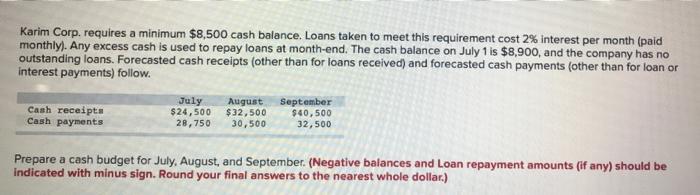

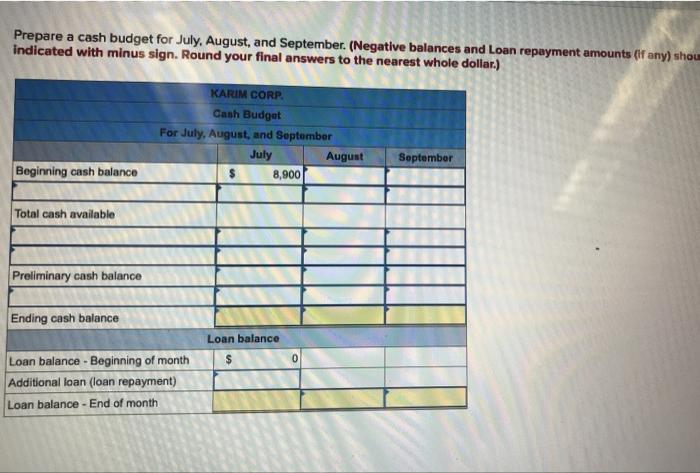

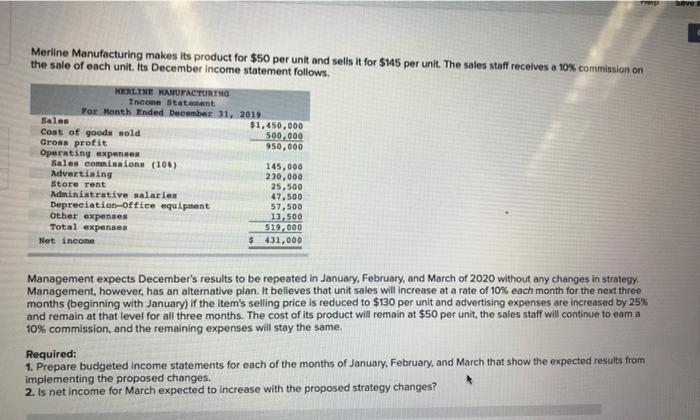

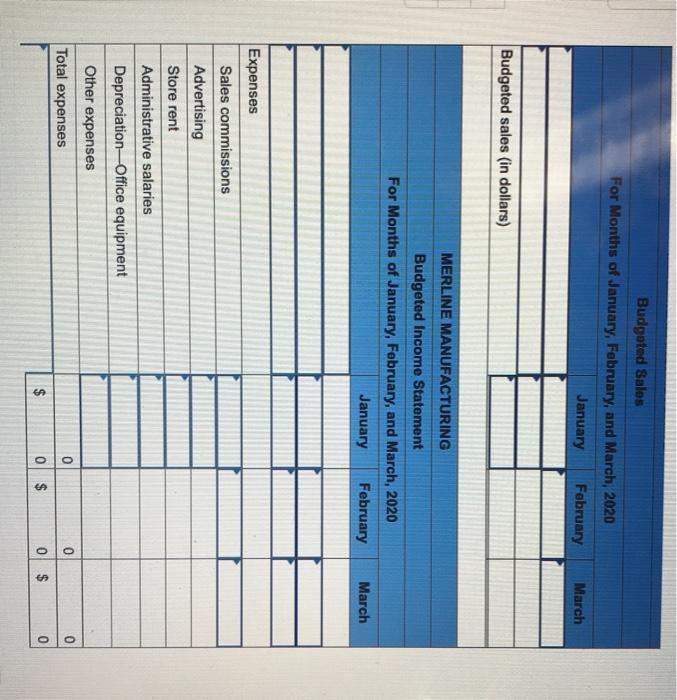

Karim Corp. requires a minimum $8,500 cash balance. Loans taken to meet this requirement cost 2% interest per month (paid monthly). Any excess cash is used to repay loans at month-end. The cash balance on July 1 is $8,900, and the company has no outstanding loans. Forecasted cash receipts (other than for loans received) and forecasted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments July $24,500 28,750 August $32,500 30,500 September $40,500 32,500 Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) Prepare a cash budget for July, August, and September. (Negative balances and Loan repayment amounts (if any) shou indicated with minus sign. Round your final answers to the nearest whole dollar.) KARIM CORP Cash Budget For July, August, and September July August 8,900 September Beginning cash balance Total cash available Preliminary cash balance Ending cash balance Loan balance $ Loan balance - Beginning of month Additional loan (loan repayment) Loan balance - End of month Merline Manufacturing makes its product for $50 per unit and sells it for $145 per unit. The sales staff receives a 10% commission on the sale of each unit. Its December Income statement follows. MERLIN MANUFACTURING Income Statement For Month Inded December 31, 2019 Sales $1,450,000 Coat of goods sold 500,000 Gross profit 950,000 Operating expenses Sales commission (101) 145,000 Advertising 230,000 Store rent 25,500 Administrative salaries 47,500 Depreciation office equipment 57,500 Other expenses 13,500 Total expenses 519,000 Net income 431,000 Management expects December's results to be repeated in January, February, and March of 2020 without any changes in strategy Management, however, has an alternative plan. It believes that unit sales will increase at a rate of 10% each month for the next three months (beginning with January) If the item's seling price is reduced to $130 per unit and advertising expenses are increased by 25% and remain at that level for all three months. The cost of its product will remain at $50 per unit, the sales staff will continue to earn a 10% commission, and the remaining expenses will stay the same. Required: 1. Prepare budgeted income statements for each of the months of January, February, and March that show the expected results from implementing the proposed changes. 2. Is net income for March expected to increase with the proposed strategy changes? Budgeted Sales For Months of January, February, and March, 2020 January February March Budgeted sales in dollars) MERLINE MANUFACTURING Budgeted Income Statement For Months of January, February, and March, 2020 January February March Expenses Sales commissions Advertising Store rent Administrative salaries Depreciation - Office equipment Other expenses 0 0 0 Total expenses $ 0 $ 0 $ 0 3.34 pints Required: 1. Prepare budgeted income statements for each of the months of January, February, and March that show the expected results from implementing the proposed changes. 2. Is net income for March expected to increase with the proposed strategy changes? eBook Complete this qustion by entering your answers in the tabs below. Print References Required 1 Required 2 Is net income for March expected to increase with the proposed strategy changes? Is net income for March expected to increase with the proposed strategy changes? Required 1