Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Just answer according to required marks. The following are statements of profit or loss and statements of changes in equity of Casa Bhd, its subsidiaries

Just answer according to required marks.

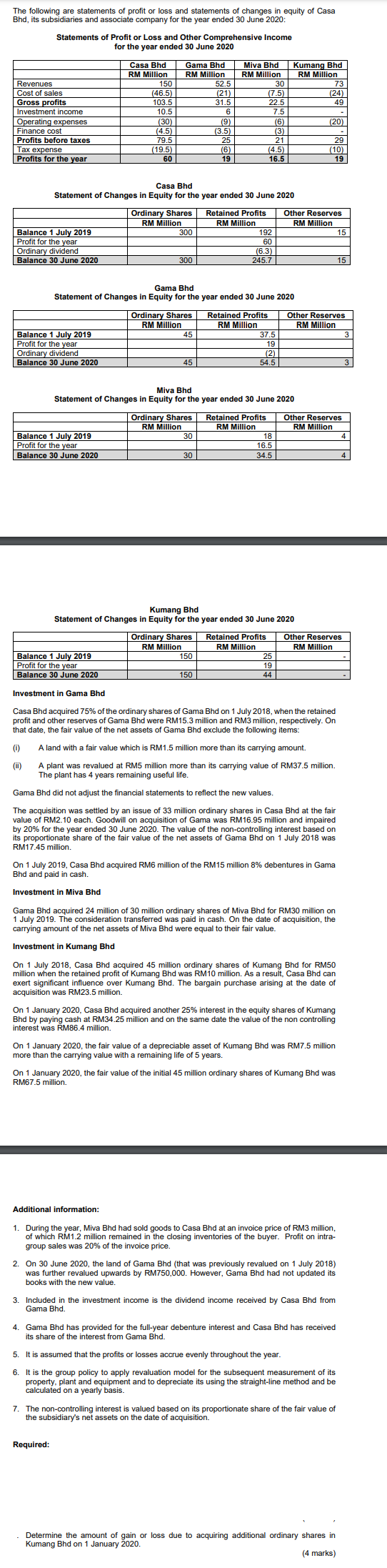

The following are statements of profit or loss and statements of changes in equity of Casa Bhd, its subsidiaries and associate company for the year ended 30 June 2020: Statements of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2020 Kumang Bhd RM Million 73 (24) 49 Revenues Cost of sales Gross profits Investment income Operating expenses Finance cost Profits before taxes Tax expense Profits for the year Casa Bhd RM Million 150 (46.5) 103.5 10.5 ( (30) (4.5) 79.5 (19.5) 60 Gama Bhd RM Million 52.5 (21) 31.5 6 (9) (3.5) 25 (6) 19 Miva Bhd RM Million 30 (7.5) 22.5 7.5 (6) (3) 21 (4.5) 16.5 (20) 29 (10) 19 Casa Bhd Statement of Changes in Equity for the year ended 30 June 2020 Ordinary Shares Retained Profits Other Reserves RM Million RM Million RM Million Balance 1 July 2019 300 192 15 Profit for the year 60 Ordinary dividend (6.3) Balance 30 June 2020 300 245.7 15 Gama Bhd Statement of Changes in Equity for the year ended 30 June 2020 Ordinary Shares Retained Profits Other Reserves RM Million RM Million RM Million Balance 1 July 2019 45 37.5 3 Profit for the year 19 Ordinary dividend (2) Balance 30 June 2020 45 54.5 3 Miva Bhd Statement of Changes in Equity for the year ended 30 June 2020 Ordinary Shares RM Million 30 Retained Profits RM Million 18 16.5 34.5 Other Reserves RM Million 4 Balance 1 July 2019 Profit for the year Balance 30 June 2020 30 4 Kumang Bhd Statement of Changes in Equity for the year ended 30 June 2020 Ordinary Shares Retained Profits Other Reserves RM Million RM Million RM Million Balance 1 July 2019 150 25 Profit for the year 19 Balance 30 June 2020 150 44 Investment in Gama Bhd Casa Bhd acquired 75% of the ordinary shares of Gama Bhd on 1 July 2018, when the retained profit and other reserves of Gama Bhd were RM15.3 million and RM3 million, respectively. On that date, the fair value of the net assets of Gama Bhd exclude the following items: (0) A land with a fair value which is RM1.5 million more than its carrying amount. () A plant was revalued at RM5 million more than its carrying value of RM37.5 million. The plant has 4 years remaining useful life. Gama Bhd did not adjust the financial statements to reflect the new values. The acquisition was settled by an issue of 33 million ordinary shares in Casa Bhd at the fair value of RM2.10 each. Goodwill on acquisition of Gama was RM16.95 million and impaired by 20% for the year ended 30 June 2020. The value of the non-controlling interest based on its proportionate share of the fair value of the net assets of Gama Bhd on 1 July 2018 was RM17.45 million. Gama On 1 July 2019, Casa Bhd acquired RM6 million of the RM15 million 8% debentures i Bhd and paid in cash. Investment in Miva Bhd Gama Bhd acquired 24 million of 30 million ordinary shares of Miva Bhd for RM30 million on 1 July 2019. The consideration transferred was paid in cash. On the date of acquisition, the carrying amount of the net assets of Miva Bhd were equal to their fair value. Investment in Kumang Bhd On 1 July 2018, Casa Bhd acquired 45 million ordinary shares of Kumang Bhd for RM50 million when the retained profit of Kumang Bhd was RM10 million. As a result, Casa Bhd can exert significant influence over Kumang Bhd. The bargain purchase arising at the date of acquisition was RM23.5 million. On 1 January 2020, Casa Bhd acquired another 25% interest in the equity shares of Kumang Bhd by paying cash at RM34.25 million and on the same date the value of the non controlling interest was RM86.4 million. On 1 January 2020, the fair value of a depreciable asset of Kumang Bhd was RM7.5 million more than the carrying value with a remaining life of 5 years. On 1 January 2020, the fair value of the initial 45 million ordinary shares of Kumang Bhd was RM67.5 million Additional information: 1. During the year, Miva Bhd had sold goods to Casa Bhd at an invoice price of RM3 million, of which RM1.2 million remained in the closing inventories of the buyer. Profit on intra- group sales was 20% of the invoice price. 2. On 30 June 2020, the land of Gama Bhd (that was previously revalued on 1 July 2018) was further revalued upwards by RM750,000. However, Gama Bhd had not updated its books with the new value. 3. Included in the investment income is the dividend income received by Casa Bhd from Gama Bhd. 4. Gama Bhd has provided for the full-year debenture interest and Casa Bhd has received its share of the interest from Gama Bhd. 5. It is assumed that the profits or losses accrue evenly throughout the year. 6. It is the group policy to apply revaluation model for the subsequent measurement of its property, plant and equipment and to depreciate its using the straight-line method and be calculated on a yearly basis. 7. The non-controlling interest is valued based on its proportionate share of the fair value of the subsidiary's net assets on the date of acquisition. Required: Determine the amount of gain or loss due to acquiring additional ordinary shares in Kumang Bhd on 1 January 2020. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started