Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly answer I and II well & correctly. Show your working as well. begin{tabular}{|l|l|l|l|} hline ( begin{array}{l}text { Miscellaneous } text { (Want) }end{array}

Kindly answer I and II well & correctly. Show your working as well.

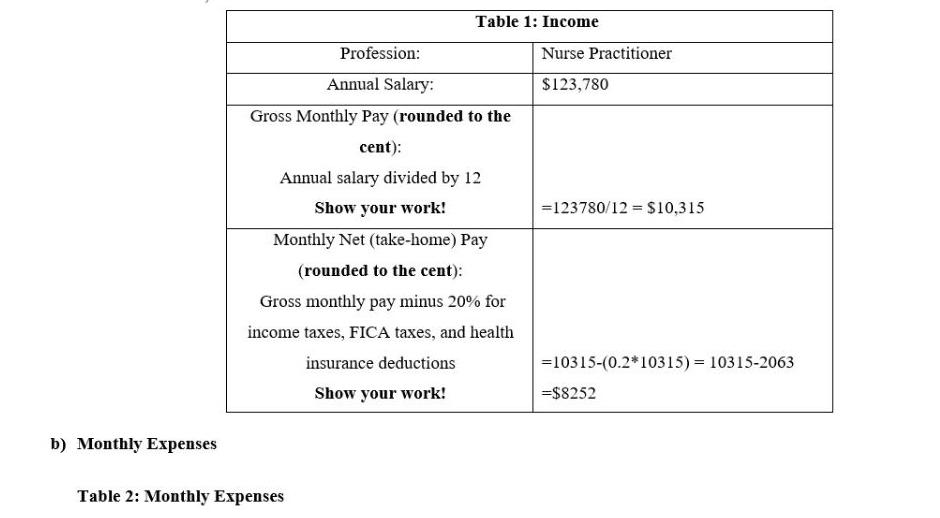

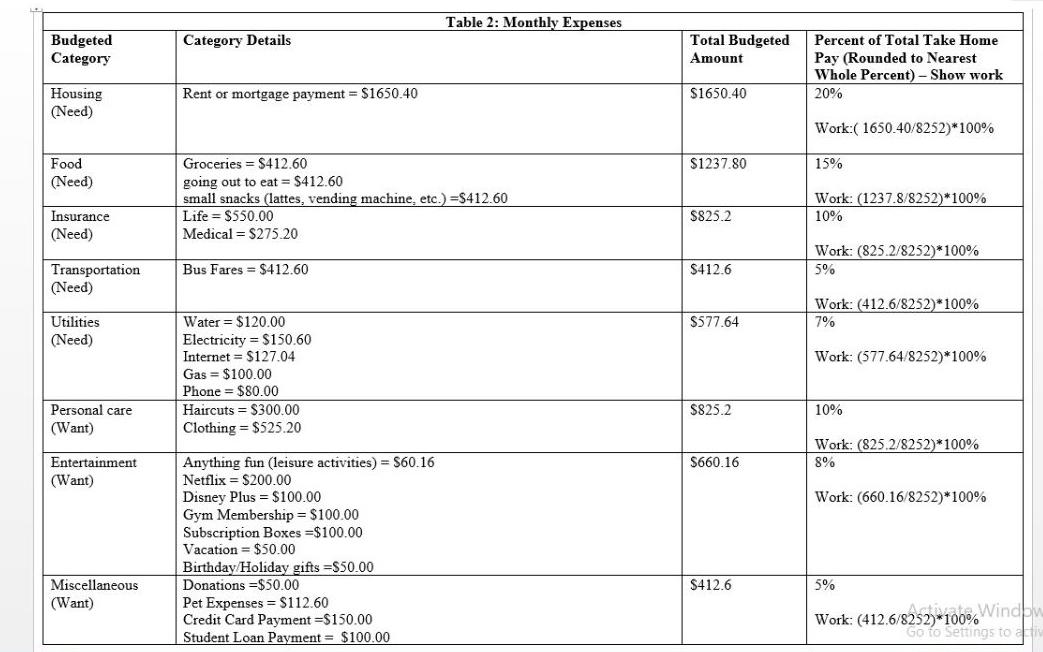

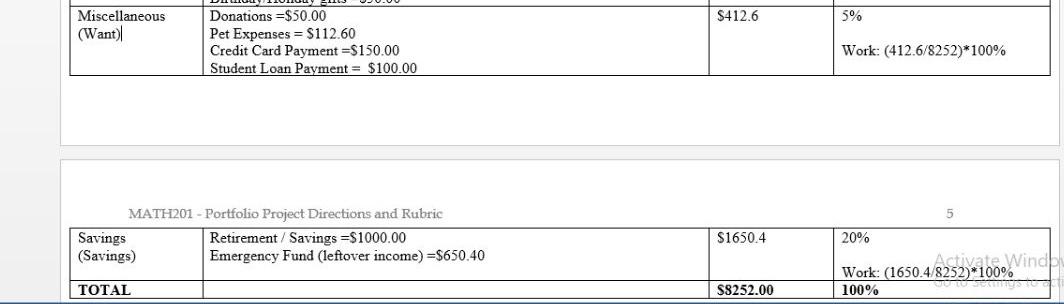

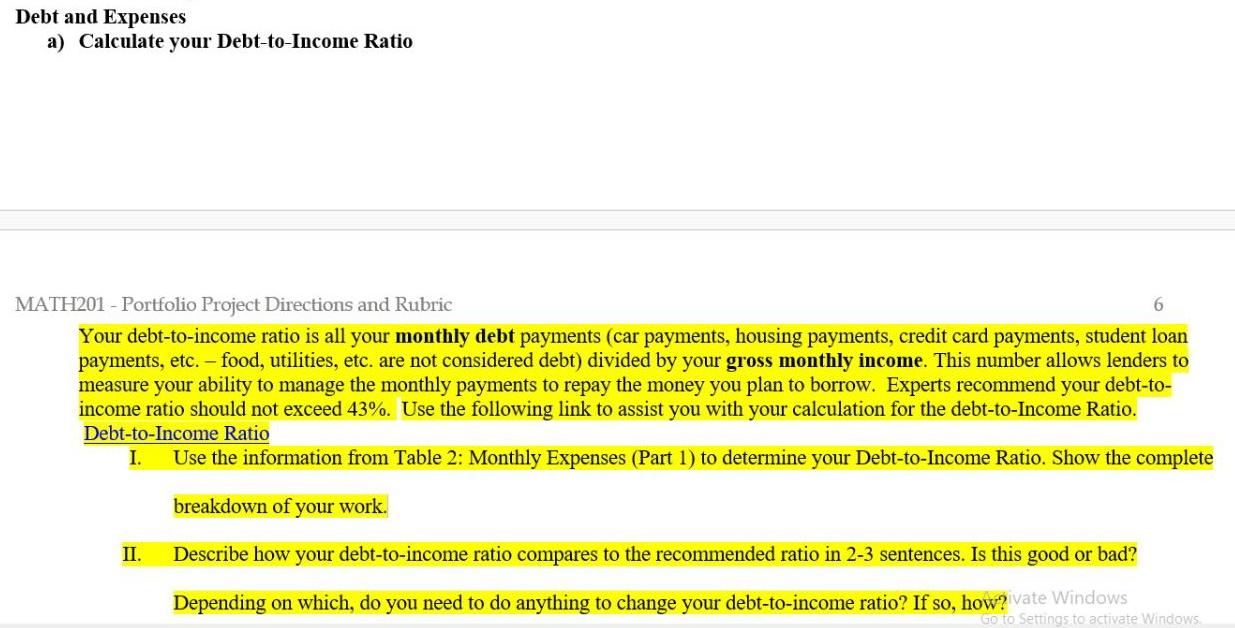

\\begin{tabular}{|l|l|l|l|} \\hline \\( \\begin{array}{l}\\text { Miscellaneous } \\\\ \\text { (Want) }\\end{array} \\) & \\( \\begin{array}{l}\\text { Donations }=\\$ 50.00 \\\\ \\text { Pet Expenses }=\\$ 112.60 \\\\ \\text { Credit Card Payment }=\\$ 150.00 \\\\ \\text { Student Loan Payment }=\\$ 100.00\\end{array} \\) & \\( \\$ 412.6 \\) & \5 \\\\ \\hline \\end{tabular} MATH201 - Portfolio Project Directions and Rubric 5 \\begin{tabular}{|l|l|l|l|} \\hline \\( \\begin{array}{l}\\text { Savings } \\\\ \\text { (Savings) }\\end{array} \\) & \\( \\begin{array}{l}\\text { Retirement / Savings }=\\$ 1000.00 \\\\ \\text { Emergency Fund (leftover income) }=\\$ 650.40\\end{array} \\) & \\( \\$ 1650.4 \\) & \20 \\\\ Work: \(1650.4/8252)100 \\end{tabular} b) Monthly Expenses Table 2: Monthly Expenses Debt and Expenses a) Calculate your Debt-to-Income Ratio MATH201 - Portfolio Project Directions and Rubric 6 Your debt-to-income ratio is all your monthly debt payments (car payments, housing payments, credit card payments, student loan payments, etc. - food, utilities, etc. are not considered debt) divided by your gross monthly income. This number allows lenders to measure your ability to manage the monthly payments to repay the money you plan to borrow. Experts recommend your debt-toincome ratio should not exceed \43. Use the following link to assist you with your calculation for the debt-to-Income Ratio. Debt-to-Income Ratio I. Use the information from Table 2: Monthly Expenses (Part 1) to determine your Debt-to-Income Ratio. Show the complete II. Describe how your debt-to-income ratio compares to the recommended ratio in 2-3 sentences. Is this good or bad? Depending on which, do you need to do anything to change your debt-to-income ratio? If so, howStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started