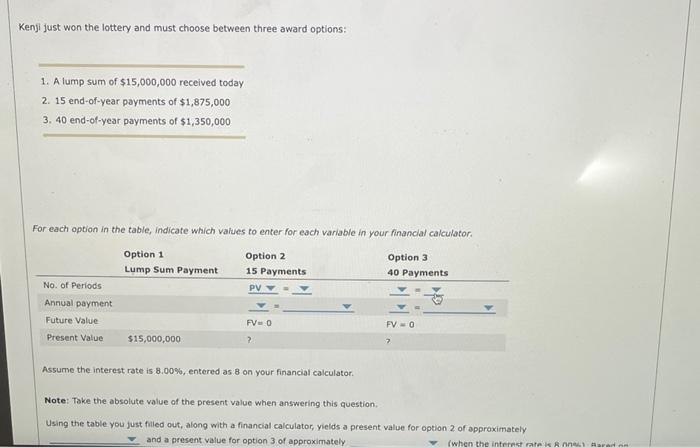

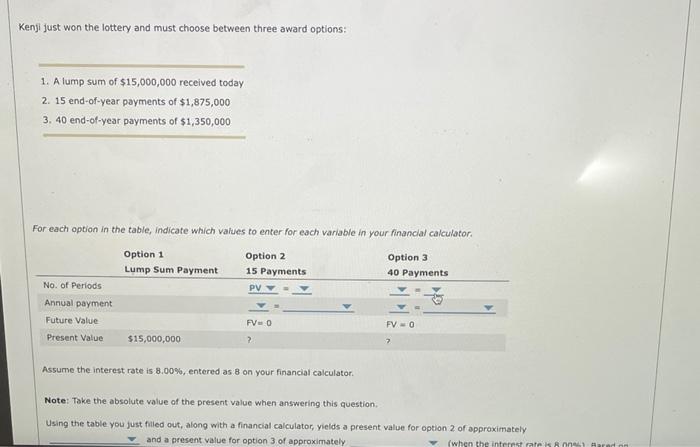

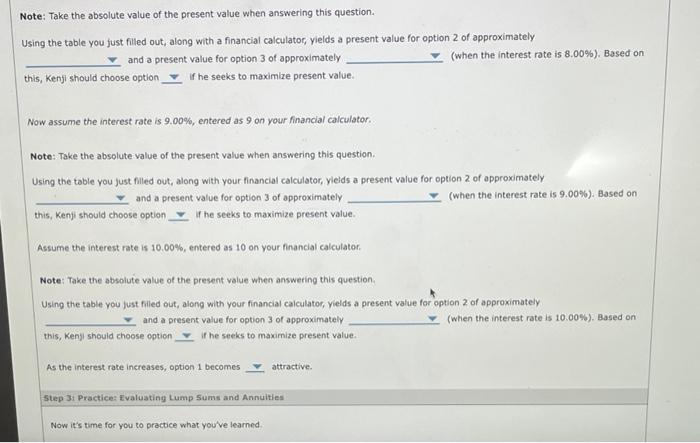

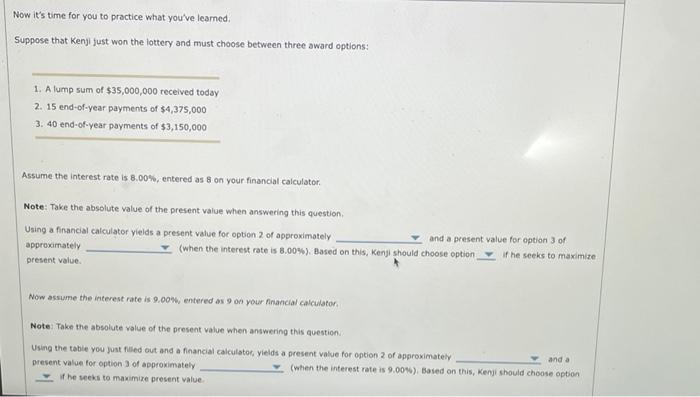

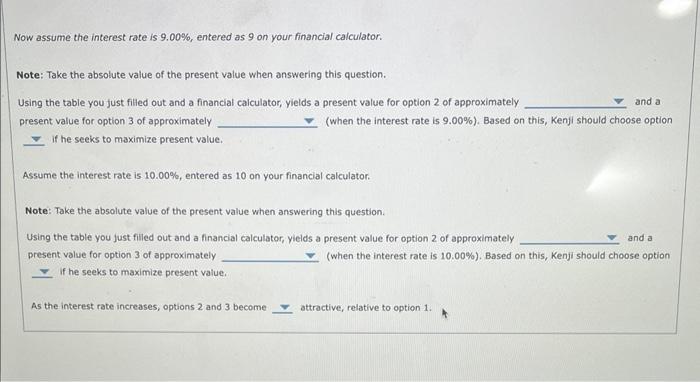

Kenji just won the lottery and must choose between three award options: 1. A lump sum of $15,000,000 received today 2. 15 end-of-year payments of $1,875,000 3. 40 end-of-year payments of $1,350,000 For each option in the table, indicate which values to enter for each variable in your financial calculator. Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filied out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately Kenji just won the lottery and must choose between three award options: 1. A lump sum of $15,000,000 received today 2. 15 end-of-year payments of $1,875,000 3. 40 end-of-year payments of $1,350,000 For each option in the table, indicate which values to enter for each variable in your financial calculator. Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filied out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately lote: Take the absolute value of the present value when answering this question. Jsing the table you fust filled out, along with a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 8.00% ). Based on if he seeks to maximize present value. this, Kenjl should choose option Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out, along with your financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 9.00% ). Based on this, Kenji should choose option it he seeks to maximize present value. Assume the interest rate is 10.00%, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answeting this question. Using the table you fust filled out, along with your financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 10.005 ). Based on this, Kenji should choose option if he seeks to maximize present value. As the interest rate increases, option 1 becomes attractive. 5tep 3i Practice: Evaluating Lump 5ums and Annuities Now it's time for you to practice what you've leamed. Suppose that Kenjl fust won the lottery and must choose between three award options: Assume the interest rate is 8.00%, entered as 8 on your financial calculator. Note: Take the absolute value of the present value when answeeing this question, Using a financial calculator yields a present value for option 2 of approximately approximately (when the interest rate is 8.004 ). Based on this, Kenji should choose option if he seeks to maximite present value. Now assume the interest rate is 9.00% entered as 9 on your financial calculator Note: Take the absolute value of the present value when answering this question. Using the table you just filled out and a financial calculatof, yields a present value for ontion 2 of approximately Dresent value for option 3 of approximately (when the interest rate is 9.004 ) Based on this, Ken)i should choose option if he reeks to maximize present value: Now assume the interest rate is 9.00%, entered as 9 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out and a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 9.00% ). Based on this, Kenfi should choose option If he seeks to maximize present value. Assume the interest rate is 10.00%, entered as 10 on your financial calculator. Note: Take the absolute value of the present value when answering this question. Using the table you just filled out and a financial calculator, yields a present value for option 2 of approximately and a present value for option 3 of approximately (when the interest rate is 10.00% ). Based on this, Kenji should choose option if he seeks to maximize present value. As the interest rate increases, options 2 and 3 become attractive, relative to option 1