Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kojo Kwabena & Sons Incorporated (KK & Sons) is a 25yr-old medium sized 'family-business' with 110 employees and 3 subsidiaries in Ghana. An arm of

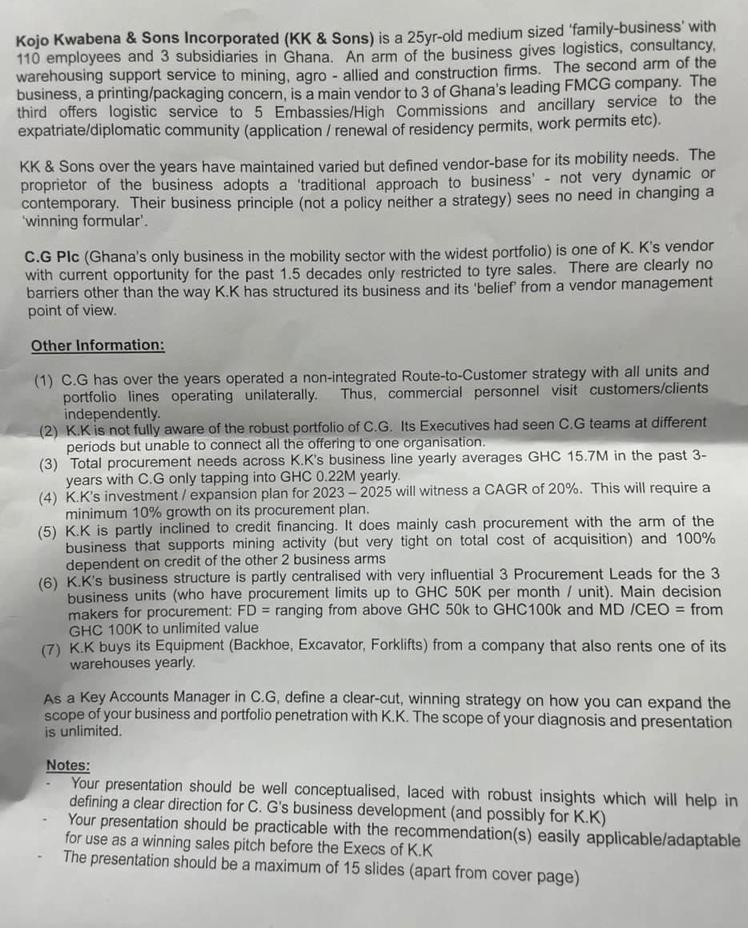

Kojo Kwabena \& Sons Incorporated (KK \& Sons) is a 25yr-old medium sized 'family-business' with 110 employees and 3 subsidiaries in Ghana. An arm of the business gives logistics, consultancy, warehousing support service to mining, agro - allied and construction firms. The second arm of the business, a printing/packaging concern, is a main vendor to 3 of Ghana's leading FMCG company. The third offers logistic service to 5 Embassies/High Commissions and ancillary service to the expatriate/diplomatic community (application / renewal of residency permits, work permits etc). KK \& Sons over the years have maintained varied but defined vendor-base for its mobility needs. The proprietor of the business adopts a 'traditional approach to business' - not very dynamic or contemporary. Their business principle (not a policy neither a strategy) sees no need in changing a 'winning formular'. C.G Plc (Ghana's only business in the mobility sector with the widest portfolio) is one of K. K's vendor with current opportunity for the past 1.5 decades only restricted to tyre sales. There are clearly no barriers other than the way K.K has structured its business and its 'belief from a vendor management point of view. Other Information: (1) C.G has over the years operated a non-integrated Route-to-Customer strategy with all units and portfolio lines operating unilaterally. Thus, commercial personnel visit customers/clients independently. (2) K.K is not fully aware of the robust portfolio of C.G. Its Executives had seen C.G teams at different periods but unable to connect all the offering to one organisation. (3) Total procurement needs across K.K's business line yearly averages GHC 15.7M in the past 3years with C.G only tapping into GHC 0.22M yearly. (4) K.K's investment / expansion plan for 20232025 will witness a CAGR of 20%. This will require a minimum 10% growth on its procurement plan. (5) K.K is partly inclined to credit financing. It does mainly cash procurement with the arm of the business that supports mining activity (but very tight on total cost of acquisition) and 100% dependent on credit of the other 2 business arms (6) K.K's business structure is partly centralised with very influential 3 Procurement Leads for the 3 business units (who have procurement limits up to GHC 50K per month / unit). Main decision makers for procurement: FD = ranging from above GHC 50k to GHC100k and MD /CEO = from GHC 100K to unlimited value (7) K.K buys its Equipment (Backhoe, Excavator, Forklifts) from a company that also rents one of its warehouses yearly. As a Key Accounts Manager in C.G, define a clear-cut, winning strategy on how you can expand the scope of your business and portfolio penetration with K.K. The scope of your diagnosis and presentation is unlimited. Notes: - Your presentation should be well conceptualised, laced with robust insights which will help in defining a clear direction for C. G's business development (and possibly for K.K) - Your presentation should be practicable with the recommendation(s) easily applicable/adaptable for use as a winning sales pitch before the Execs of K.K - The presentation should be a maximum of 15 slides (apart from cover page)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started