Answered step by step

Verified Expert Solution

Question

1 Approved Answer

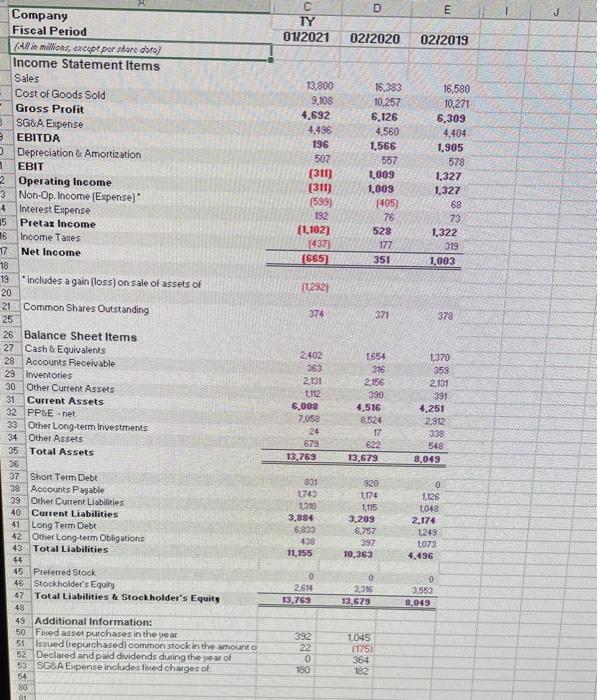

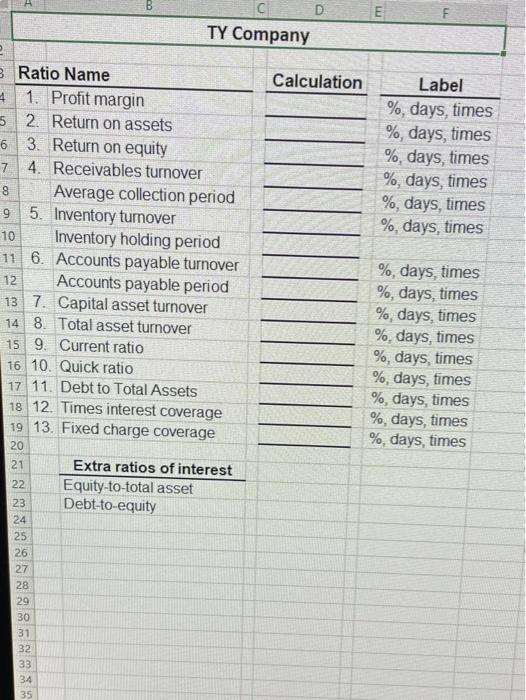

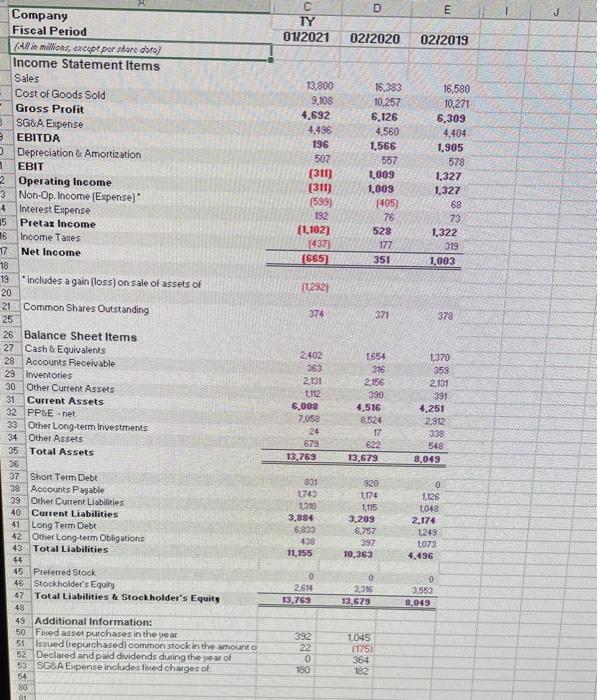

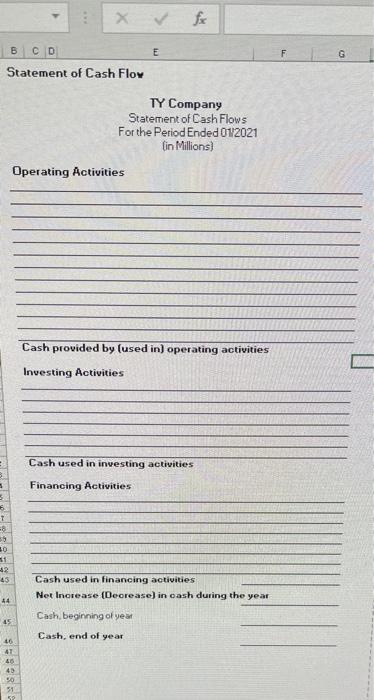

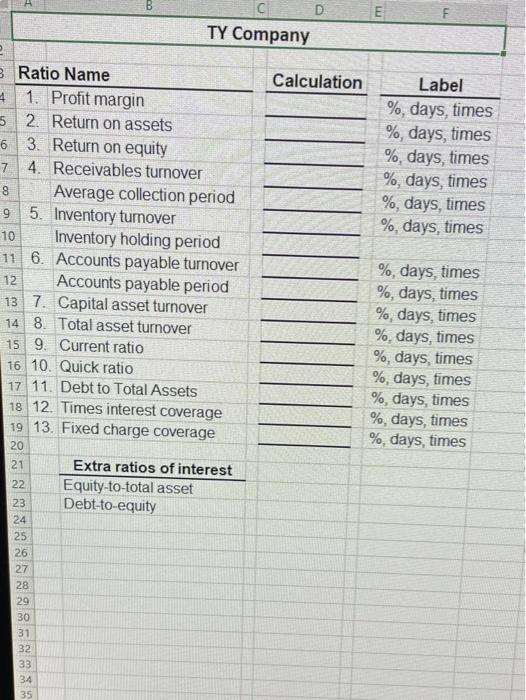

prepare cash flow statement and find ratios someone can just help me with ratios please D E C TY 012021 02/2020 02/2019 13,800 9,108 4.692

prepare cash flow statement and find ratios

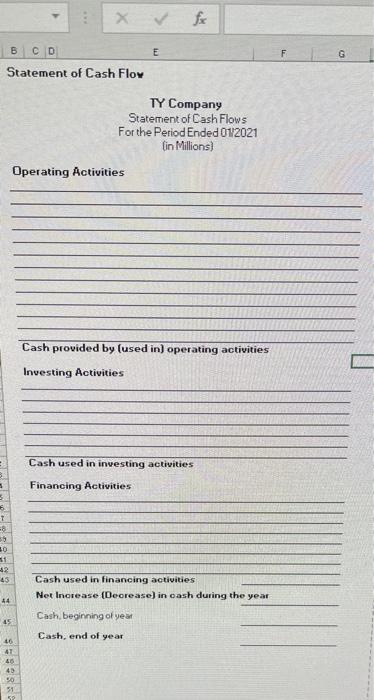

D E C TY 012021 02/2020 02/2019 13,800 9,108 4.692 4,496 196 507 (311) (311) (599) 192 (1.102) 1437 (665) 16,383 16,580 10,257 10,271 6.126 6.309 4,560 4,404 1,566 1.905 557 578 1,009 1,327 1,009 1.327 1405) 68 76 73 528 1.322 177 319 3511,003 (1232) 374 371 378 Company Fiscal Period KAM in millions, reape por share chils) Income Statement Items Sales . Cost of Goods Sold Gross Profit 3 SG&A Expense 8 EBITDA - Depreciation & Amortization 1 EBIT 2 Operating Income 3 Non-Op. Income (Expense) 4 Interest Expense 15 Pretax Income 16 Income Taxes 17 Net Income 18 19 includes a gain (loss) on sale of assets of 20 21 Common Shares Outstanding 25 26 Balance Sheet Items 27. Cash & Equivalents 28 Accounts Receivable 29 Inventories 30 Other Current Assets 31 Current Assets 32 PP&E-net 33 Other Long-term Investments 34 Other Assets 35 Total Assets 36 37 Short Term Debt 38 Accounts Payable 39 Other Outrent Liabilities 40 Current Liabilities 41 Long Term Debt 42 Other Long-term Obligations 43 Total Liabilities 44 45 Preferred Stook 46 Stockholder's Equity 47 Total Liabilities & Stockholder's Equity 48 49 Additional Information: 50 Fred asset purchases in the year 51 Issued repurchased common stock in the amounto 52 Declared and paid dividends during the year of 63 SG&A Expense includes tored charges of 54 80 2,402 363 2.131 112 6,008 7,058 24 679 13.769 1654 316 2,156 390 4,516 8,524 17 622 13,679 1,370 359 2,131 391 4,251 2,912 338 549 8,049 831 1743 1330 3,884 6.833 438 11.155 920 1174 1.115 3.203 8,757 397 10.363 0 1.126 1048 2.174 1249 1073 4.436 2614 13769 0 3,336 13.679 0 3,553 8.049 332 22 0 180 1.045 175 364 182 21 f fx E F G Statement of Cash Flow TY Company Statement of Cash Flows For the Period Ended 012021 (in Millions) Operating Activities Cash provided by (used in) operating activities Investing Activities Cash used in investing activities Financing Activities 3 7 30 1 45 Cash used in financing activities Net Increase (Decrease) in cash during the year 44 Cash beginning of year 45 Cash, end of year 16 41 & 43 50 51 52 D E F TY Company Calculation Label %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times 3 Ratio Name 4 1. Profit margin 5 2. Return on assets 6 3. Return on equity 7 4. Receivables turnover 8 Average collection period 9 5. Inventory turnover 10 Inventory holding period 11 6. Accounts payable turnover 12 Accounts payable period 13 7. Capital asset turnover 14 8. Total asset turnover 15 9. Current ratio 16 10. Quick ratio 17. 11. Debt to Total Assets 18 12. Times interest coverage 19 13. Fixed charge coverage %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times %, days, times 20 21 22 Extra ratios of interest Equity-to-total asset Debt-to-equity 23 24 25 26 27 28 29 30 31 32 33 34 35 someone can just help me with ratios please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started