Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly help and answer this question. show all your workings 1 QUESTION 2 20 Marks Kick Ltd is a listed company on the Namibian Stock

kindly help and answer this question. show all your workings

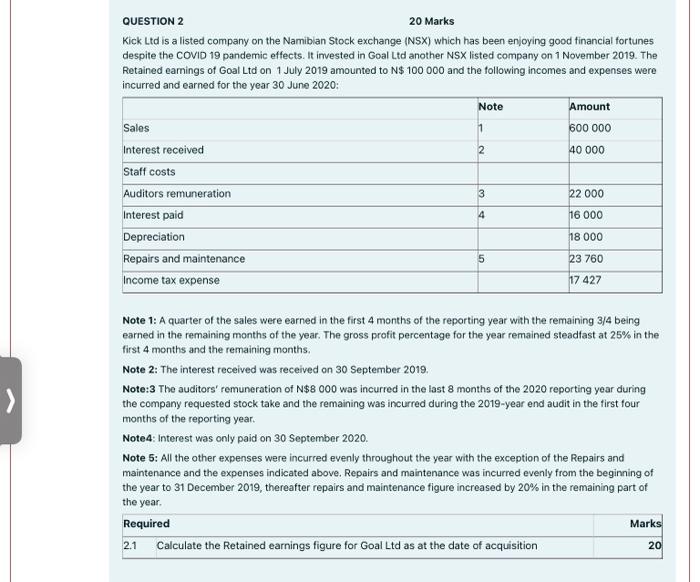

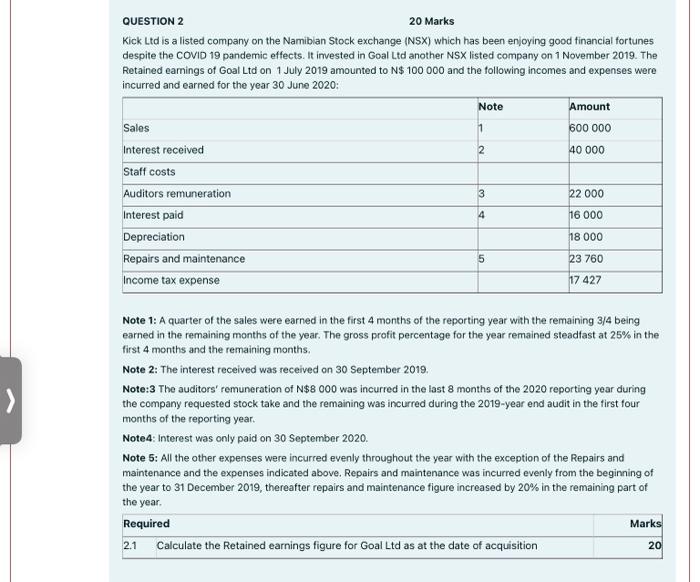

1 QUESTION 2 20 Marks Kick Ltd is a listed company on the Namibian Stock exchange (NSX) which has been enjoying good financial fortunes despite the COVID 19 pandemic effects. It invested in Goal Ltd another NSX listed company on 1 November 2019. The Retained earnings of Goal Ltd on 1 July 2019 amounted to N$ 100 000 and the following incomes and expenses were incurred and earned for the year 30 June 2020: Note Amount Sales 600 000 Interest received 40 000 Staff costs Auditors remuneration 22 000 Interest paid 16 000 Depreciation 18 000 Repairs and maintenance 5 23 760 Income tax expense 17 427 2 3 4 5 Note 1: A quarter of the sales were earned in the first 4 months of the reporting year with the remaining 3/4 being earned in the remaining months of the year. The gross profit percentage for the year remained steadfast at 25% in the first 4 months and the remaining months, Note 2: The interest received was received on 30 September 2019. Note:3 The auditors' remuneration of N$8 000 was incurred in the last 8 months of the 2020 reporting year during the company requested stock take and the remaining was incurred during the 2019-year end audit in the first four months of the reporting year. Note 4: Interest was only paid on 30 September 2020. Note 5: All the other expenses were incurred evenly throughout the year with the exception of the Repairs and maintenance and the expenses indicated above. Repairs and maintenance was incurred evenly from the beginning of the year to 31 December 2019, thereafter repairs and maintenance figure increased by 20% in the remaining part of the year Required Marks 2.1 Calculate the retained earnings figure for Goal Ltd as at the date of acquisition 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started