Answered step by step

Verified Expert Solution

Question

1 Approved Answer

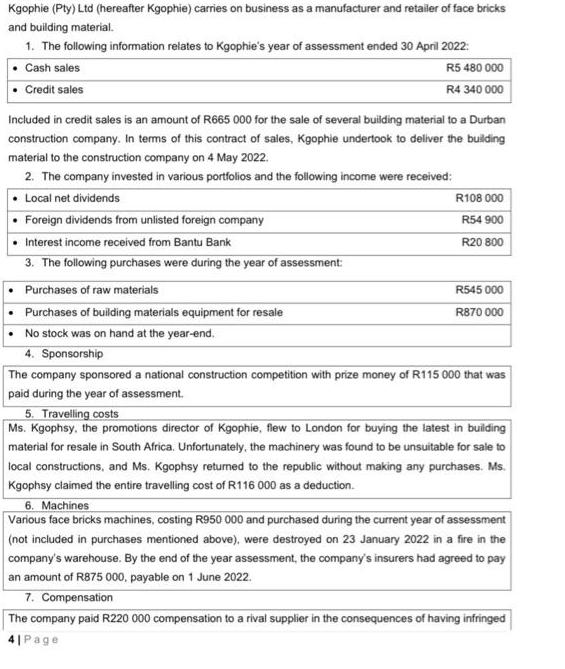

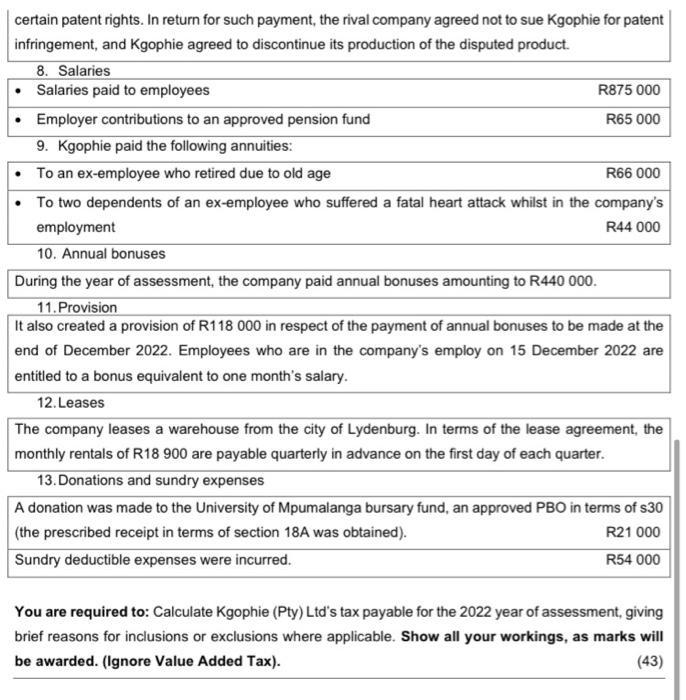

Kgophie (Pty) Ltd (hereafter Kgophie) carries on business as a manufacturer and retailer of face bricks and building material. 1. The following information relates

Kgophie (Pty) Ltd (hereafter Kgophie) carries on business as a manufacturer and retailer of face bricks and building material. 1. The following information relates to Kgophie's year of assessment ended 30 April 2022: Cash sales R5 480 000 R4 340 000 Credit sales Included in credit sales is an amount of R665 000 for the sale of several building material to a Durban construction company. In terms of this contract of sales, Kgophie undertook to deliver the building material to the construction company on 4 May 2022. 2. The company invested in various portfolios and the following income were received: Local net dividends R108 000 Foreign dividends from unlisted foreign company R54 900 Interest income received from Bantu Bank R20 800 3. The following purchases were during the year of assessment: Purchases of raw materials R545 000 Purchases of building materials equipment for resale R870 000 No stock was on hand at the year-end. 4. Sponsorship The company sponsored a national construction competition with prize money of R115 000 that was paid during the year of assessment. 5. Travelling costs Ms. Kgophsy, the promotions director of Kgophie, flew to London for buying the latest in building material for resale in South Africa. Unfortunately, the machinery was found to be unsuitable for sale to local constructions, and Ms. Kgophsy returned to the republic without making any purchases. Ms. Kgophsy claimed the entire travelling cost of R116 000 as a deduction. 6. Machines Various face bricks machines, costing R950 000 and purchased during the current year of assessment (not included in purchases mentioned above), were destroyed on 23 January 2022 in a fire in the company's warehouse. By the end of the year assessment, the company's insurers had agreed to pay an amount of R875 000, payable on 1 June 2022. 7. Compensation The company paid R220 000 compensation to a rival supplier in the consequences of having infringed 4| Page certain patent rights. In return for such payment, the rival company agreed not to sue Kgophie for patent infringement, and Kgophie agreed to discontinue its production of the disputed product. 8. Salaries Salaries paid to employees R875 000 R65 000 Employer contributions to an approved pension fund 9. Kgophie paid the following annuities: To an ex-employee who retired due to old age R66 000 To two dependents of an ex-employee who suffered a fatal heart attack whilst in the company's employment R44 000 10. Annual bonuses During the year of assessment, the company paid annual bonuses amounting to R440 000. 11. Provision It also created a provision of R118 000 in respect of the payment of annual bonuses to be made at the end of December 2022. Employees who are in the company's employ on 15 December 2022 are entitled to a bonus equivalent to one month's salary. 12. Leases The company leases a warehouse from the city of Lydenburg. In terms of the lease agreement, the monthly rentals of R18 900 are payable quarterly in advance on the first day of each quarter. 13. Donations and sundry expenses A donation was made to the University of Mpumalanga bursary fund, an approved PBO in terms of $30 (the prescribed receipt in terms of section 18A was obtained). R21 000 Sundry deductible expenses were incurred. R54 000 You are required to: Calculate Kgophie (Pty) Ltd's tax payable for the 2022 year of assessment, giving brief reasons for inclusions or exclusions where applicable. Show all your workings, as marks will be awarded. (Ignore Value Added Tax). (43)

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Kgophie Pty Ltds tax payable for the 2022 year of assessment is R1 071 000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started