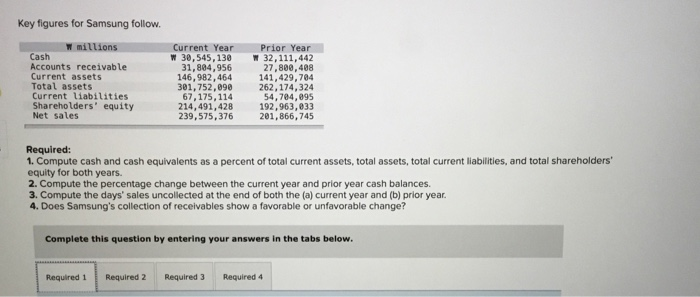

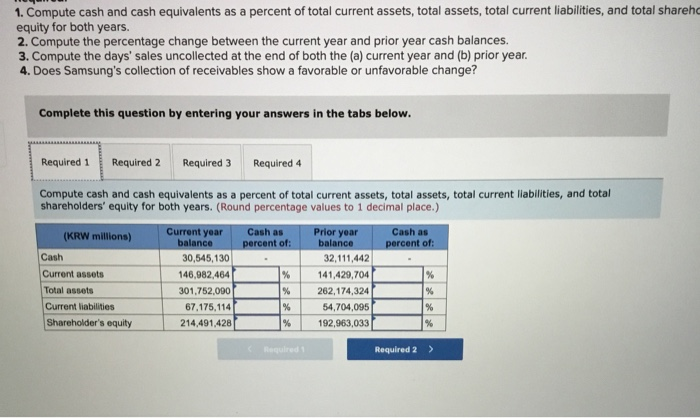

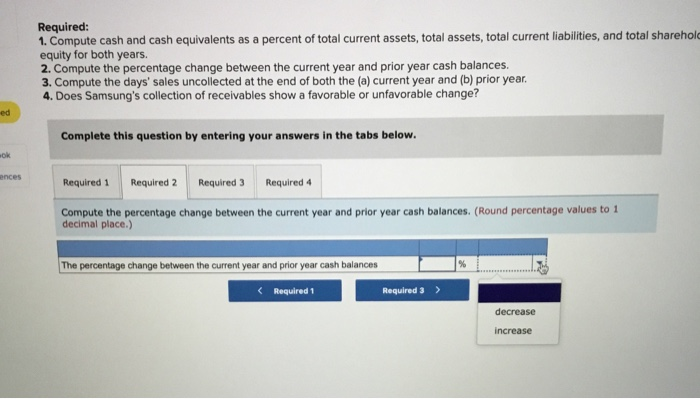

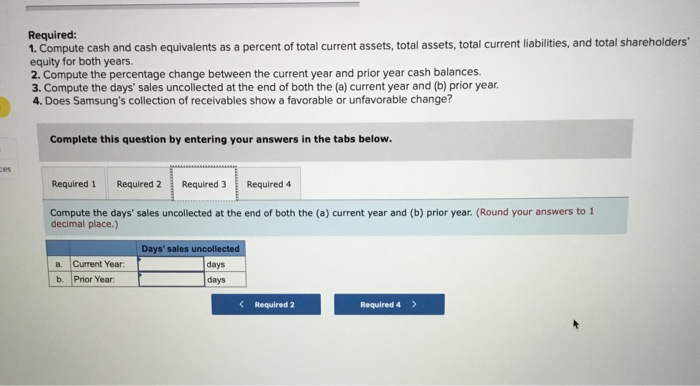

Key figures for Samsung follow, W millions Cash Accounts receivable Current assets Total assets Current liabilities Shareholders' equity Net sales Current Year W 30,545,130 31,894,956 146.982.464 301.752.090 67,175, 114 214,491,428 239,575,376 Prior Year W 32.111.442 27,800,408 141, 429,704 262,174,324 54,704,895 192,963,033 201,866, 745 Required: 1. Compute cash and cash equivalents as a percent of total current assets, total assets, total current liabilities, and total shareholders' equity for both years. 2. Compute the percentage change between the current year and prior year cash balances. 3. Compute the days' sales uncollected at the end of both the (a) current year and (b) prior year. 4. Does Samsung's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 1. Compute cash and cash equivalents as a percent of total current assets, total assets, total current liabilities, and total shareho equity for both years. 2. Compute the percentage change between the current year and prior year cash balances. 3. Compute the days' sales uncollected at the end of both the (a) current year and (b) prior year. 4. Does Samsung's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute cash and cash equivalents as a percent of total current assets, total assets, total current liabilities, and total shareholders' equity for both years. (Round percentage values to 1 decimal place.) (KRW millions) Cash as percent of: Cash as percent of: Cash Current assets Total assets Current liabilities Shareholder's equity Current year balance 30,545,130 146,982,464 301,752,090 67,175,114 214,491,428 Prior year balance 32,111,442 141,429,704 262,174,324 54.704,095 192,963,033 Required 2 > Required: 1. Compute cash and cash equivalents as a percent of total current assets, total assets, total current liabilities, and total sharehold equity for both years. 2. Compute the percentage change between the current year and prior year cash balances 3. Compute the days' sales uncollected at the end of both the (a) current year and (b) prior year. 4. Does Samsung's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Inces Required 1 Required 2 Required 3 Required 4 Compute the percentage change between the current year and prior year cash balances. (Round percentage values to 1 decimal place.) The percentage change between the current year and prior year cash balances decrease increase Required: 1. Compute cash and cash equivalents as a percent of total current assets, total assets, total current liabilities, and total shareholders' equity for both years. 2. Compute the percentage change between the current year and prior year cash balances 3. Compute the days' sales uncollected at the end of both the (a) current year and (b) prior year 4. Does Samsung's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the days' sales uncollected at the end of both the (a) current year and (b) prior year. (Round your answers to 1 decimal place.) Days' sales uncollected days a. Current Year: b. Prior Year Required 2 Required 4 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Does Samsung's collection of receivables show a favorable or unfavorable change? Does Samsung's collection of receivables show a favorable or unfavorable change? Required 3 Required Favorable Unfavorable