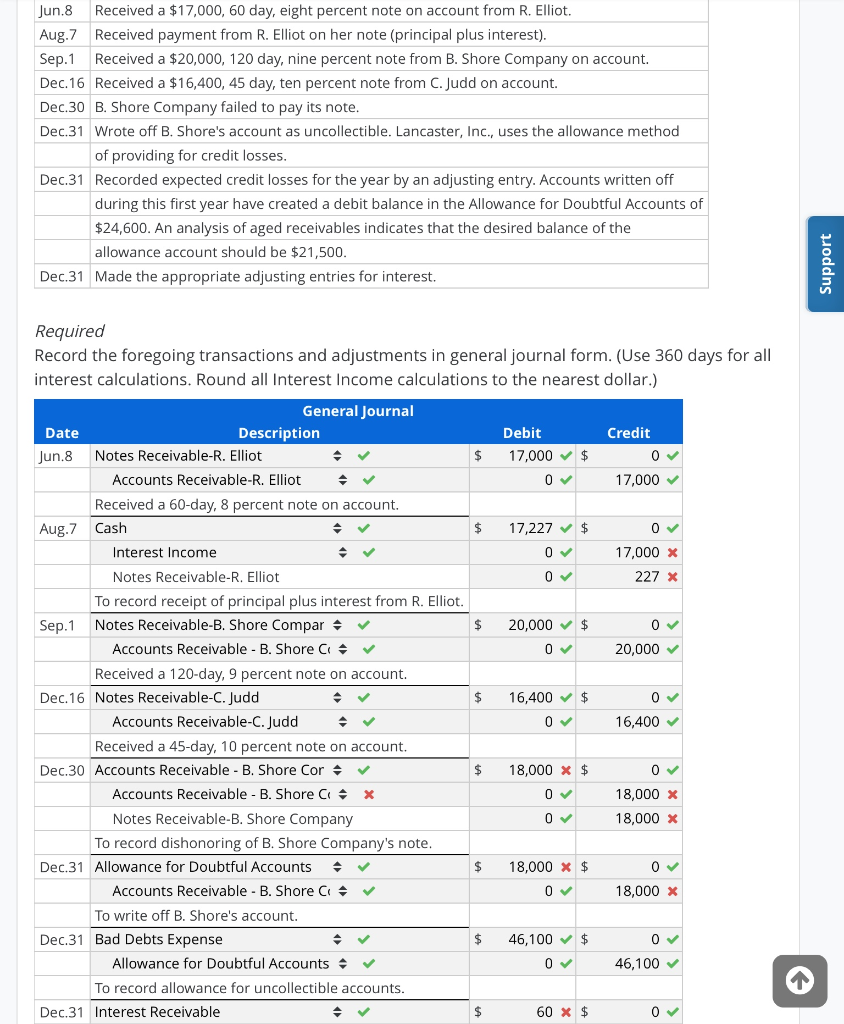

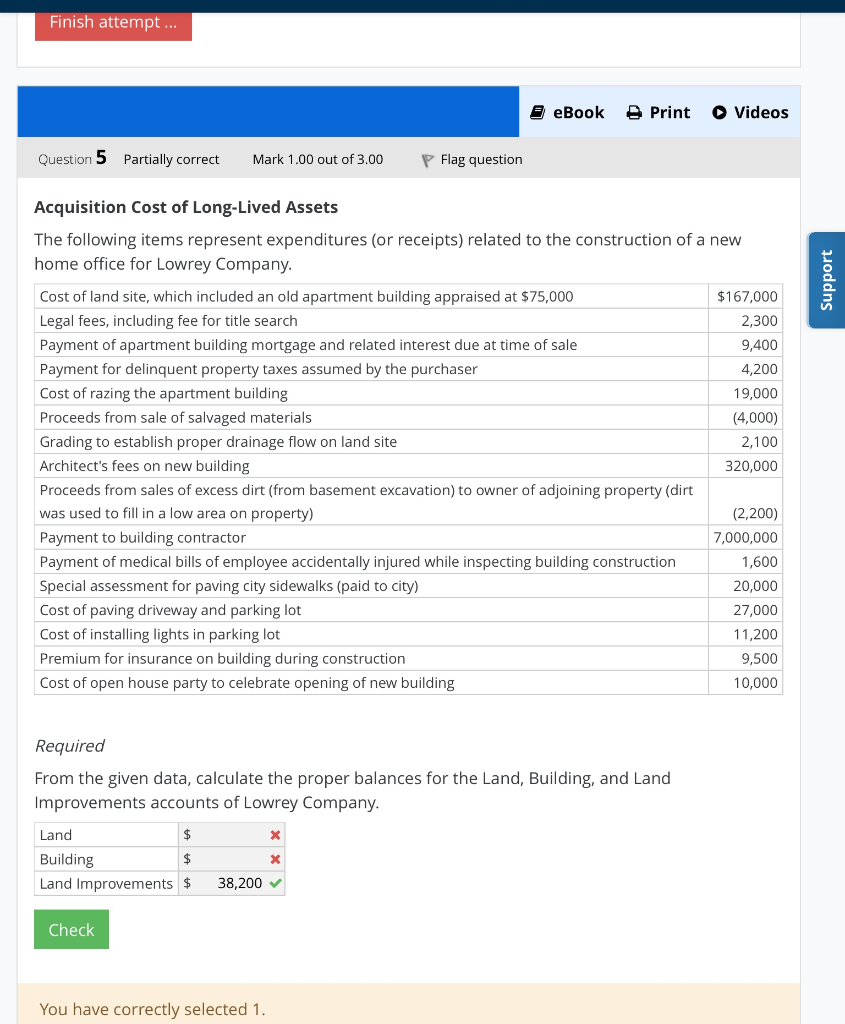

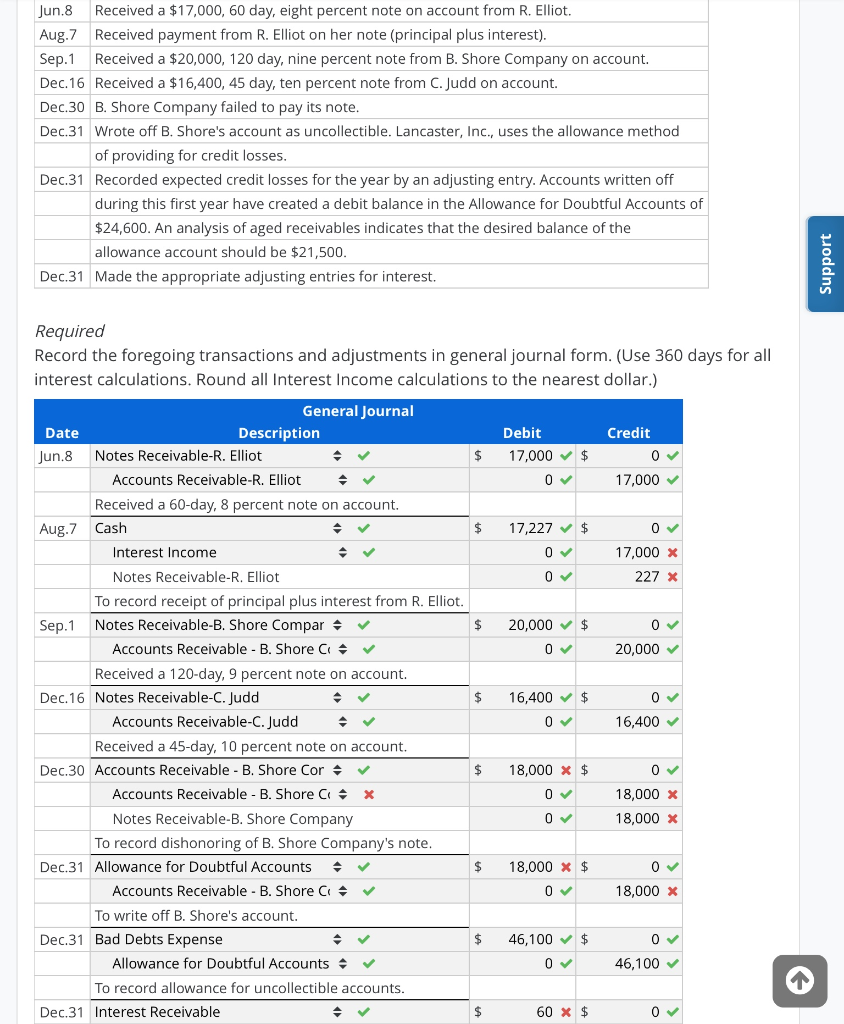

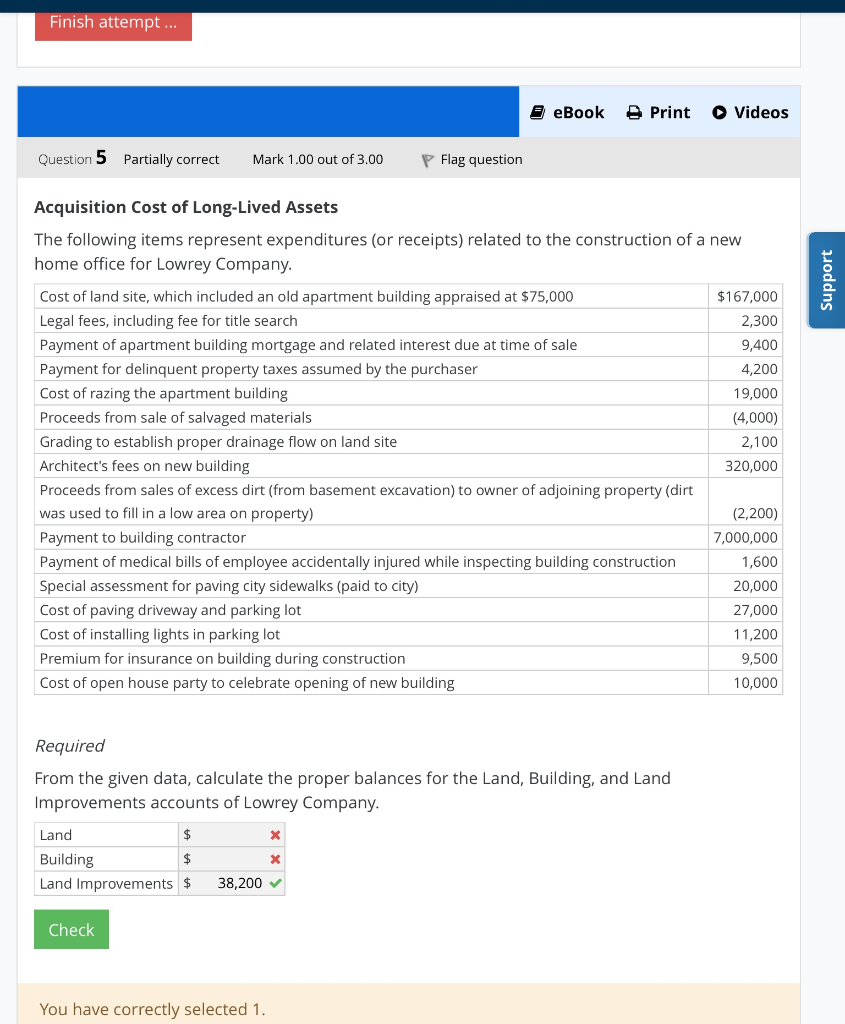

Jun.8 Received a $17,000, 60 day, eight percent note on account from R. Elliot Received payment from R. Elliot on her note (principal plus interest) Aug.7 Sep.1 Received a $20,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $16,400, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $24,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $21,500. Dec.31 Made the appropriate adjusting entries for interest. Required Record the foregoing transactions and adjustments in general journal form. (Use 360 days for all interest calculations. Round all Interest Income calculations to the nearest dollar.) General Journal Description Debit Credit Date 17,000$ 0 v Notes Receivable-R. Elliot $ Jun.8 Accounts Receivable-R. Elliot 0 17,000 Received a 60-day, 8 percent note on account. Cash $ 17,227 $ Aug.7 0 v 0 Interest Income 17,000 Notes Receivable-R. Elliot 0 227 To record receipt of principal plus interest from R. Elliot. 20.000 $ Notes Receivable-B. Shore Compar 0 Sep.1 Accounts Receivable - B. Shore C 0 20,000 Received a 120-day, 9 percent note on account. Notes Receivable-C. Judd 16,400 $ Dec.16 Accounts Receivable-C. Judd 0 16,400 Received a 45-day, 10 percent note on account. 18,000 $ Dec.30 Accounts Receivable - B. Shore Cor $ 0v Accounts Receivable B. Shore C 0 18,000 Notes Receivable-B. Shore Company 0 18,000 To record dishonoring of B. Shore Company's note. Dec.31 Allowance for Doubtful Accounts 18,000 $ $ 18,000 Accounts Receivable B. Shore C 0v To write off B. Shore's account. Dec.31 Bad Debts Expense 46,100 $ 0 v Allowance for Doubtful Accounts To record allowance for uncollectible accounts 46,100 0 60 x$ Dec.31 Interest Receivable $ 0 Support Finish attempt ... E eBook A Print O Videos Question 5 Partially correct Mark 1.00 out of 3.00 Flag question Acquisition Cost of Long-Lived Assets The following items represent expenditures (or receipts) related to the construction of a new home office for Lowrey Company Cost of land site, which included an old apartment building appraised at $75,000 $167,000 Legal fees, including fee for title search 2,300 Payment of apartment building mortgage and related interest due at time of sale 9,400 Payment for delinquent property taxes assumed by the purchaser 4,200 Cost of razing the apartment building 19,000 Proceeds from sale of salvaged materials (4,000) Grading to establish proper drainage flow on land site 2,100 Architect's fees on new building 320,000 Proceeds from sales of excess dirt (from basement excavation) to owner of adjoining property (dirt was used to fill in a low area on property) (2,200) Payment to building contractor 7,000,000 Payment of medical bills of employee accidentally injured while inspecting building construction 1,600 Special assessment for paving city sidewalks (paid to city) 20,000 Cost of paving driveway and parking lot Cost of installing lights in parking lot 27,000 11,200 Premium for insurance on building during construction 9,500 Cost of open house party to celebrate opening of new building 10,000 Required From the given data, calculate the proper balances for the Land, Building, and Land Improvements accounts of Lowrey Company. Land Building Land Improvements $ 38,200 Check You have correctly selected 1