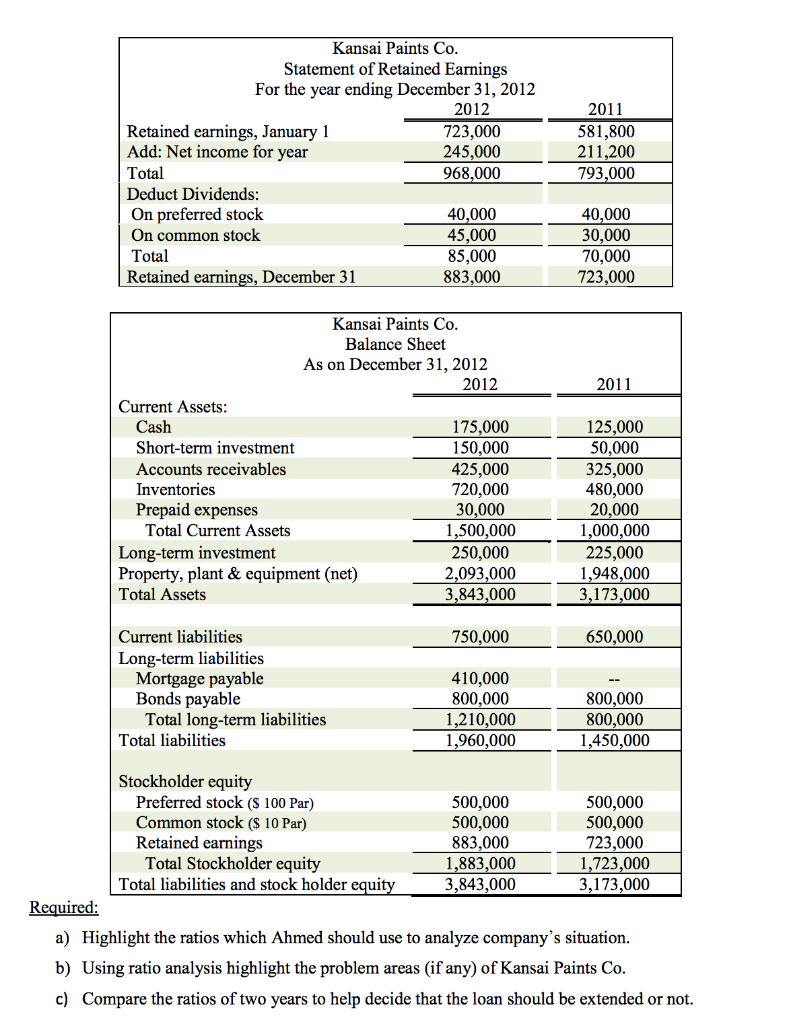

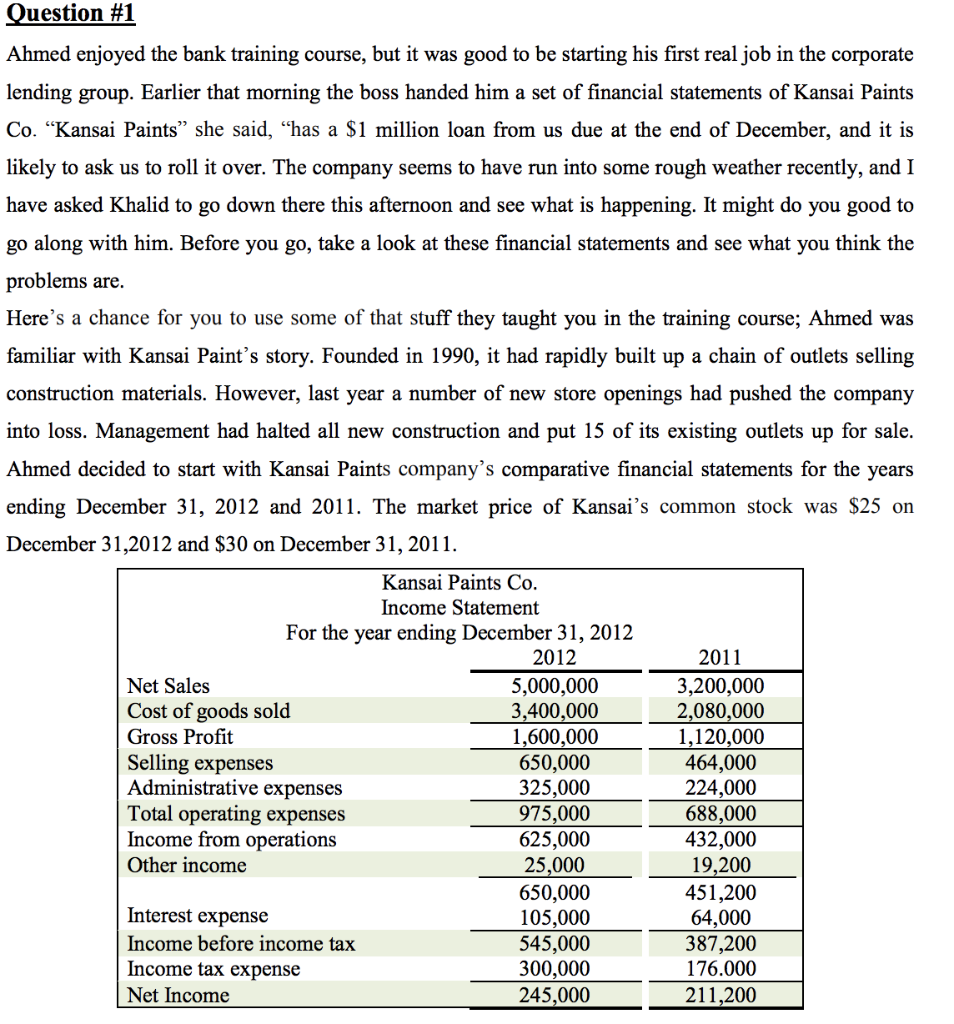

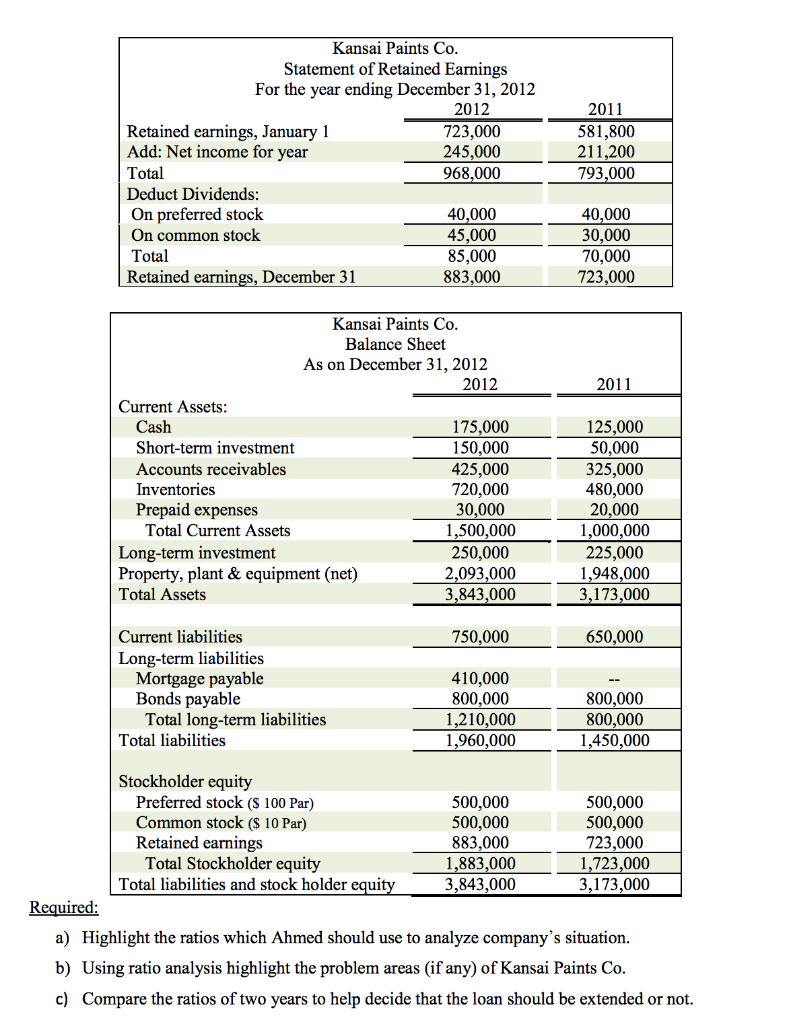

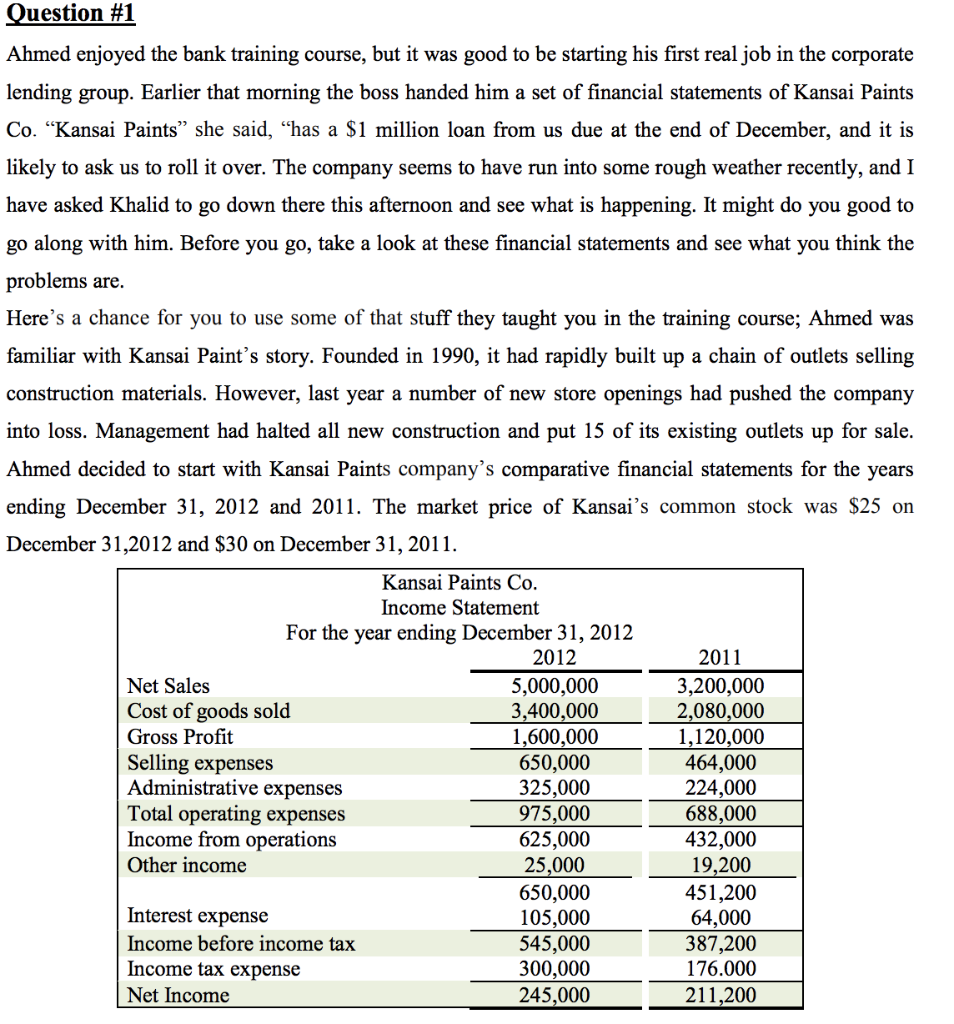

Kansai Paints Co. Statement of Retained Earnings For the year ending December 31, 2012 2012 Retained earnings, January 1 723,000 Add: Net income for year 245,000 Total 968,000 Deduct Dividends: On preferred stock 40,000 On common stock 45,000 Total 85,000 Retained earnings, December 31 883,000 2011 581,800 211,200 793,000 40,000 30,000 70.000 723,000 2011 Kansai Paints Co. Balance Sheet As on December 31, 2012 2012 Current Assets: Cash 175,000 Short-term investment 150,000 Accounts receivables 425,000 Inventories 720,000 Prepaid expenses 30,000 Total Current Assets 1,500,000 Long-term investment 250,000 Property, plant & equipment (net) 2,093,000 Total Assets 3,843,000 125.000 50,000 325,000 480,000 20,000 1,000,000 225,000 1,948,000 3,173,000 750,000 650,000 Current liabilities Long-term liabilities Mortgage payable Bonds payable Total long-term liabilities Total liabilities 410,000 800,000 1,210,000 1,960,000 800,000 800,000 1,450,000 Stockholder equity Preferred stock ($ 100 Par) 500,000 500,000 Common stock ($ 10 Par) 500,000 500,000 Retained earnings 883,000 723,000 Total Stockholder equity 1,883,000 1,723,000 Total liabilities and stock holder equity 3,843,000 3,173,000 Required: a) Highlight the ratios which Ahmed should use to analyze company's situation. b) Using ratio analysis highlight the problem areas (if any) of Kansai Paints Co. c) Compare the ratios of two years to help decide that the loan should be extended or not. Question #1 Ahmed enjoyed the bank training course, but it was good to be starting his first real job in the corporate lending group. Earlier that morning the boss handed him a set of financial statements of Kansai Paints Co. Kansai Paints she said, has a $1 million loan from us due at the end of December, and it is likely to ask us to roll it over. The company seems to have run into some rough weather recently, and I have asked Khalid to go down there this afternoon and see what is happening. It might do you good to go along with him. Before you go, take a look at these financial statements and see what you think the problems are. Here's a chance for you to use some of that stuff they taught you in the training course; Ahmed was familiar with Kansai Paint's story. Founded in 1990, it had rapidly built up a chain of outlets selling construction materials. However, last year a number of new store openings had pushed the company into loss. Management had halted all new construction and put 15 of its existing outlets up for sale. Ahmed decided to start with Kansai Paints company's comparative financial statements for the years ending December 31, 2012 and 2011. The market price of Kansai's common stock was $25 on December 31,2012 and $30 on December 31, 2011. Kansai Paints Co. Income Statement For the year ending December 31, 2012 2012 Net Sales 5,000,000 Cost of goods sold 3,400,000 Gross Profit 1,600,000 Selling expenses 650,000 Administrative expenses 325,000 Total operating expenses 975,000 Income from operations 625,000 Other income 25,000 650,000 Interest expense 105,000 Income before income tax 545,000 Income tax expense 300,000 Net Income 245,000 2011 3,200,000 2,080,000 1,120,000 464,000 224,000 688,000 432,000 19,200 451,200 64,000 387,200 176.000 211,200