Answered step by step

Verified Expert Solution

Question

1 Approved Answer

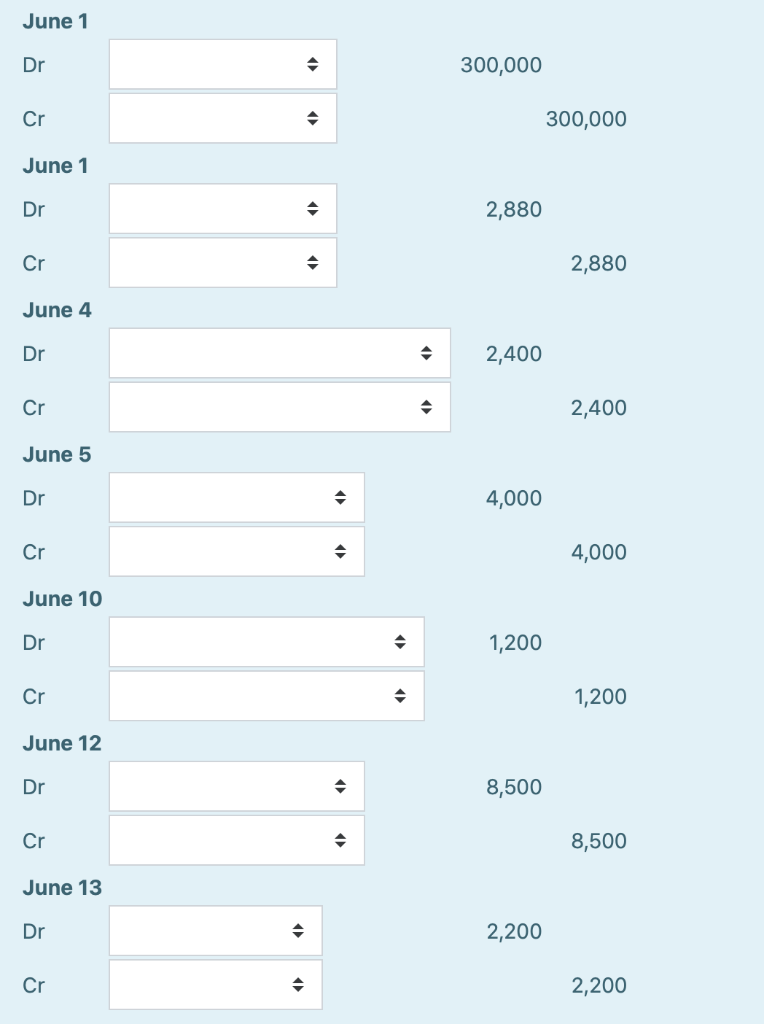

JOURNAL ENTRIES The following transactions took place for a company owned and operated by Elena during June 2019, the first month of operations: June 1.

JOURNAL ENTRIES

The following transactions took place for a company owned and operated by Elena during June 2019, the first month of operations:

- June 1. Elena contributed $300,000 cash to the business and a laptop computer valued at $2,880. Elena plans to use the computer in the business for a period of 4 years. The residual value of the computer at the end of the 4 years is estimated to be zero.

- June 4. Received $2,400 from Vincent for services to be performed in July.

- June 5. Received $4,000 for services performed for Chloe.

- June 10. Purchased mobile phone to be used in the business. The purchase price of $1,200 is due to be paid later.

- June 12. Invoiced Claire $8,500 for services performed.

- June 13. Paid $2,200 salary to the office receptionist.

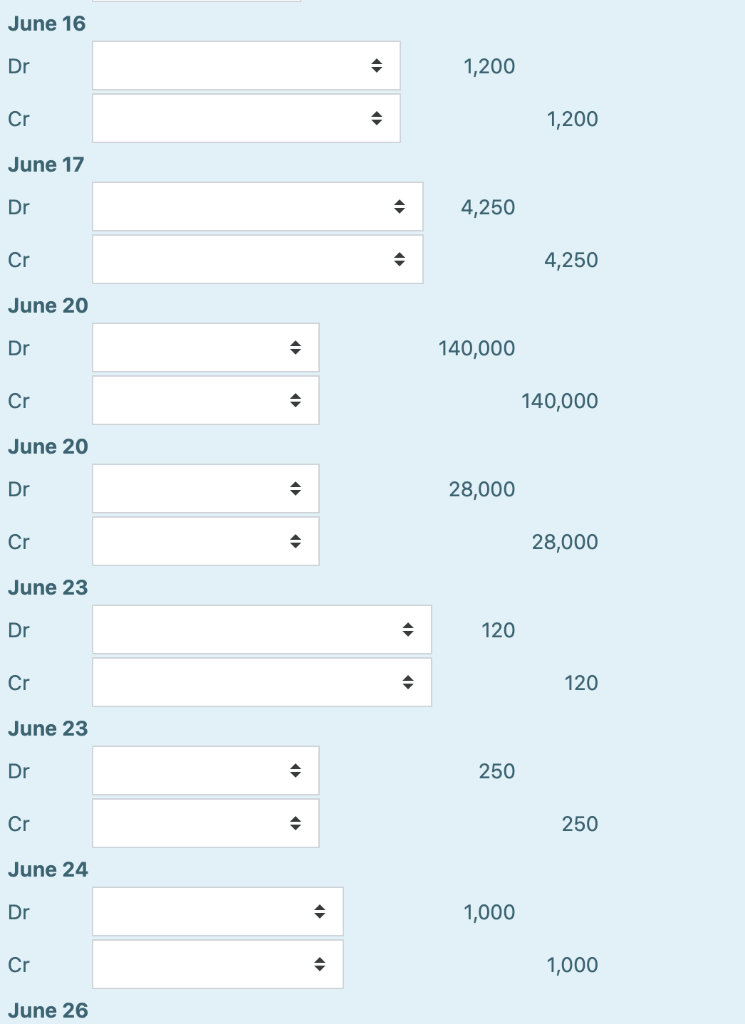

- June 16. Paid the $1,200 purchase price of the mobile phone purchased previously.

- June 17. Claire paid $4,250 cash for the services invoice above and agreed to pay the remaining balance on July 5.

- June 20. Purchased a small building for the company. The purchase price was financed via a mortgage loan of $140,000 and a cash payment of $28,000 from the business bank account.

- June 23. Received bills for the business for water and electricity use of $120 and mobile phone use of $250.

- June 24. Paid $1,000 for advertising for the business from the business bank account. The advertising company already run ads for the business for that amount.

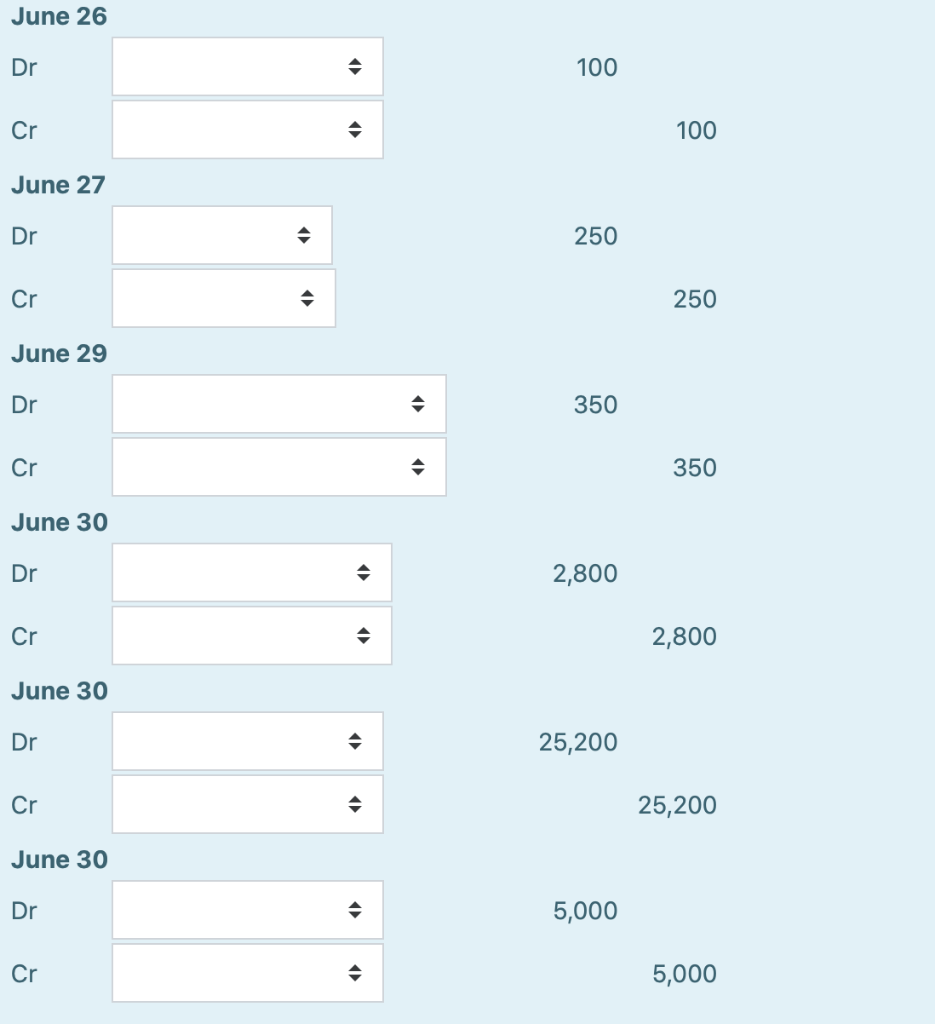

- June 26. Took the laptop computer to a repair shop to be repaired. The repairs cost incurred was $100, with the amount to be paid within 30 days.

- June 27. Paid $250 for 1 month worth of rent for an office covering the period 1 July to 30 July.

- June 29. Purchased office supplies for $350 in cash.

- June 30. Paid $28,000 on the mortgage loan. That amount includes $2,800 interest incurred on the loan until 30 June.

- June 30. Withdrawn $5,000 cash from the business.

REQUIRED:

Please complete the journal entries below to record the effects of all business transactions for Elena's business for the period ended 30 June 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started