JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

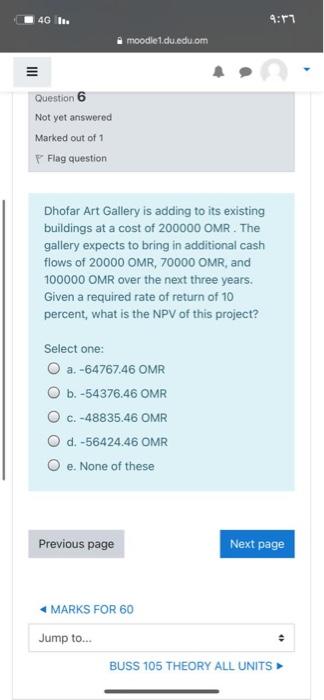

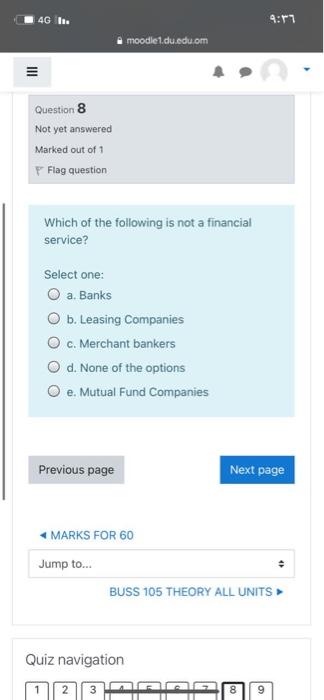

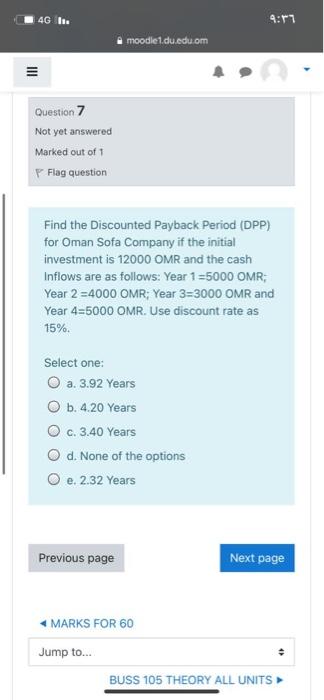

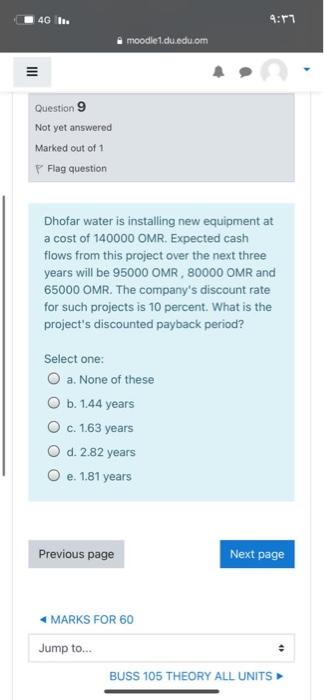

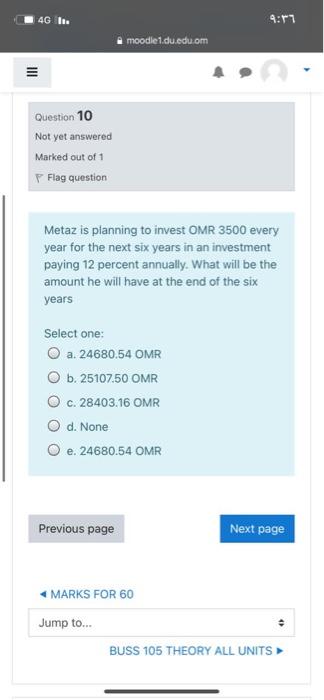

46 I. 4:17 moodle1.cu.edu.om Question 6 Not yet answered Marked out of 1 Flag question Dhofar Art Gallery is adding to its existing buildings at a cost of 200000 OMR. The gallery expects to bring in additional cash flows of 20000 OMR, 70000 OMR, and 100000 OMR over the next three years. Given a required rate of return of 10 percent, what is the NPV of this project? Select one: O a. -64767.46 OMR O b.-54376.46 OMR O C. -48835.46 OMR d. -56424.46 OMR Oe. None of these Previous page Next page MARKS FOR 60 Jump to... BUSS 105 THEORY ALL UNITS 4G. 4:17 moodle1.cu.edu.om = Question 8 Not yet answered Marked out of 1 P Flag question Which of the following is not a financial service? Select one: O a. Banks O b. Leasing Companies c. Merchant bankers d. None of the options e. Mutual Fund Companies O Previous page Next page MARKS FOR 60 Jump to... BUSS 105 THEORY ALL UNITS Quiz navigation 1729AAG 9 46. 4:17 moodle1.cu.edu.om = Question 7 Not yet answered Marked out of 1 Flag question Find the Discounted Payback Period (DPP) for Oman Sofa Company if the initial investment is 12000 OMR and the cash Inflows are as follows: Year 1=5000 OMR; Year 2 =4000 OMR; Year 3=3000 OMR and Year 4=5000 OMR. Use discount rate as 15%. Select one: O a. 3.92 Years O b.4.20 Years O c. 3.40 Years O d. None of the options O e. 2.32 Years Previous page Next page MARKS FOR 60 Jump to... BUSS 105 THEORY ALL UNITS 461. 4:17 moodle1.cu.edu.om = Question 9 Not yet answered Marked out of 1 Flag question Dhofar water is installing new equipment at a cost of 140000 OMR. Expected cash flows from this project over the next three years will be 95000 OMR, 80000 OMR and 65000 OMR. The company's discount rate for such projects is 10 percent. What is the project's discounted payback period? Select one: a. None of these O b. 1.44 years O c. 1.63 years d. 2.82 years e. 1.81 years Previous page Next page MARKS FOR 60 Jump to... BUSS 105 THEORY ALL UNITS 4G I. 4:17 moodle1.cu.edu.om = Question 10 Not yet answered Marked out of 1 Flag question Metaz is planning to invest OMR 3500 every year for the next six years in an investment paying 12 percent annually. What will be the amount he will have at the end of the six years Select one: a. 24680.54 OMR O b. 25107.50 OMR O c. 28403.16 OMR O d. None O e. 24680.54 OMR Previous page Next page MARKS FOR 60 Jump to... BUSS 105 THEORY ALL UNITS