revenue and cash received. Note: Enter debits before credits. Journal entry worksheet Record the transfer of the manufacturing overhead account balance to cost of goods sold. Note: Enter debits before credits. Tyler Tooling Company uses a job order cost system with overhead applled to products on the basis of machine hours. For the upcoming year, the company estimated its total manufacturing overhead cost at $200,640 and total machine hours at 62,700 . During the first month of operations, the company worked on three jobs and recorded the following actual direct materials cost, direct labor cost, and machine hours for each job: Job 101 was completed and sold for $51,400. Job 102 was completed but not sold. Job 103 is still in process. Actual overhead costs recorded during the first month of operations totaled $12,780. Required: 1. Prepare a journal entry showing the transfer of Job 102 into Finished Goods inventory upon its completion. 2. Prepare the journal entries to recognize the sales revenue and cost of goods sold for Job 101. 3. Prepare the journal entry to transfer the balance of the Manufacturing Overhead account to Cost of Goods Sold. Note: If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round your intermediate calculations