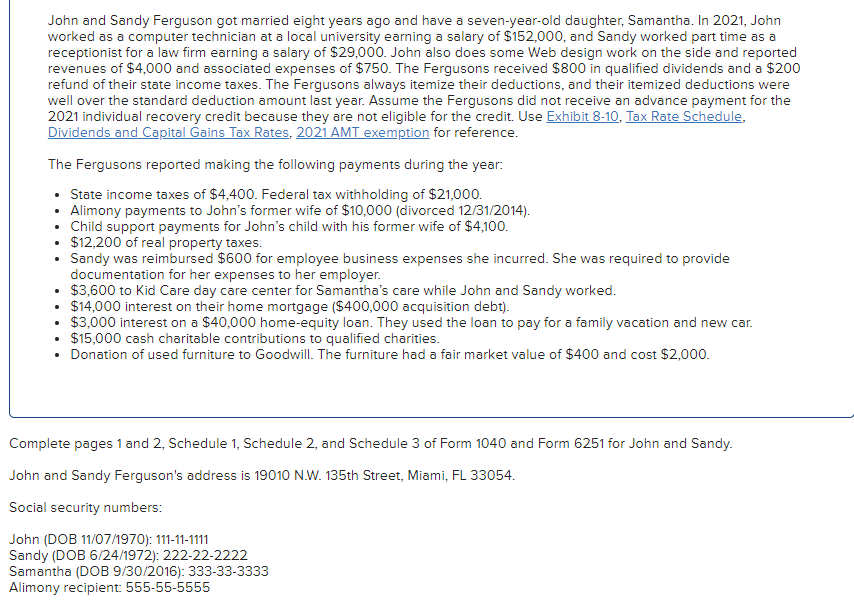

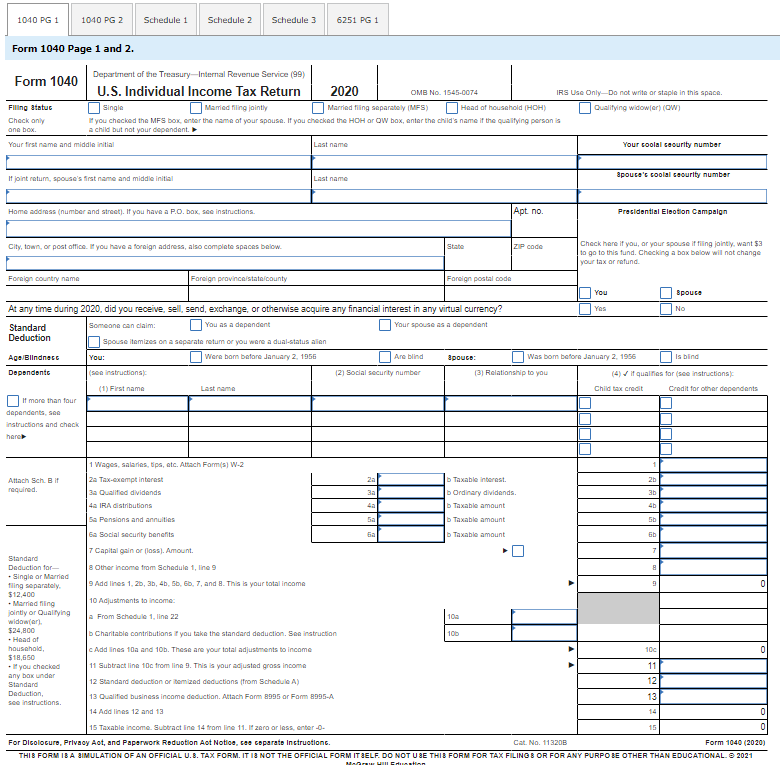

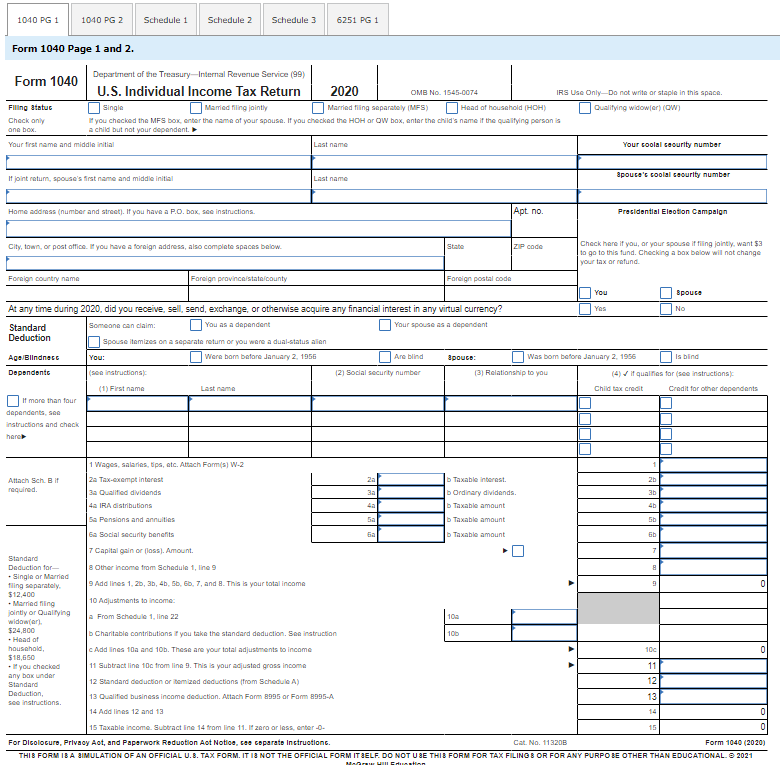

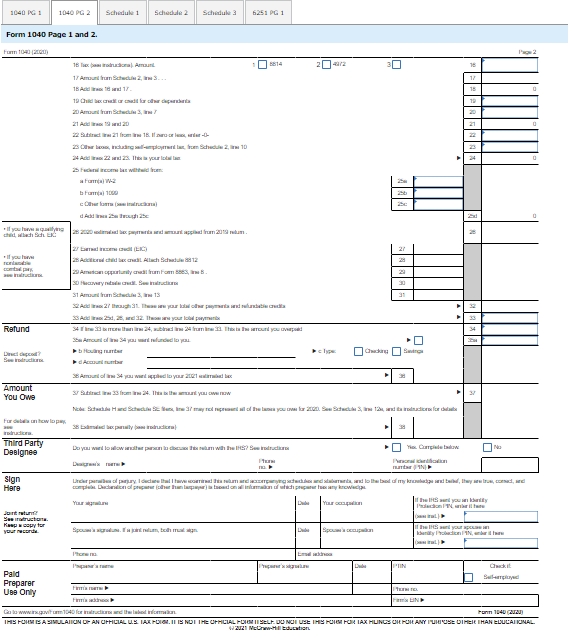

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 1040 PG 1 1040 PG 2 Schedule 1 Schedule 2 Schedule 3 6251 PG 1 Form 1040 Page 1 and 2. Department of the Treasury - Internal Revenue Service (99) Form 1040 U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space Filling Status Single Married fling jointly Married filing separately IMES) Head of household (HOH) Qualifying widower) (OW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH Or O box, enter the child's name if the qualifying person is ane box. a child but not your dependent Your first name and middle initial Last name Your coolal caourity number If joint ratum, spouse's first name and middle initial apouce's coolal ceourity number Last name Home address (number and street). If you have a P.O. bax, see instructions. Apt no Presidential Election Campaign City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below wil not change your tax or refund Foreign country name Foreign province state county Foreign postal code You Spouce At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate rotum or you were a dual-status allen Age Blindness You: Were born before January 2, 1956 Are blind apouce: Was bom before January 2, 1956 is bind Dependents (sonstructions 12) Social security number 131 Relationship to you (4) if qualities for (see instructions (1) First name Lastma Child tax credit Credit for other dependents If more than four dependents, See Instructions and check here 1 Wages, salaries, ups, etc. Attach Farms W-2 Attach Sch. Bit 2a Tax-exempt interest 2a Taxable interest 2b required. 3. Oualified dividends 3a Ordinary dividends. 3b 4. IRA distributions Taxable amount 45 5 Pensions and annuities Sa Taxable amount 5b 6a Social security benefits 62 Taxable amount Gb 7 Capital gain or loss). Amount Standard Deduction for 8 Other income from Schedule 1, line 9 - Single or Married filing separately 9 Add lines 1, 2, 3, 4, 5, 6, 7, and .This is your total income 0 $12,400 Married ning 10 Adjustments to income: jointly or Quallying From Schedule 1, line 22 100 widower $24,800 Charitable contributions you take the standard deduction. See instruction 100 Head of household c Add lines 10 and 10h. These are your total adjustments to income 100 0 $18,650 - If you checked 11 Subtract line 100 from line. This is your adjusted gross income 11 any bax under Standard 12 Standard deduction or omized deductions from Schedule A) 12 Deduction, 13 Qualified business income deduction. Attach Form 2995 or Form 1995-A see instructions 13 14 Addlines 12 and 13 14 0 15 Taxable income. Subtract line 14 from line 11. fra or less enter-O- 15 0 For Dicolours, Privacy Act, and Paperwork Reduotion Act Notice, ces coparate Instructions. Cat No. 11320B Form 1040 (2020) THIS FORM IBA SIMULATION OF AN OFFICIAL U. 8. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIB FORM FOR TAX FILINGS OR FOR ANY PURPO BE OTHER THAN EDUCATIONAL 8 2021 Menu Hiduation 1040 11 1040 PG 2 Schedule 1 Schedule 2 Schedule 3 6251 PG 1 Form 1040 Page 1 and 2 17 13 27 2 30 Foam 1000/2000 16. Am 14 1/ Amundrum Sch. 18 Aw1 13 19 Chies the anaitle 2Amundro Schedule 21 Add 20 21 221 18 - 23 hogy ha 2, 10 24 A 22 2 Thea your lo Sercome be with the ma baForma 1000 che ancora Ashe Il you 2200 dan 2015 27 ) If you 2 Add child bead Allach dadul 812 www 23 Auspuruly drones, Swydded S1 Amundrum Schedule 13 Sada 2 Theug. These your heart and sub Add: 25, 28, 32w you loodus Refund ste 24 ubinde 2 free. The round you Amoure you want. Troud to you Direcce F CS FAmutta Amundo you want to your walls Amount You Owe Side from 24. The busy CATLOW Nebe Hard Schedule, 3 mayroll of the you200. Succuber 12, dari for Sale Forlop Sider 3 odd Third Party Deelgnee Do you will wait parancsnih her? Se roddir tha. airs I'd TUTIN sign Litcar para o pery loudella consumate brei woh bodo kreditwy dd Here complete Didiend prepare the persoon dinamakan dan kecil Yare | the Soul | data Jor Suertruction Keep copy tor your recorde . , ht Styl Now w Em I'' PIIN Pald Preparer Use Only HEN Bato www.ix.com 1040 child men Porn 1040 100 THE POSSA SIMULACIN DANCIFCIAL US. TAK PEGI IS NOT THE OFICIAL DE SELT. DO NOT USE THE HOME FOR IAX HLINES OR OR ANY OTHER THAN EDUCATIONAL W2121 Mcwill Education John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 1040 PG 1 1040 PG 2 Schedule 1 Schedule 2 Schedule 3 6251 PG 1 Form 1040 Page 1 and 2. Department of the Treasury - Internal Revenue Service (99) Form 1040 U.S. Individual Income Tax Return 2020 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space Filling Status Single Married fling jointly Married filing separately IMES) Head of household (HOH) Qualifying widower) (OW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH Or O box, enter the child's name if the qualifying person is ane box. a child but not your dependent Your first name and middle initial Last name Your coolal caourity number If joint ratum, spouse's first name and middle initial apouce's coolal ceourity number Last name Home address (number and street). If you have a P.O. bax, see instructions. Apt no Presidential Election Campaign City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Checking a box below wil not change your tax or refund Foreign country name Foreign province state county Foreign postal code You Spouce At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate rotum or you were a dual-status allen Age Blindness You: Were born before January 2, 1956 Are blind apouce: Was bom before January 2, 1956 is bind Dependents (sonstructions 12) Social security number 131 Relationship to you (4) if qualities for (see instructions (1) First name Lastma Child tax credit Credit for other dependents If more than four dependents, See Instructions and check here 1 Wages, salaries, ups, etc. Attach Farms W-2 Attach Sch. Bit 2a Tax-exempt interest 2a Taxable interest 2b required. 3. Oualified dividends 3a Ordinary dividends. 3b 4. IRA distributions Taxable amount 45 5 Pensions and annuities Sa Taxable amount 5b 6a Social security benefits 62 Taxable amount Gb 7 Capital gain or loss). Amount Standard Deduction for 8 Other income from Schedule 1, line 9 - Single or Married filing separately 9 Add lines 1, 2, 3, 4, 5, 6, 7, and .This is your total income 0 $12,400 Married ning 10 Adjustments to income: jointly or Quallying From Schedule 1, line 22 100 widower $24,800 Charitable contributions you take the standard deduction. See instruction 100 Head of household c Add lines 10 and 10h. These are your total adjustments to income 100 0 $18,650 - If you checked 11 Subtract line 100 from line. This is your adjusted gross income 11 any bax under Standard 12 Standard deduction or omized deductions from Schedule A) 12 Deduction, 13 Qualified business income deduction. Attach Form 2995 or Form 1995-A see instructions 13 14 Addlines 12 and 13 14 0 15 Taxable income. Subtract line 14 from line 11. fra or less enter-O- 15 0 For Dicolours, Privacy Act, and Paperwork Reduotion Act Notice, ces coparate Instructions. Cat No. 11320B Form 1040 (2020) THIS FORM IBA SIMULATION OF AN OFFICIAL U. 8. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIB FORM FOR TAX FILINGS OR FOR ANY PURPO BE OTHER THAN EDUCATIONAL 8 2021 Menu Hiduation 1040 11 1040 PG 2 Schedule 1 Schedule 2 Schedule 3 6251 PG 1 Form 1040 Page 1 and 2 17 13 27 2 30 Foam 1000/2000 16. Am 14 1/ Amundrum Sch. 18 Aw1 13 19 Chies the anaitle 2Amundro Schedule 21 Add 20 21 221 18 - 23 hogy ha 2, 10 24 A 22 2 Thea your lo Sercome be with the ma baForma 1000 che ancora Ashe Il you 2200 dan 2015 27 ) If you 2 Add child bead Allach dadul 812 www 23 Auspuruly drones, Swydded S1 Amundrum Schedule 13 Sada 2 Theug. These your heart and sub Add: 25, 28, 32w you loodus Refund ste 24 ubinde 2 free. The round you Amoure you want. Troud to you Direcce F CS FAmutta Amundo you want to your walls Amount You Owe Side from 24. The busy CATLOW Nebe Hard Schedule, 3 mayroll of the you200. Succuber 12, dari for Sale Forlop Sider 3 odd Third Party Deelgnee Do you will wait parancsnih her? Se roddir tha. airs I'd TUTIN sign Litcar para o pery loudella consumate brei woh bodo kreditwy dd Here complete Didiend prepare the persoon dinamakan dan kecil Yare | the Soul | data Jor Suertruction Keep copy tor your recorde . , ht Styl Now w Em I'' PIIN Pald Preparer Use Only HEN Bato www.ix.com 1040 child men Porn 1040 100 THE POSSA SIMULACIN DANCIFCIAL US. TAK PEGI IS NOT THE OFICIAL DE SELT. DO NOT USE THE HOME FOR IAX HLINES OR OR ANY OTHER THAN EDUCATIONAL W2121 Mcwill Education