Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnny turned 45 years old today. He would like to be retired after his 65th birthday and then withdraw $15,000 from his bank account

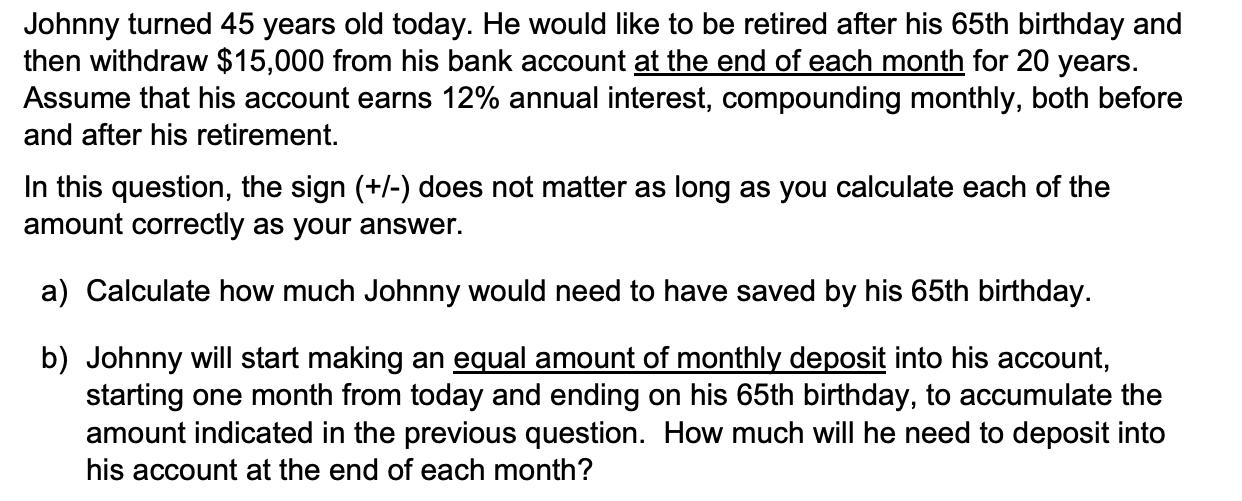

Johnny turned 45 years old today. He would like to be retired after his 65th birthday and then withdraw $15,000 from his bank account at the end of each month for 20 years. Assume that his account earns 12% annual interest, compounding monthly, both before and after his retirement. In this question, the sign (+/-) does not matter as long as you calculate each of the amount correctly as your answer. a) Calculate how much Johnny would need to have saved by his 65th birthday. b) Johnny will start making an equal amount of monthly deposit into his account, starting one month from today and ending on his 65th birthday, to accumulate the amount indicated in the previous question. How much will he need to deposit into his account at the end of each month?

Step by Step Solution

★★★★★

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate how much Johnny would need to have saved by his 65th birthday we can use the formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started