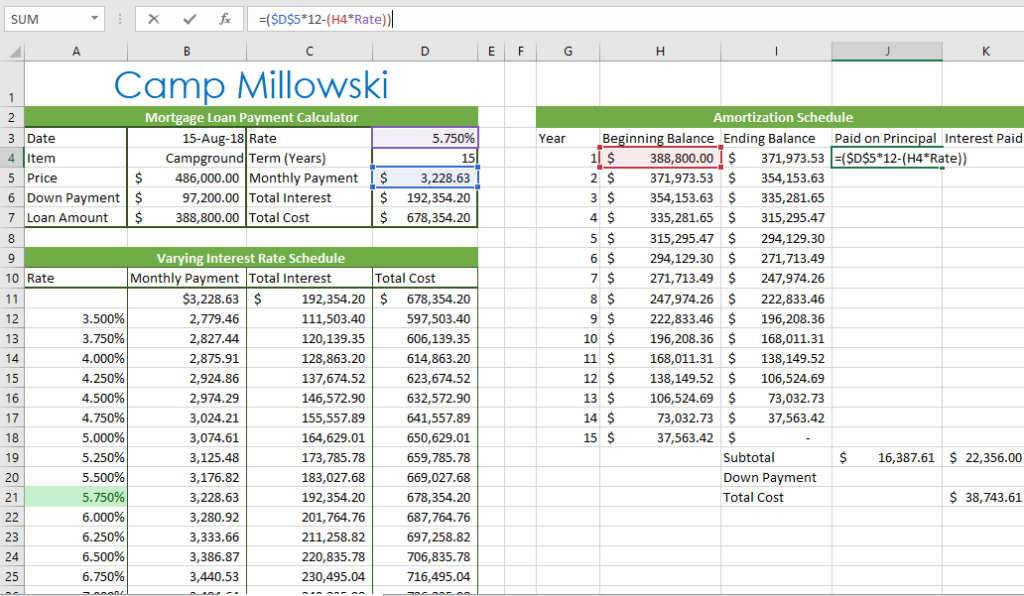

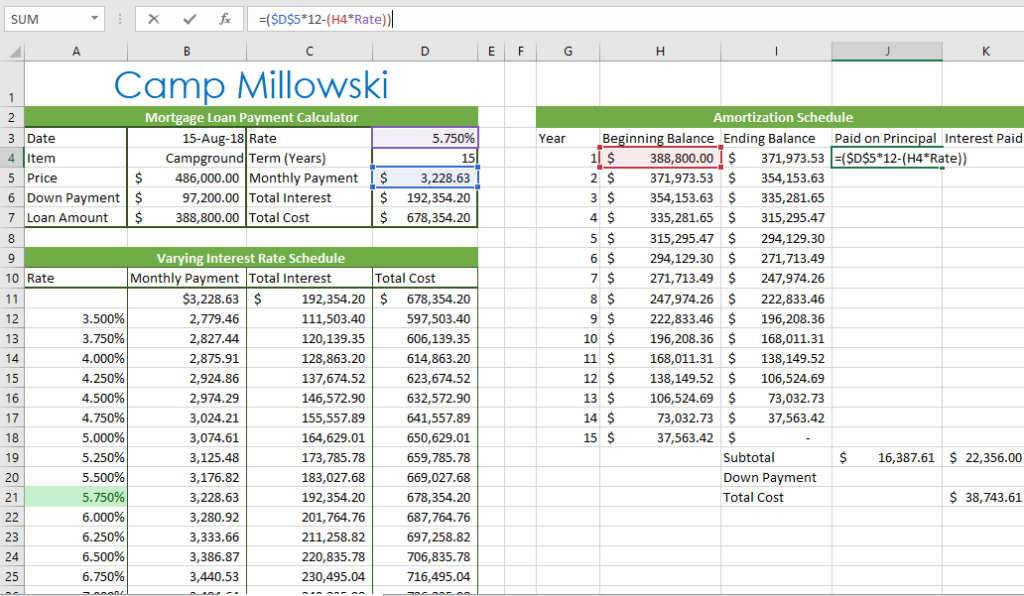

- Kaleen now wishes to finalize the Amortization schedule.

In cell J4, create a formula without using a function that subtracts the value in cell I4 from the value in cell H4 to determine how much of the mortgage principal is being paid off each year.

I got $16,387.61 but the correct answer is $16,826.47. What mistake do I made?

I got $16,387.61 but the correct answer is $16,826.47. What mistake do I made?

SUM Camp Millowski ortgage Loan Payment Calculator Amortization Schedule 15-Aug-18 Rate 5.750% Beginning Balance Ending Balance Paid on Principal Interest Paid 1388,800.00 371,973.53SDS5 12-(H4 Rate) 2 $ 371,973.53 354,153.63 3 $354,153.63 335,281.65 4 $335,281.65 $ 315,295.47 5 $ 315,295.47$ 294,129.30 6 $ 294,129.30$271,713.49 7 $ 271,713.49 247,974.26 8 247,974.26 222,833.46 9 $ 222,833.46 196,208.36 10 $196,208.36 $ 168,011.31 11 168,011.31 $138,149.52 12 $138,149.52$ 106,524.69 13 106,524.69$ 73,032.73 14 $ 73,032.73 $ 37,563.42 15 $37,563.42 3 Date 4 Item Year Campground Term (Years) 15 $486,000.00 Monthly Payment 3,228.63 $ 192,354.20 $ 678,354.20 6 Down Payment 97,200.00 Total Interest 7 Loan Amount$388,800.00 Total Cost Varying Interest Rate Schedule Monthly Payment Total Interest 10 Rate Total Cost 3,228.63 $ 2,779.46 2,827.44 2,875.91 2,924.86 2,974.29 3,024.21 3,074.61 3,125.48 3,176.82 3,228.63 3,280.92 3,333.66 3,386.87 3,440.53 192,354.20678,354.20 111,503.40 120,139.35 128,863.20 137,674.52 146,572.90 55,557.89 164,629.01 173,785.78 183,027.68 192,354.20 201,764.76 211,258.82 220,835.78 230,495.04 3.500% 4.000% 4.250% 4.500% 4.750% 5.000% 5.250% 5.500% 5.750% 6.000% 6.250% 6.500% 6.750% 597,503.40 606,139.35 614,863.20 623,674.52 632,572.90 41,557.89 650,629.01 659,785.78 669,027.68 678,354.20 687,764.76 697,258.82 706,835.78 716,495.04 Subtotal Down Payment Total Cost $16,387.61 22,356.00 21 38,743.61 SUM Camp Millowski ortgage Loan Payment Calculator Amortization Schedule 15-Aug-18 Rate 5.750% Beginning Balance Ending Balance Paid on Principal Interest Paid 1388,800.00 371,973.53SDS5 12-(H4 Rate) 2 $ 371,973.53 354,153.63 3 $354,153.63 335,281.65 4 $335,281.65 $ 315,295.47 5 $ 315,295.47$ 294,129.30 6 $ 294,129.30$271,713.49 7 $ 271,713.49 247,974.26 8 247,974.26 222,833.46 9 $ 222,833.46 196,208.36 10 $196,208.36 $ 168,011.31 11 168,011.31 $138,149.52 12 $138,149.52$ 106,524.69 13 106,524.69$ 73,032.73 14 $ 73,032.73 $ 37,563.42 15 $37,563.42 3 Date 4 Item Year Campground Term (Years) 15 $486,000.00 Monthly Payment 3,228.63 $ 192,354.20 $ 678,354.20 6 Down Payment 97,200.00 Total Interest 7 Loan Amount$388,800.00 Total Cost Varying Interest Rate Schedule Monthly Payment Total Interest 10 Rate Total Cost 3,228.63 $ 2,779.46 2,827.44 2,875.91 2,924.86 2,974.29 3,024.21 3,074.61 3,125.48 3,176.82 3,228.63 3,280.92 3,333.66 3,386.87 3,440.53 192,354.20678,354.20 111,503.40 120,139.35 128,863.20 137,674.52 146,572.90 55,557.89 164,629.01 173,785.78 183,027.68 192,354.20 201,764.76 211,258.82 220,835.78 230,495.04 3.500% 4.000% 4.250% 4.500% 4.750% 5.000% 5.250% 5.500% 5.750% 6.000% 6.250% 6.500% 6.750% 597,503.40 606,139.35 614,863.20 623,674.52 632,572.90 41,557.89 650,629.01 659,785.78 669,027.68 678,354.20 687,764.76 697,258.82 706,835.78 716,495.04 Subtotal Down Payment Total Cost $16,387.61 22,356.00 21 38,743.61

I got $16,387.61 but the correct answer is $16,826.47. What mistake do I made?

I got $16,387.61 but the correct answer is $16,826.47. What mistake do I made?