Question

Kay The following occurred during 20X1 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000 3. Bonds payable (maturing in 20X5)

Kay

The following occurred during 20X1

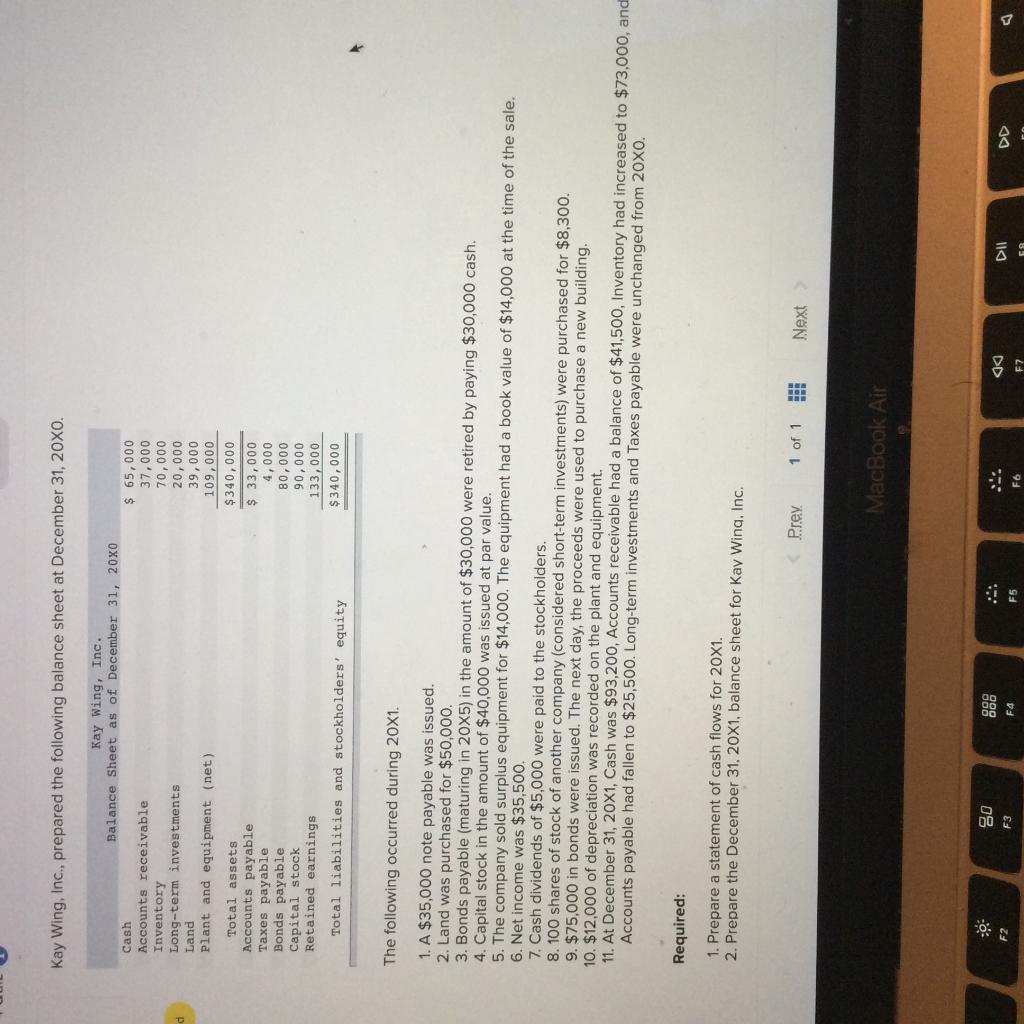

1. A $35,000 note payable was issued.

2. Land was purchased for $50,000

3. Bonds payable (maturing in 20X5) in the amount of $30,000 were retired by paying $30,000 cash.

4. Capital stock in the amount of $40,000 was issued par value.

5. The company sold surplus equipment for $14,000 at the time of the sale. The equipment had a book value of $14,000 at the time of the sale.

6. Net Income was $35,500

7. Cash dividends of $5,000 were paid to the stockholders

8. 100 shares of stock of another company ( considered short-term investments) were purchased for $8,300.

9. $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building

10. $12,000 of depreciation was recorded on the plant and equipment

11. At December 31, 20X1, Cash was $93,200, Accounts receivable had a balance of $41,500, inventory had increased to $73,000, and accounts payable had fallen to $25,500. Long term investments and Taxes payable were unchanged from 20X0.

Kay Wing, Inc., prepared the following balance sheet at December 31, 20X0. Kay Wing, Inc. Balance Sheet as of December 31, 20X0 Cash Accounts receivable Inventory Long-term investments Land Plant and equipment (net) Total assets Accounts payable Taxes payable Bonds payable Capital stock Retained earnings Total liabilities and stockholders' equity $ 65,000 37,000 70,000 20,000 39,000 109,000 $340,000 $ 33,000 4,000 80,000 90,000 133,000 $340,000 The following occurred during 20X1. 1. A $35,000 note payable was issued. 2. Land was purchased for $50,000. 3. Bonds payable (maturing in 20X5) in the amount of $30,000 were retired by paying $30,000 cash. 4. Capital stock in the amount of $40,000 was issued at par value. 5. The company sold surplus equipment for $14,000. The equipment had a book value of $14,000 at the time of the sale. 6. Net income was $35,500. 7. Cash dividends of $5,000 were paid to the stockholders, 8.100 shares of stock of another company (considered short-term investments) were purchased for $8,300. 9. $75,000 in bonds were issued. The next day, the proceeds were used to purchase a new building. 10. $12,000 of depreciation was recorded on the plant and equipment. 11. At December 31, 20X1, Cash was $93,200, Accounts receivable had a balance of $41,500, Inventory had increased to $73,000, and Accounts payable had fallen to $25,500. Long-term investments and Taxes payable were unchanged from 20x0. Required: 1. Prepare a statement of cash flows for 20X1. 2. Prepare the December 31, 20X1. balance sheet for Kay Wing, Inc. Prey 1 of 1 Next MacBook Air o F2 F3 DII F4 DD F5 F7 FIAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started