Answered step by step

Verified Expert Solution

Question

1 Approved Answer

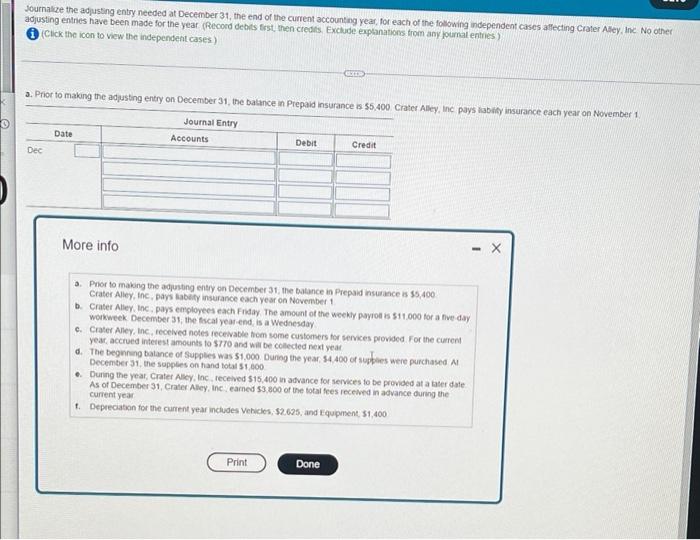

Journalize the adjusting entry needed at December 31, the end of the current accounting year, for each of the following independent cases affecting Crater

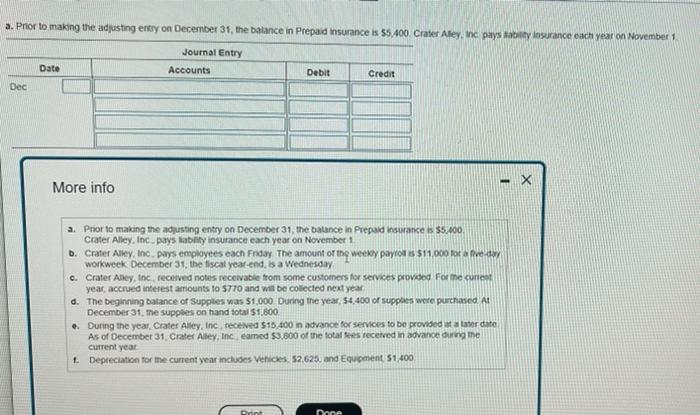

Journalize the adjusting entry needed at December 31, the end of the current accounting year, for each of the following independent cases affecting Crater Alley, Inc. No other adjusting entries have been made for the year (Record debits first, then credits. Exclude explanations from any journal entries) (Click the icon to view the independent cases) GEER a. Prior to making the adjusting entry on December 31, the balance in Prepaid insurance is $5,400 Crater Alley, Inc pays lability insurance each year on November 1 Date Dec Journal Entry Accounts Debit Credit More info a. Prior to making the adjusting entry on December 31, the balance in Prepaid insurance is $5,400 Crater Alley, Inc, pays sabeity insurance each year on November 1 b. Crater Alley, Inc. pays employees each Friday. The amount of the weekly payroll is $11,000 for a five-day workweek December 31, the fiscal year-end, is a Wednesday c. Crater Alley, Inc., received notes receivable from some customers for services provided. For the current year, accrued interest amounts to $770 and will be collected next year d. The beginning balance of Supplies was $1,000. During the year, $4,400 of suppes were purchased. At December 31, the supplies on hand total $1,000 e. During the year, Crater Alley, Inc., received $15,400 in advance for services to be provided at a later date As of December 31, Crater Alley, Inc earned $3,800 of the total fees received in advance during the current year f. Depreciation for the current year includes Vehicles, $2.625, and Equipment, $1,400 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started