Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Keylor Navas, CFA, covers initial public offerings for Kylian Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate

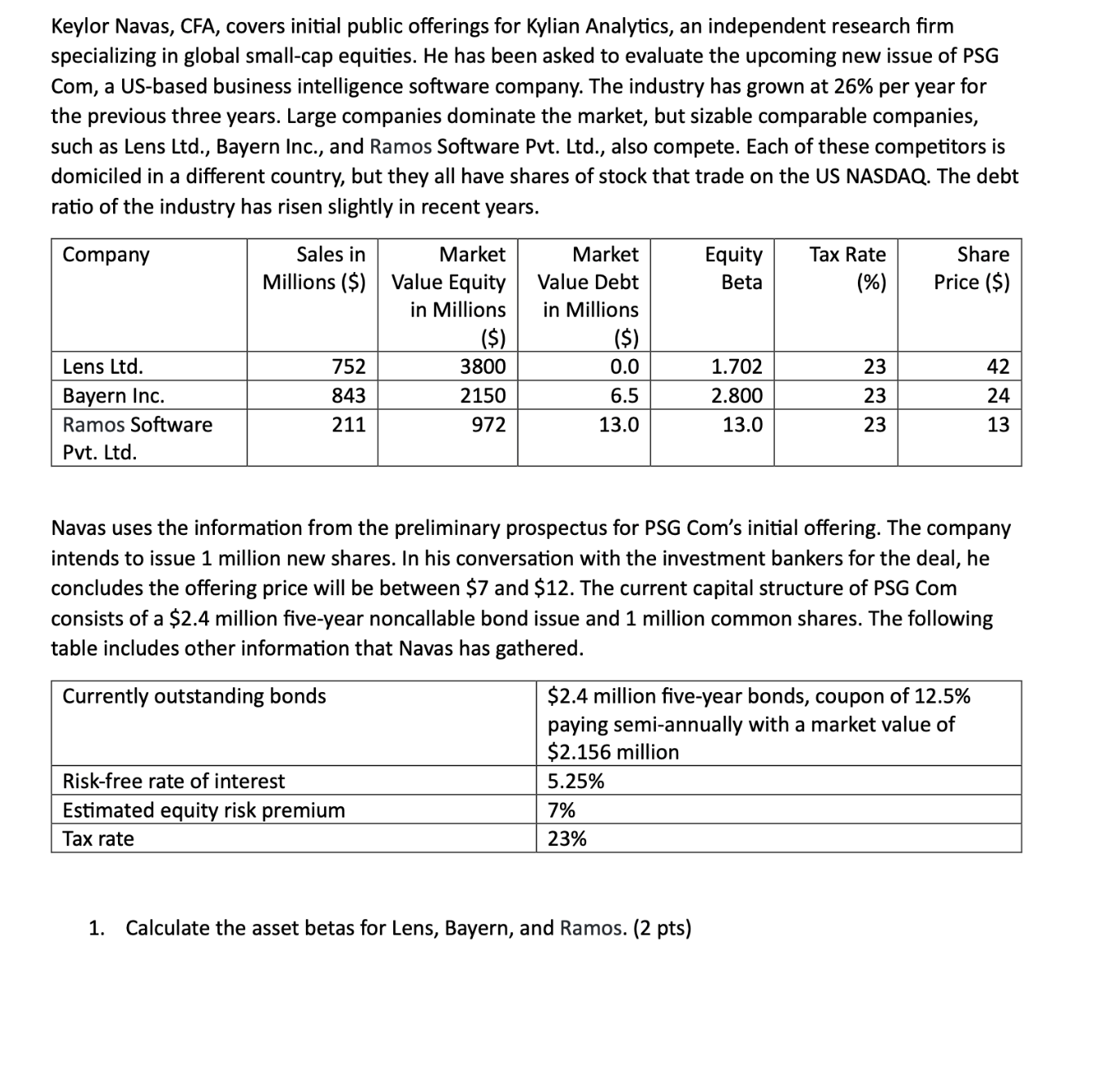

Keylor Navas, CFA, covers initial public offerings for Kylian Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate the upcoming new issue of PSG Com, a US-based business intelligence software company. The industry has grown at 26% per year for the previous three years. Large companies dominate the market, but sizable comparable companies, such as Lens Ltd., Bayern Inc., and Ramos Software Pvt. Ltd., also compete. Each of these competitors is domiciled in a different country, but they all have shares of stock that trade on the US NASDAQ. The debt ratio of the industry has risen slightly in recent years. Navas uses the information from the preliminary prospectus for PSG Com's initial offering. The company intends to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12. The current capital structure of PSG Com consists of a \$2.4 million five-year noncallable bond issue and 1 million common shares. The following table includes other information that Navas has gathered. 1. Calculate the asset betas for Lens, Bayern, and Ramos. (2 pts) 2. The average asset beta for comparable players in this industry, Lens, Bayern, and Ramos, weighted by market value of equity is (3 pts) 3. Using the capital asset pricing model, calculate the cost of equity capital for a company in this industry with a debt-to-equity ratio of 0.01 , an asset beta of 2.27 , and a marginal tax rate of 23% (2 pts) 4. Calculate the marginal cost of capital for PSG Com, based on an average asset beta of 2.27 for the industry and assuming that new stock can be issued at $8 per share. (3 pts) Keylor Navas, CFA, covers initial public offerings for Kylian Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate the upcoming new issue of PSG Com, a US-based business intelligence software company. The industry has grown at 26% per year for the previous three years. Large companies dominate the market, but sizable comparable companies, such as Lens Ltd., Bayern Inc., and Ramos Software Pvt. Ltd., also compete. Each of these competitors is domiciled in a different country, but they all have shares of stock that trade on the US NASDAQ. The debt ratio of the industry has risen slightly in recent years. Navas uses the information from the preliminary prospectus for PSG Com's initial offering. The company intends to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12. The current capital structure of PSG Com consists of a \$2.4 million five-year noncallable bond issue and 1 million common shares. The following table includes other information that Navas has gathered. 1. Calculate the asset betas for Lens, Bayern, and Ramos. (2 pts) 2. The average asset beta for comparable players in this industry, Lens, Bayern, and Ramos, weighted by market value of equity is (3 pts) 3. Using the capital asset pricing model, calculate the cost of equity capital for a company in this industry with a debt-to-equity ratio of 0.01 , an asset beta of 2.27 , and a marginal tax rate of 23% (2 pts) 4. Calculate the marginal cost of capital for PSG Com, based on an average asset beta of 2.27 for the industry and assuming that new stock can be issued at $8 per share. (3 pts)

Keylor Navas, CFA, covers initial public offerings for Kylian Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate the upcoming new issue of PSG Com, a US-based business intelligence software company. The industry has grown at 26% per year for the previous three years. Large companies dominate the market, but sizable comparable companies, such as Lens Ltd., Bayern Inc., and Ramos Software Pvt. Ltd., also compete. Each of these competitors is domiciled in a different country, but they all have shares of stock that trade on the US NASDAQ. The debt ratio of the industry has risen slightly in recent years. Navas uses the information from the preliminary prospectus for PSG Com's initial offering. The company intends to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12. The current capital structure of PSG Com consists of a \$2.4 million five-year noncallable bond issue and 1 million common shares. The following table includes other information that Navas has gathered. 1. Calculate the asset betas for Lens, Bayern, and Ramos. (2 pts) 2. The average asset beta for comparable players in this industry, Lens, Bayern, and Ramos, weighted by market value of equity is (3 pts) 3. Using the capital asset pricing model, calculate the cost of equity capital for a company in this industry with a debt-to-equity ratio of 0.01 , an asset beta of 2.27 , and a marginal tax rate of 23% (2 pts) 4. Calculate the marginal cost of capital for PSG Com, based on an average asset beta of 2.27 for the industry and assuming that new stock can be issued at $8 per share. (3 pts) Keylor Navas, CFA, covers initial public offerings for Kylian Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate the upcoming new issue of PSG Com, a US-based business intelligence software company. The industry has grown at 26% per year for the previous three years. Large companies dominate the market, but sizable comparable companies, such as Lens Ltd., Bayern Inc., and Ramos Software Pvt. Ltd., also compete. Each of these competitors is domiciled in a different country, but they all have shares of stock that trade on the US NASDAQ. The debt ratio of the industry has risen slightly in recent years. Navas uses the information from the preliminary prospectus for PSG Com's initial offering. The company intends to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12. The current capital structure of PSG Com consists of a \$2.4 million five-year noncallable bond issue and 1 million common shares. The following table includes other information that Navas has gathered. 1. Calculate the asset betas for Lens, Bayern, and Ramos. (2 pts) 2. The average asset beta for comparable players in this industry, Lens, Bayern, and Ramos, weighted by market value of equity is (3 pts) 3. Using the capital asset pricing model, calculate the cost of equity capital for a company in this industry with a debt-to-equity ratio of 0.01 , an asset beta of 2.27 , and a marginal tax rate of 23% (2 pts) 4. Calculate the marginal cost of capital for PSG Com, based on an average asset beta of 2.27 for the industry and assuming that new stock can be issued at $8 per share. (3 pts) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started