Answered step by step

Verified Expert Solution

Question

1 Approved Answer

just need the answer and work shown for question 4 please AlphaBeta Co. Company reports net income of $192,000 each year and declares an annual

just need the answer and work shown for question 4 please

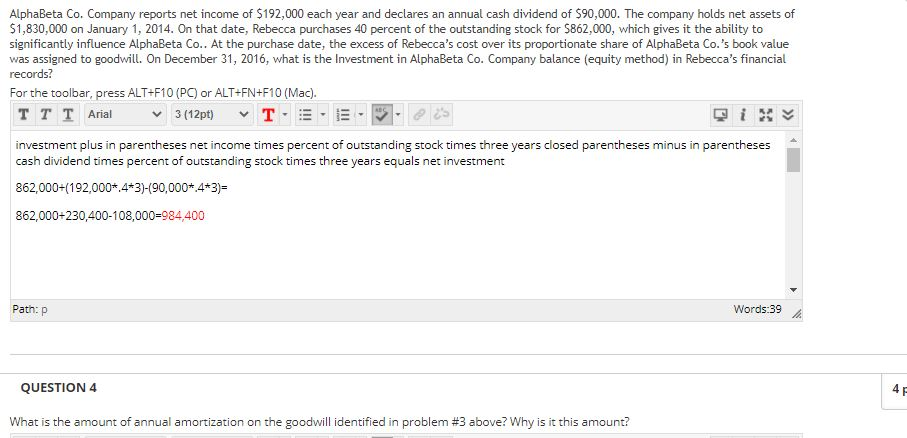

AlphaBeta Co. Company reports net income of $192,000 each year and declares an annual cash dividend of $90,000. The company holds net assets of $1,830,000 on January 1, 2014. On that date, Rebecca purchases 40 percent of the outstanding stock for 5862,000, which gives it the ability to significantly influence AlphaBeta Co.. At the purchase date, the excess of Rebecca's cost over its proportionate share of AlphaBeta Co.'s book value was assigned to goodwill. On December 31, 2016, what is the Investment in AlphaBeta Co. Company balance (equity method) in Rebecca's financial records? For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TTT Arial 3 (12pt) investment plus in parentheses net income times percent of outstanding stock times three years closed parentheses minus in parentheses cash dividend times percent of outstanding stock times three years equals net investment 862,000+(192,000*4*3)-(90,000+4+3)= 862,000+230,400-108,000=984,400 Path: P Words:39 QUESTION 4 4 What is the amount of annual amortization on the goodwill identified in problem #3 above? Why is it this amountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started