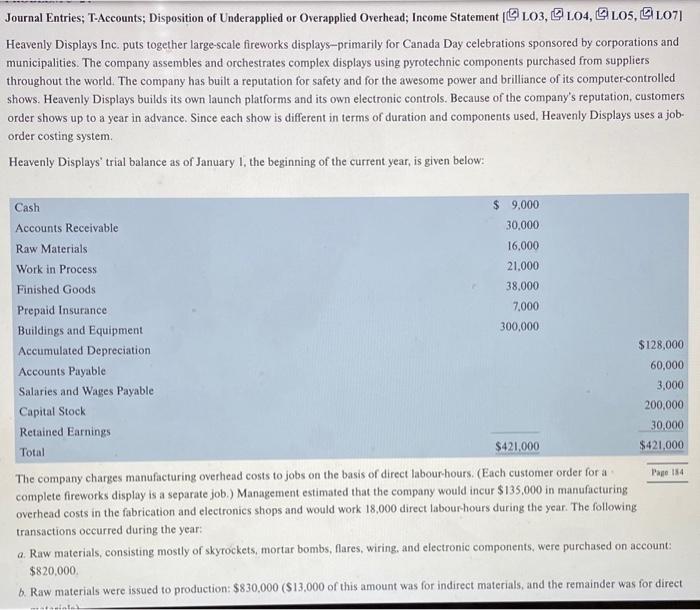

Journal Entries; T-Accounts; Disposition of Underapplied or Overapplied Overhead; Income Statement [S LO3, [ LO4, GS LO5, [ LO7] Heavenly Displays Inc. puts together large-scale fireworks displays-primarily for Canada Day celebrations sponsored by corporations and municipalities. The company assembles and orchestrates complex displays using pyrotechnic components purchased from suppliers throughout the world. The company has built a reputation for safety and for the awesome power and brilliance of its computer-controlled shows. Heavenly Displays builds its own launch platforms and its own electronic controls. Because of the company's reputation, customers order shows up to a year in advance. Since each show is different in terms of duration and components used, Heavenly Displays uses a joborder costing system. Heavenly Displays' trial balance as of January I, the beginning of the current year, is given below: The company charges manufacturing overhead costs to jobs on the basis of direct labour-hours. (Each customer order for a complete fireworks display is a separate job.) Management estimated that the company would incur $135,000 in manufacturing overhead costs in the fabrication and electronics shops and would work 18,000 direct labour-hours during the year. The following transactions occurred during the year: a. Raw materials, consisting mostly of skyrockets, mortar bombs, flares, wiring, and electronic components, were purchased on account: $820,000. b. Raw materials were issued to production: $830,000 ( $13,000 of this amount was for indirect materials, and the remainder was for direct Journal Entries; T-Accounts; Disposition of Underapplied or Overapplied Overhead; Income Statement [S LO3, [ LO4, GS LO5, [ LO7] Heavenly Displays Inc. puts together large-scale fireworks displays-primarily for Canada Day celebrations sponsored by corporations and municipalities. The company assembles and orchestrates complex displays using pyrotechnic components purchased from suppliers throughout the world. The company has built a reputation for safety and for the awesome power and brilliance of its computer-controlled shows. Heavenly Displays builds its own launch platforms and its own electronic controls. Because of the company's reputation, customers order shows up to a year in advance. Since each show is different in terms of duration and components used, Heavenly Displays uses a joborder costing system. Heavenly Displays' trial balance as of January I, the beginning of the current year, is given below: The company charges manufacturing overhead costs to jobs on the basis of direct labour-hours. (Each customer order for a complete fireworks display is a separate job.) Management estimated that the company would incur $135,000 in manufacturing overhead costs in the fabrication and electronics shops and would work 18,000 direct labour-hours during the year. The following transactions occurred during the year: a. Raw materials, consisting mostly of skyrockets, mortar bombs, flares, wiring, and electronic components, were purchased on account: $820,000. b. Raw materials were issued to production: $830,000 ( $13,000 of this amount was for indirect materials, and the remainder was for direct