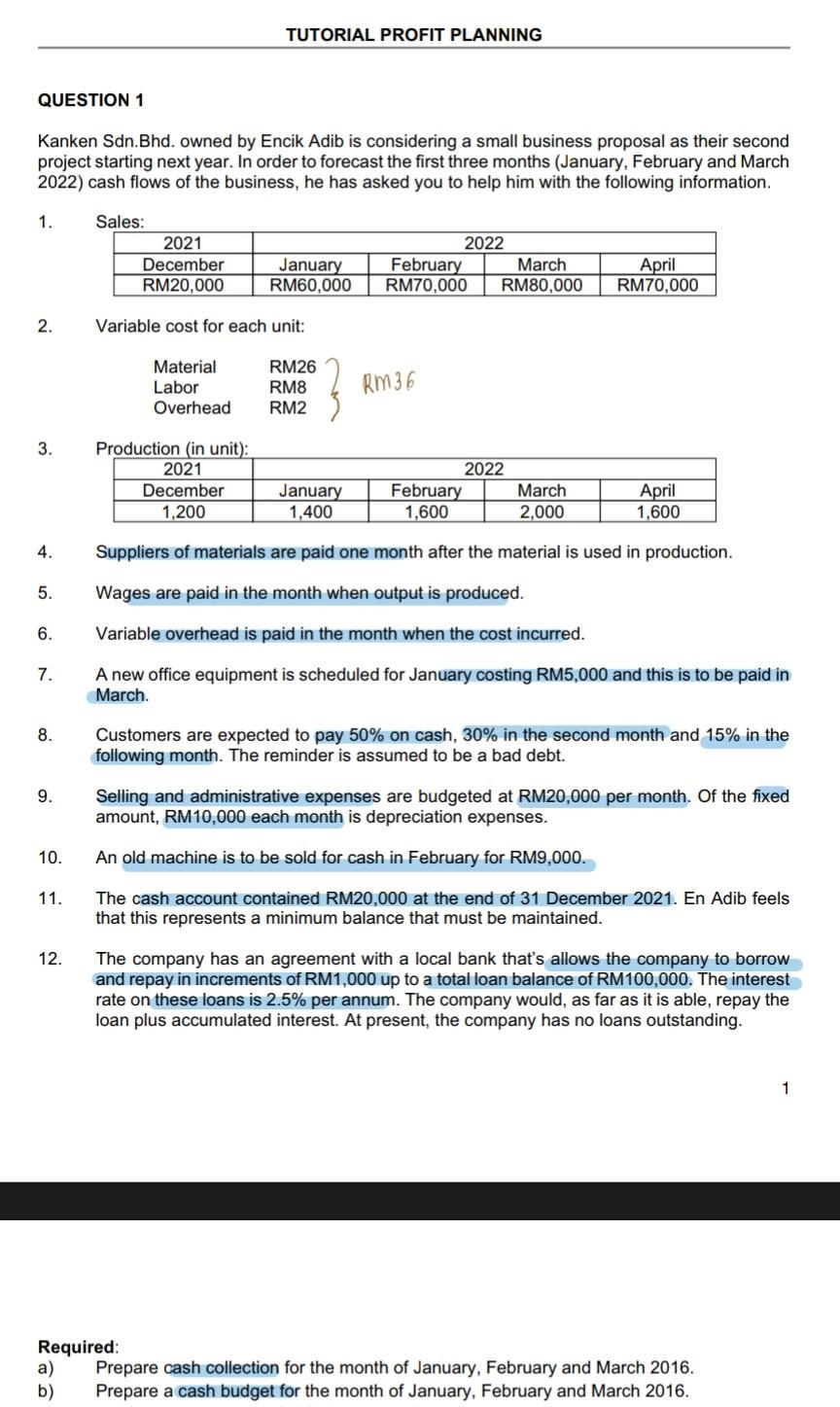

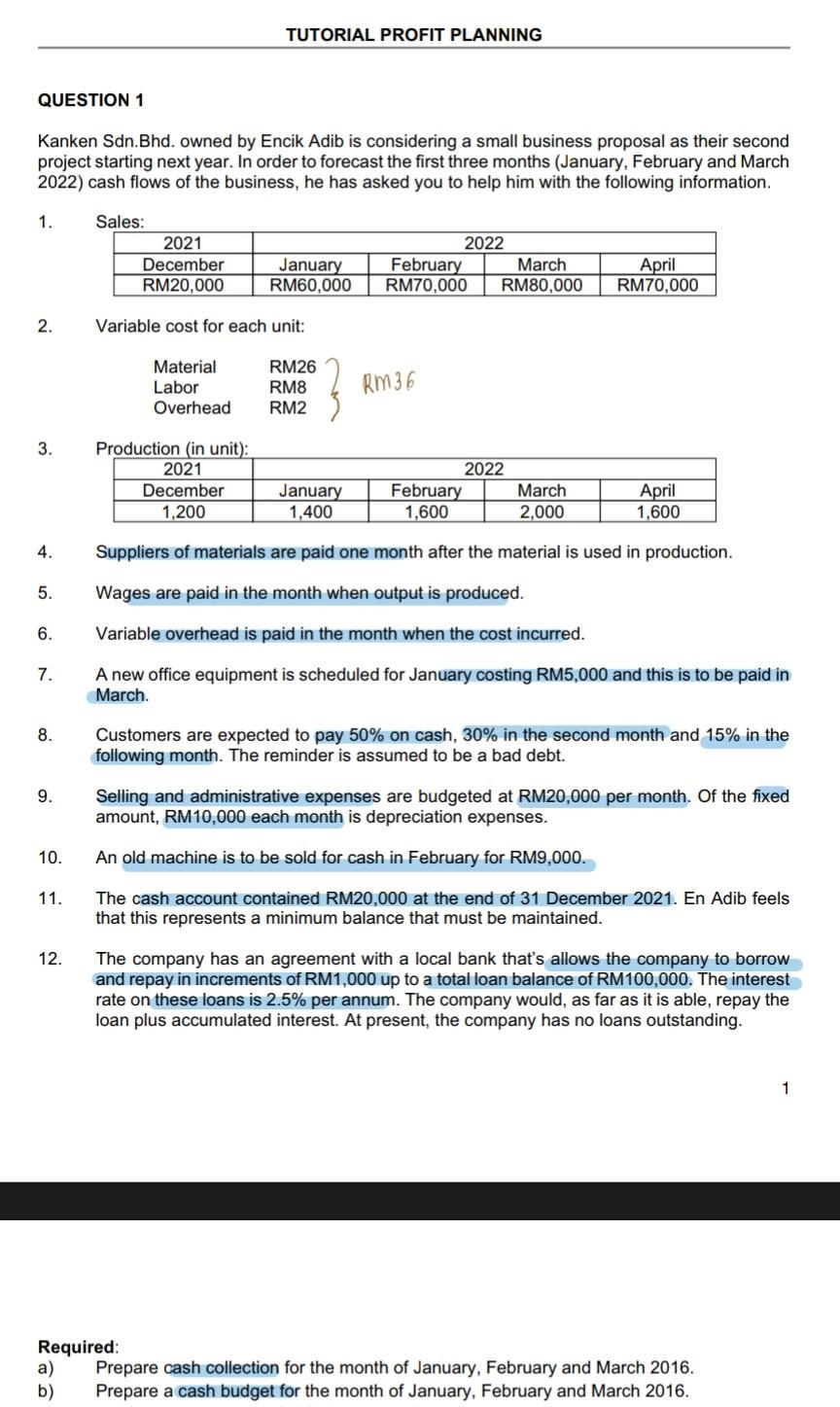

Kanken Sdn.Bhd. owned by Encik Adib is considering a small business proposal as their second project starting next year. In order to forecast the first three months (January, February and March 2022) cash flows of the business, he has asked you to help him with the following information. 1. 2. Variable cost for each unit: 3. 4. Suppliers of materials are paid one month after the material is used in production. 5. Wages are paid in the month when output is produced. 6. Variable overhead is paid in the month when the cost incurred. 7. A new office equipment is scheduled for January costing RM5,000 and this is to be paid in March. 8. Customers are expected to pay 50% on cash, 30% in the second month and 15% in the following month. The reminder is assumed to be a bad debt. 9. Selling and administrative expenses are budgeted at RM20,000 per month. Of the fixed amount, RM10,000 each month is depreciation expenses. 10. An old machine is to be sold for cash in February for RM9,000. 11. The cash account contained RM20,000 at the end of 31 December 2021. En Adib feels that this represents a minimum balance that must be maintained. 12. The company has an agreement with a local bank that's allows the company to borrow and repay in increments of RM1,000 up to a total loan balance of RM100,000. The interest rate on these loans is 2.5% per annum. The company would, as far as it is able, repay the loan plus accumulated interest. At present, the company has no loans outstanding. 1 Required: a) Prepare cash collection for the month of January, February and March 2016. b) Prepare a cash budget for the month of January, February and March 2016. Kanken Sdn.Bhd. owned by Encik Adib is considering a small business proposal as their second project starting next year. In order to forecast the first three months (January, February and March 2022) cash flows of the business, he has asked you to help him with the following information. 1. 2. Variable cost for each unit: 3. 4. Suppliers of materials are paid one month after the material is used in production. 5. Wages are paid in the month when output is produced. 6. Variable overhead is paid in the month when the cost incurred. 7. A new office equipment is scheduled for January costing RM5,000 and this is to be paid in March. 8. Customers are expected to pay 50% on cash, 30% in the second month and 15% in the following month. The reminder is assumed to be a bad debt. 9. Selling and administrative expenses are budgeted at RM20,000 per month. Of the fixed amount, RM10,000 each month is depreciation expenses. 10. An old machine is to be sold for cash in February for RM9,000. 11. The cash account contained RM20,000 at the end of 31 December 2021. En Adib feels that this represents a minimum balance that must be maintained. 12. The company has an agreement with a local bank that's allows the company to borrow and repay in increments of RM1,000 up to a total loan balance of RM100,000. The interest rate on these loans is 2.5% per annum. The company would, as far as it is able, repay the loan plus accumulated interest. At present, the company has no loans outstanding. 1 Required: a) Prepare cash collection for the month of January, February and March 2016. b) Prepare a cash budget for the month of January, February and March 2016