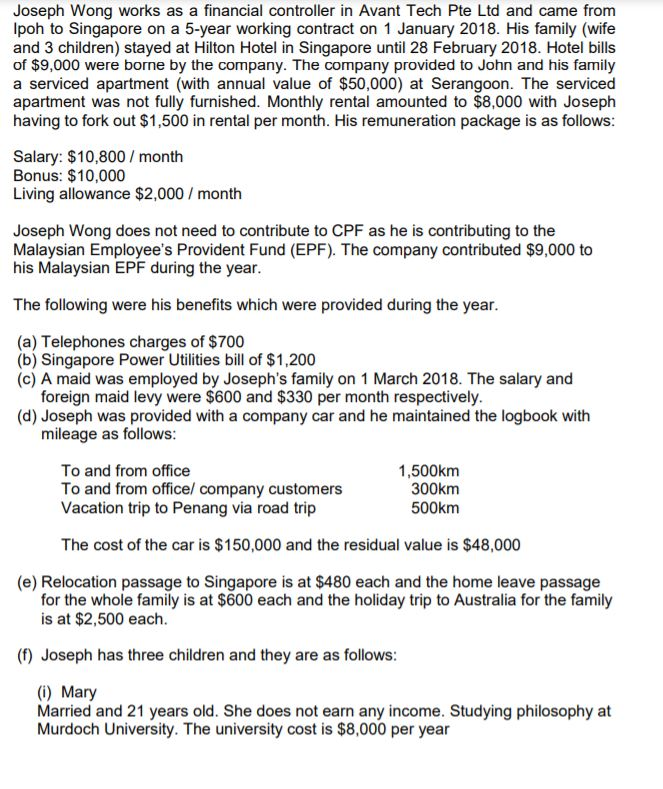

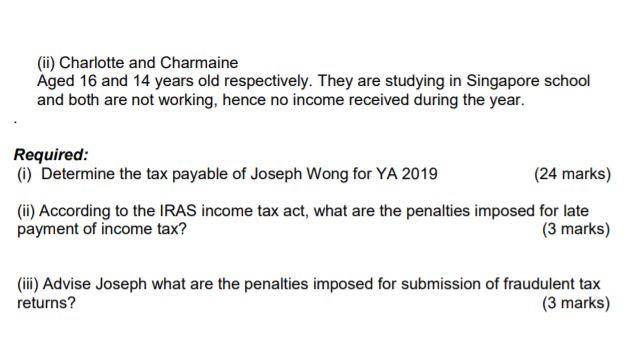

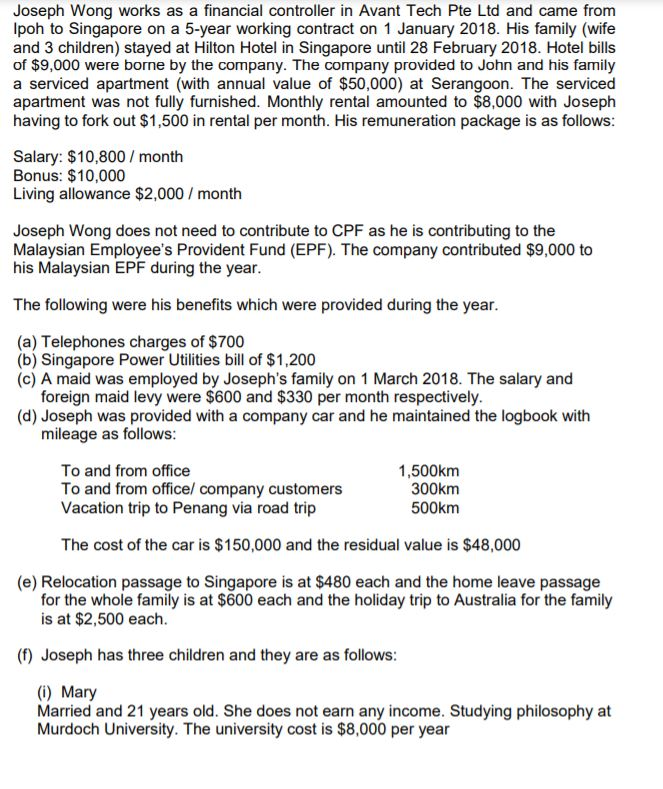

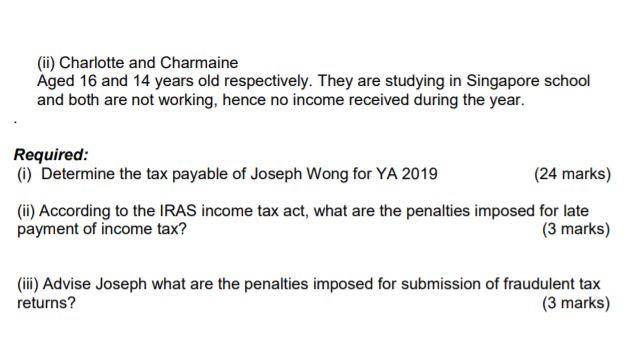

Joseph Wong works as a financial controller in Avant Tech Pte Ltd and came from Ipoh to Singapore on a 5-year working contract on 1 January 2018. His family (wife and 3 children) stayed at Hilton Hotel in Singapore until 28 February 2018. Hotel bills of $9,000 were borne by the company. The company provided to John and his family a serviced apartment with annual value of $50,000) at Serangoon. The serviced apartment was not fully furnished. Monthly rental amounted to $8,000 with Joseph having to fork out $1,500 in rental per month. His remuneration package is as follows: Salary: $10,800 / month Bonus: $10,000 Living allowance $2,000 / month Joseph Wong does not need to contribute to CPF as he is contributing to the Malaysian Employee's Provident Fund (EPF). The company contributed $9,000 to his Malaysian EPF during the year. The following were his benefits which were provided during the year. (a) Telephones charges of $700 (b) Singapore Power Utilities bill of $1,200 (c) A maid was employed by Joseph's family on 1 March 2018. The salary and foreign maid levy were $600 and $330 per month respectively. (d) Joseph was provided with a company car and he maintained the logbook with mileage as follows: To and from office 1,500km To and from office/ company customers 300km Vacation trip to Penang via road trip 500km The cost of the car is $150,000 and the residual value is $48,000 (e) Relocation passage to Singapore is at $480 each and the home leave passage for the whole family is at $600 each and the holiday trip to Australia for the family is at $2,500 each. (1) Joseph has three children and they are as follows: (i) Mary Married and 21 years old. She does not earn any income. Studying philosophy at Murdoch University. The university cost is $8,000 per year (ii) Charlotte and Charmaine Aged 16 and 14 years old respectively. They are studying in Singapore school and both are not working, hence no income received during the year. Required: (1) Determine the tax payable of Joseph Wong for YA 2019 (24 marks) (ii) According to the IRAS income tax act, what are the penalties imposed for late payment of income tax? (3 marks) (iii) Advise Joseph what are the penalties imposed for submission of fraudulent tax returns? (3 marks) Joseph Wong works as a financial controller in Avant Tech Pte Ltd and came from Ipoh to Singapore on a 5-year working contract on 1 January 2018. His family (wife and 3 children) stayed at Hilton Hotel in Singapore until 28 February 2018. Hotel bills of $9,000 were borne by the company. The company provided to John and his family a serviced apartment with annual value of $50,000) at Serangoon. The serviced apartment was not fully furnished. Monthly rental amounted to $8,000 with Joseph having to fork out $1,500 in rental per month. His remuneration package is as follows: Salary: $10,800 / month Bonus: $10,000 Living allowance $2,000 / month Joseph Wong does not need to contribute to CPF as he is contributing to the Malaysian Employee's Provident Fund (EPF). The company contributed $9,000 to his Malaysian EPF during the year. The following were his benefits which were provided during the year. (a) Telephones charges of $700 (b) Singapore Power Utilities bill of $1,200 (c) A maid was employed by Joseph's family on 1 March 2018. The salary and foreign maid levy were $600 and $330 per month respectively. (d) Joseph was provided with a company car and he maintained the logbook with mileage as follows: To and from office 1,500km To and from office/ company customers 300km Vacation trip to Penang via road trip 500km The cost of the car is $150,000 and the residual value is $48,000 (e) Relocation passage to Singapore is at $480 each and the home leave passage for the whole family is at $600 each and the holiday trip to Australia for the family is at $2,500 each. (1) Joseph has three children and they are as follows: (i) Mary Married and 21 years old. She does not earn any income. Studying philosophy at Murdoch University. The university cost is $8,000 per year (ii) Charlotte and Charmaine Aged 16 and 14 years old respectively. They are studying in Singapore school and both are not working, hence no income received during the year. Required: (1) Determine the tax payable of Joseph Wong for YA 2019 (24 marks) (ii) According to the IRAS income tax act, what are the penalties imposed for late payment of income tax? (3 marks) (iii) Advise Joseph what are the penalties imposed for submission of fraudulent tax returns