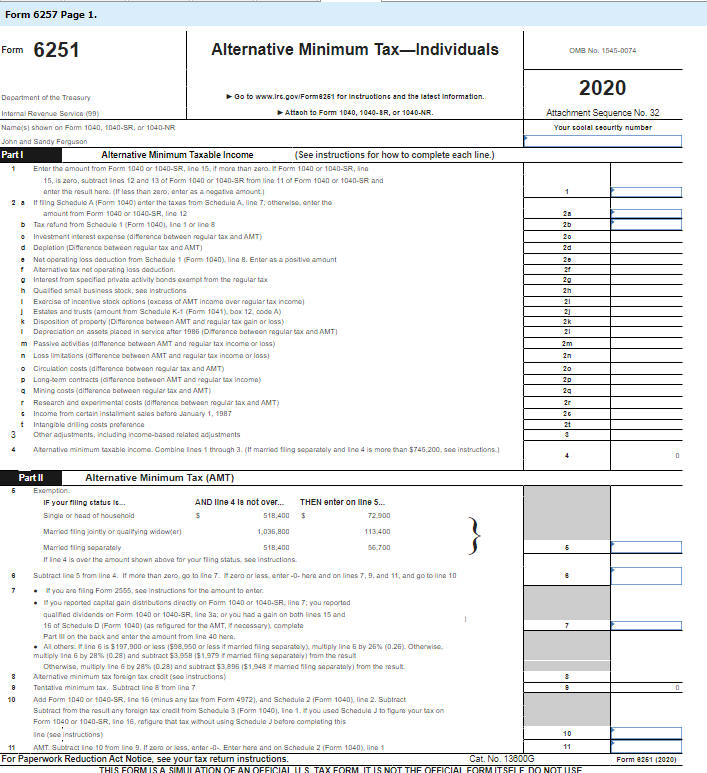

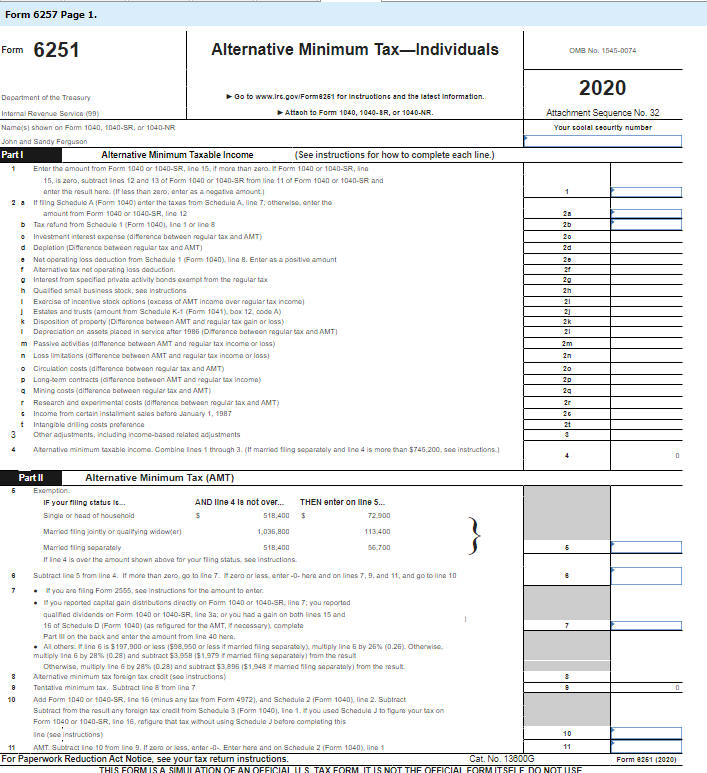

John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 Form 6257 Page 1. Form 6251 Alternative Minimum Tax-Individuals OMB No. 1545-0074 2020 Attachment Sequence No. 32 Your coolal courity number 1 2b 20 2d Department of the Treasury o to www.lrc.gov.Forme251 for inctructions and the latest Information. Internal Revenue Service (90) Attach to Form 1040, 1040-BR, or 1040-NR. Name() shown on Fam 1040, 040-SR, or 1040-NR John and Sandy Ferguson Part1 Alternative Minimum Taxable income (See instructions for how to complete each line.) Enter the amount from Form 1040 or 1040-SR, ine 15. if more than zero. I Form 1040 or 1040-SR, line 15, is zero, subtract lines 12 and 13 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result here. (If less than zero, enteres a negative amount 2. If filing Schedule A Form 1040) enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12 b Tax refund from Schedule 1 (Form 1040), line 1 or line 8 o Investment interest expense (difference between regular tax and AMT) d Depletion Difference between regular tax and AMT) Net operating loss deduction from Schedule 1 (Form 1040), line. Enter as a positive amount | Alternative tax net operating loss deduction Interest from specified private activity bonds exempt from the regular tax h Qualified small business stock, so instructions Exercise of incentive stock options (excess of AMT income over regular tax income) 1 Estates and trusts (amount from Schedule K-1 (Form 1041), bax 12, code A) Disposition of property Difference between AMT and regular tax gain or loss) Depreciation on assets placed in service after 1986 Dorence between regular tax and AMT) m Passive activities (difference between AMT and regular tax income or loss) n Loss limitations difference between AMT and regular tax income or loss o Circulation costs (difference between regular tax and AMT) Long-term contracts (difference between AMT and regular tax income) Mining costs (difference between regular tax and AMT) Research and experimental costs difference between regular tax and AMT) Income from certain installment sales before January 1, 1997 Intangible drilling costs preference 3 Other adjustments, including income-based related adjustments 4 Alternative minimum taxable income. Combine lines through 2. (If married fling separately and ine 4 is more than $745,200, see instructions. 29 2h 21 2] 2k 21 2m 20 2p 29 2r at 3 4 0 6 } Part II Alternative Minimum Tax (AMT) Exemption IF your filing status ... AND line 4 la not over.... THEN enter on line 5... Single or head of household 518,400 $ 72.900 Married fling jointly or qualitying widower) 1.036,800 113.400 Married fling separately 518,400 56.700 If Iine 4 is over the amount shown above for your fling status, see instructions. B Subtract line 5 from line 4. If more than zero go to line 7. fzera or less, enter -- here and on lines 7.9, and 11, and go to line 10 7 you are filing Fom 2555, see instructions for the amount to enter . If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR line 3n; or you had again on both lines 15 and 16 of Schedule Form 1040) (as nefigured for the AMT, necessary, complete Part III on the back and enter the amount from line 40 here. All others: line 6 is $197,900 or less ($98.950 or less if married filing separately).multiply line 5 by 25% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3.958 ($1,979 married fling separately from the result Otherwise, multiplyine by 28% (0.28) and Subtract $3.896 ($1.948 married filling separately from the result. 8 Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7 10 Add Form 1040 or 1040-SR, Ine 16 (minus any tax from Form 4972), and Schedule 2 Form 1040), line 2. Subtract Subtract from the result any foreign tax credit from Schedule 3 (Form 1040), ine 1. If you used Schedule to figure your tax on Form 1040 or 1040-SR, line 16,refigure that tax without using Schedule J before completing this line (see instructions) 10 11 AMT. Subtractine 10 from line 9. If zero or less, enter -- Enter here and on Schedule 2 Form 1040), line 1 11 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 13800G THIS FORM IS A SIMULATION OF AN OFFICIALUS TAX FORM IT IS NOT THE OFFICIAL FORMIT SELF DO NOT USE Form 251 (2020) John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 Form 6257 Page 1. Form 6251 Alternative Minimum Tax-Individuals OMB No. 1545-0074 2020 Attachment Sequence No. 32 Your coolal courity number 1 2b 20 2d Department of the Treasury o to www.lrc.gov.Forme251 for inctructions and the latest Information. Internal Revenue Service (90) Attach to Form 1040, 1040-BR, or 1040-NR. Name() shown on Fam 1040, 040-SR, or 1040-NR John and Sandy Ferguson Part1 Alternative Minimum Taxable income (See instructions for how to complete each line.) Enter the amount from Form 1040 or 1040-SR, ine 15. if more than zero. I Form 1040 or 1040-SR, line 15, is zero, subtract lines 12 and 13 of Form 1040 or 1040-SR from line 11 of Form 1040 or 1040-SR and enter the result here. (If less than zero, enteres a negative amount 2. If filing Schedule A Form 1040) enter the taxes from Schedule A, line 7; otherwise, enter the amount from Form 1040 or 1040-SR, line 12 b Tax refund from Schedule 1 (Form 1040), line 1 or line 8 o Investment interest expense (difference between regular tax and AMT) d Depletion Difference between regular tax and AMT) Net operating loss deduction from Schedule 1 (Form 1040), line. Enter as a positive amount | Alternative tax net operating loss deduction Interest from specified private activity bonds exempt from the regular tax h Qualified small business stock, so instructions Exercise of incentive stock options (excess of AMT income over regular tax income) 1 Estates and trusts (amount from Schedule K-1 (Form 1041), bax 12, code A) Disposition of property Difference between AMT and regular tax gain or loss) Depreciation on assets placed in service after 1986 Dorence between regular tax and AMT) m Passive activities (difference between AMT and regular tax income or loss) n Loss limitations difference between AMT and regular tax income or loss o Circulation costs (difference between regular tax and AMT) Long-term contracts (difference between AMT and regular tax income) Mining costs (difference between regular tax and AMT) Research and experimental costs difference between regular tax and AMT) Income from certain installment sales before January 1, 1997 Intangible drilling costs preference 3 Other adjustments, including income-based related adjustments 4 Alternative minimum taxable income. Combine lines through 2. (If married fling separately and ine 4 is more than $745,200, see instructions. 29 2h 21 2] 2k 21 2m 20 2p 29 2r at 3 4 0 6 } Part II Alternative Minimum Tax (AMT) Exemption IF your filing status ... AND line 4 la not over.... THEN enter on line 5... Single or head of household 518,400 $ 72.900 Married fling jointly or qualitying widower) 1.036,800 113.400 Married fling separately 518,400 56.700 If Iine 4 is over the amount shown above for your fling status, see instructions. B Subtract line 5 from line 4. If more than zero go to line 7. fzera or less, enter -- here and on lines 7.9, and 11, and go to line 10 7 you are filing Fom 2555, see instructions for the amount to enter . If you reported capital gain distributions directly on Form 1040 or 1040-SR, line 7; you reported qualified dividends on Form 1040 or 1040-SR line 3n; or you had again on both lines 15 and 16 of Schedule Form 1040) (as nefigured for the AMT, necessary, complete Part III on the back and enter the amount from line 40 here. All others: line 6 is $197,900 or less ($98.950 or less if married filing separately).multiply line 5 by 25% (0.26). Otherwise, multiply line 6 by 28% (0.28) and subtract $3.958 ($1,979 married fling separately from the result Otherwise, multiplyine by 28% (0.28) and Subtract $3.896 ($1.948 married filling separately from the result. 8 Alternative minimum tax foreign tax credit (see instructions) Tentative minimum tax. Subtract line 8 from line 7 10 Add Form 1040 or 1040-SR, Ine 16 (minus any tax from Form 4972), and Schedule 2 Form 1040), line 2. Subtract Subtract from the result any foreign tax credit from Schedule 3 (Form 1040), ine 1. If you used Schedule to figure your tax on Form 1040 or 1040-SR, line 16,refigure that tax without using Schedule J before completing this line (see instructions) 10 11 AMT. Subtractine 10 from line 9. If zero or less, enter -- Enter here and on Schedule 2 Form 1040), line 1 11 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 13800G THIS FORM IS A SIMULATION OF AN OFFICIALUS TAX FORM IT IS NOT THE OFFICIAL FORMIT SELF DO NOT USE Form 251 (2020)