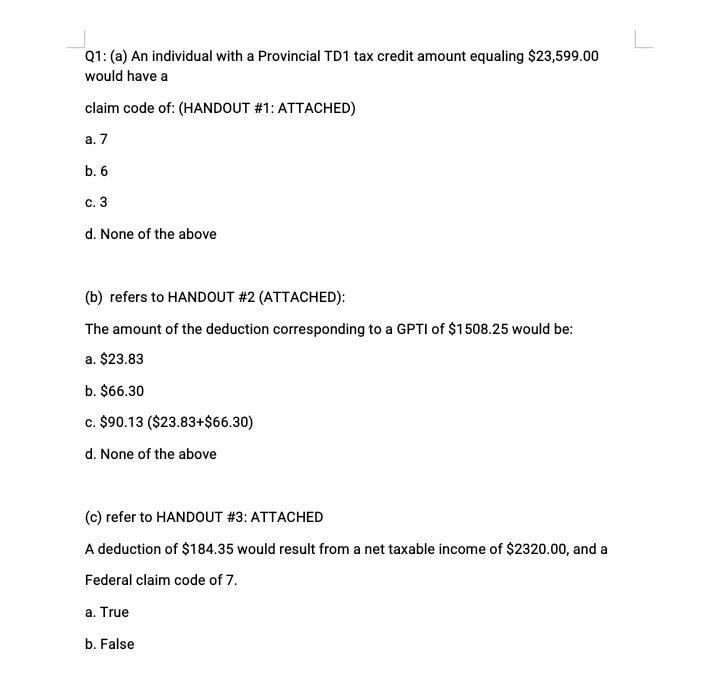

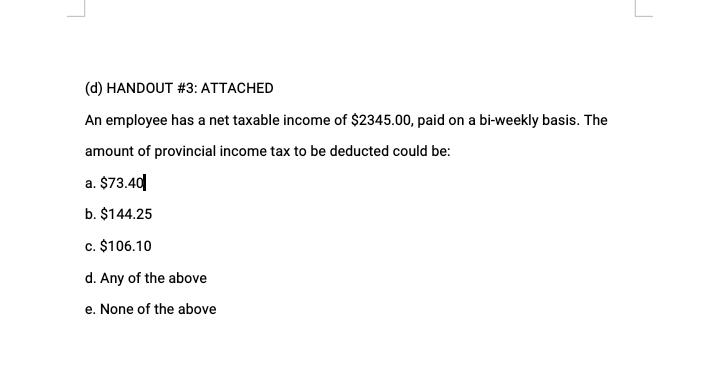

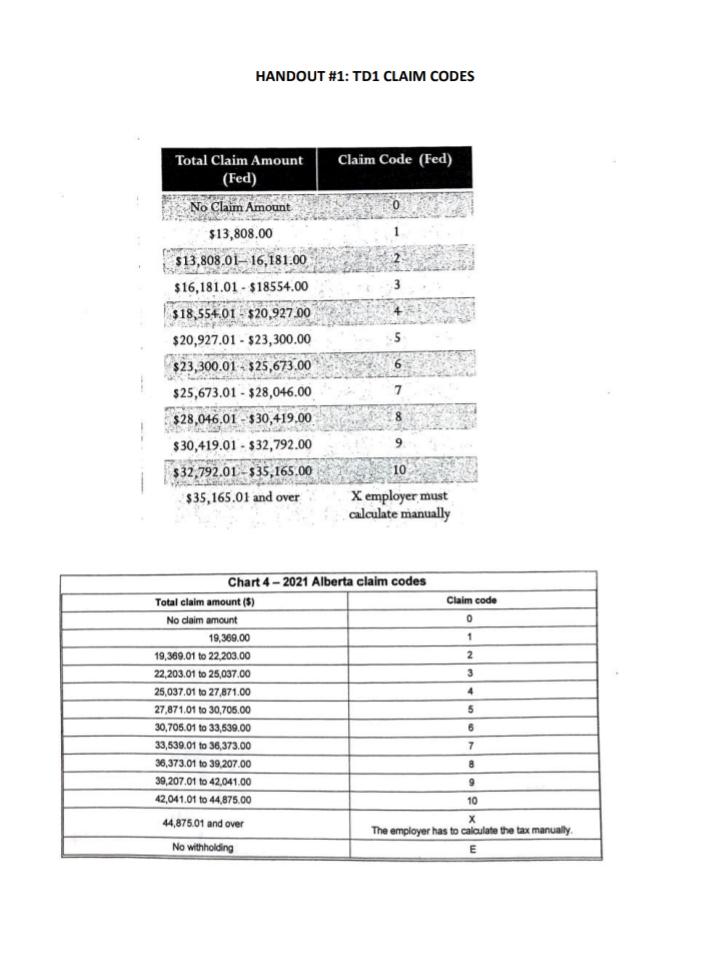

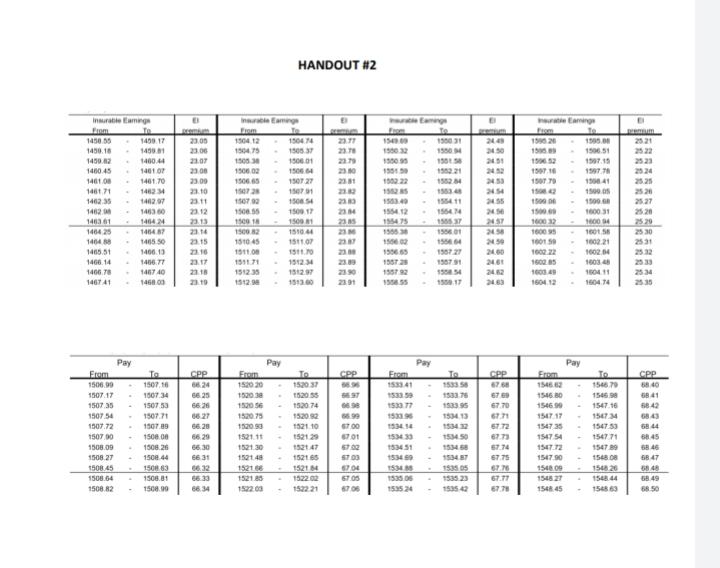

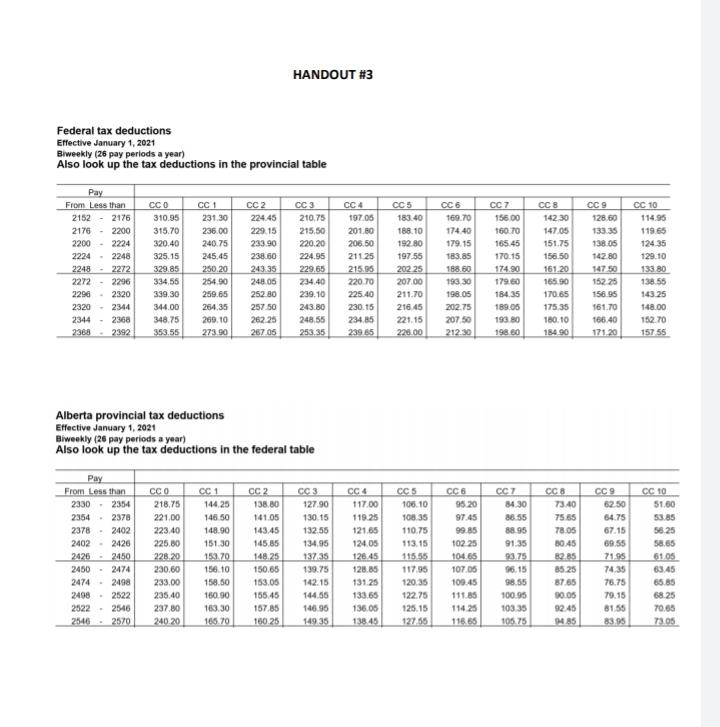

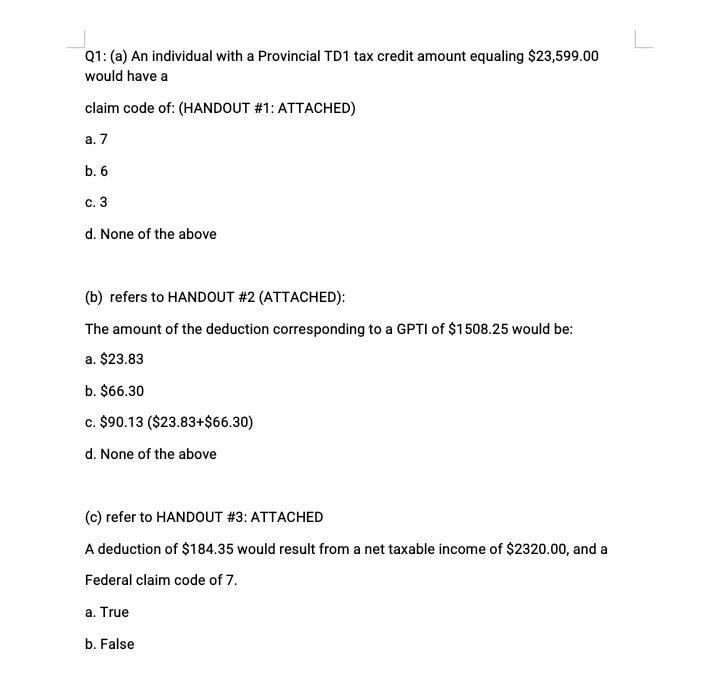

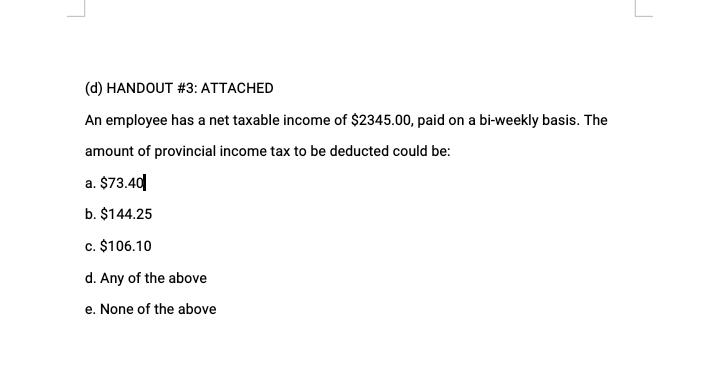

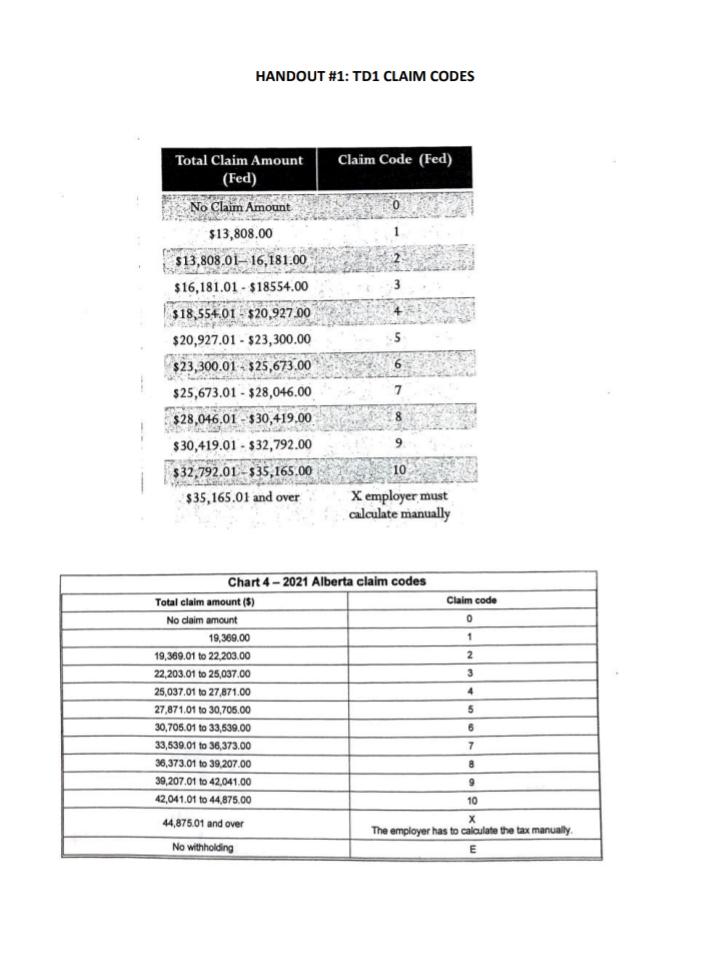

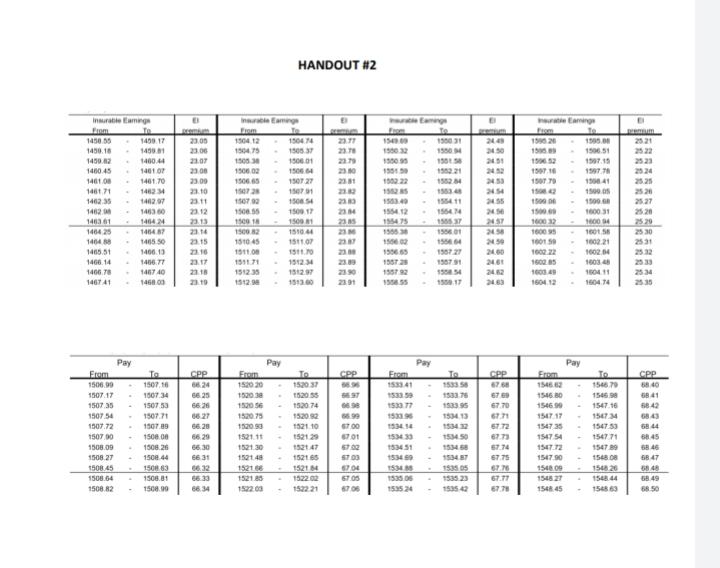

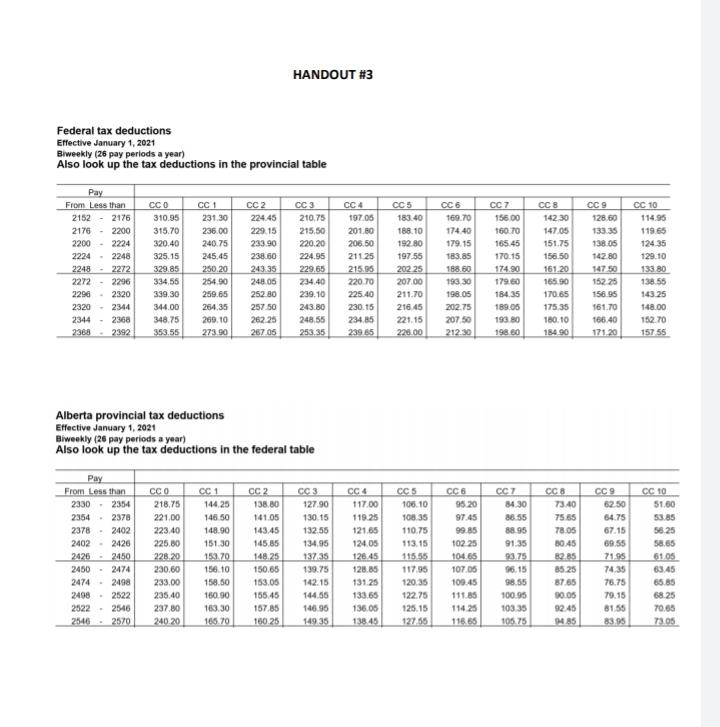

L. Q1: (a) An individual with a Provincial TD1 tax credit amount equaling $23,599.00 would have a claim code of: (HANDOUT #1: ATTACHED) a. 7 b. 6 c. 3 d. None of the above (b) refers to HANDOUT #2 (ATTACHED): The amount of the deduction corresponding to a GPTI of $1508.25 would be: a. $23.83 b. $66.30 c. $90.13 ($23.83+$66.30) d. None of the above (c) refer to HANDOUT #3: ATTACHED A deduction of $184.35 would result from a net taxable income of $2320.00, and a Federal claim code of 7. a. True b. False (d) HANDOUT #3: ATTACHED An employee has a net taxable income of $2345.00, paid on a bi-weekly basis. The amount of provincial income tax to be deducted could be: a. $73.40 b. $144.25 c. $106.10 d. Any of the above e. None of the above HANDOUT #1: TD1 CLAIM CODES : Claim Code (Fed) Total Claim Amount (Fed) No Claim Amount $13,808.00 2 $13,808,01-16,181.00 $16,181.01 - $18554.00 $18,554.01 - $20.927.00 $ 20,927.01 - $23,300.00 $23,300.01 - $25,673.00 $25,673.01 - $28,046.00 $28,046.01 - $30,419.00 $30,419.01 - $32,792.00 $32,792.01 - $35,165.00 $35,165.01 and over 7 9 10 X employer must calculate manually Chart 4-2021 Alberta claim codes Total claim amount (5) Claim code No claim amount 0 19,369.00 1 19,369.01 to 22.203.00 2 22,203.01 to 25,037.00 3 25,037.01 to 27 871.00 4 27,871.01 to 30,706.00 5 30,705.01 to 33,539.00 6 33,539.01 to 36,373.00 7 36,373.01 to 39.207.00 8 39,207.01 to 42,041.00 9 42,041.01 to 44,875.00 10 44,875.01 and over The employer has to calculate the tax manually No withholding E HANDOUT #2 Insurate aming 150 150474 150537 150001 23 23. 1950 31 1556 2450 241 Rom 23:05 23.00 2007 23.00 23.00 20 2311 2312 1950 1951 190222 23.10 231 Bm 25 26 2522 2523 2524 25.25 2520 1905.08 1906.51 1907.15 1997 190041 1500 1450 55 1450.16 1450 12 1400.45 1461 148771 1402 35 1482 1403 61 1464 25 1464 1465.51 1466 14 1466.78 146741 1450 17 1430.81 1400.44 140107 146170 1483 34 146297 141360 146424 146487 1435 50 1400.13 1466.77 146740 1468.00 1996 20 1988 15062 1507 1907 79 100 1509 1500 160012 23.00 150412 150475 15003 19000 150065 150728 1507 15005 150018 1500 1510 45 1511 159171 151235 150727 15071 150854 150017 5552 1945 23 AS 155221 155234 1953 135411 1554 1955 155601 1564 155721 15679 584 155017 25 20 2530 2531 2314 2315 2210 2317 2018 2010 1044 151 OF 1511.10 1512.34 2454 245 24 245 24 250 240 2461 24 23 23 160150 16022 1600 1008 150412 1966 1952 155792 18 1600 31 1600 1050 160220 10024 1803 100411 150474 200 2390 2534 Pay CPP CPP CPP 676 67 69 SEST TA 153358 1533 75 1933 153413 153359 153377 6770 Pay From 1506.99 1507.17 150735 1507.54 1507.72 15070 1508.09 150827 150845 1508 64 1508.82 To 1520 37 520 55 152074 1520.92 152110 152129 67.71 To 1507,18 150734 1507 53 150771 1507 89 1508 08 150826 1508 44 1508 83 15088 1508.99 56.25 6620 6627 66.28 66.29 66.30 6631 Pay Em 152020 152039 152056 1520.75 15200 1521 11 152130 152140 152166 152185 152200 T2 5599 6700 0701 670 5703 6704 6703 676 Pay Eram 15462 1546B0 154690 15:47 17 154735 1547 54 1547.72 1547 90 154809 15452 1548.45 153454 153433 153451 15349 1534 1536 Os 159524 1545.70 1566 154710 1567M 1547 53 1547 71 154789 1568.00 156820 1568 44 154863 CPP 5840 6841 58 42 6843 6844 68 45 68 46 6847 5840 68.49 153450 451458 15347 1526 15214 1522.02 159221 6773 57.74 67.75 67.77 66 33 66.34 535 23 153542 HANDOUT #3 Federal tax deductions Effective January 1, 2021 Biweekly (26 pay periods a year) Also look up the tax deductions in the provincial table Pay From Less than 2152 - 2176 2176 - 2200 2200 - 2224 2224 2248 2248 2272 2272 2296 2296 2320 - 2344 2344 - 2368 2388 2392 CCO 310.95 315.70 320.40 325.15 329.85 334,55 339.30 344.00 348.75 353.55 CC 1 231,30 236.00 240.75 245.45 250.20 254.90 259.65 264.35 269.10 273.90 CC2 224.45 229.15 233 90 238.60 243 35 248.06 252 80 257.50 262.25 267 05 CC3 210.75 215.50 220.20 224.95 229.65 234.40 239.10 243.80 248 55 253.35 CC 4 19705 201.80 206.50 211 25 215.95 220.70 225.40 230.15 234.85 239 65 CC5 183.40 188.10 192.80 197.55 202 25 207.00 211.70 216.45 221.15 220.00 CC6 169.70 174.40 179.15 183.85 188.60 19330 198.05 202.75 207 50 212.30 CC 7 156.00 160.70 165.45 170.15 174.90 179.80 184.35 189.05 1930 198.60 CCB 142.30 14705 151.75 156.50 161.20 165 90 17065 175 35 150.10 184.90 CC 9 128.60 133.33 138.05 142.80 147.50 152.25 156.95 161.70 166.40 171.20 CC 10 114.95 119.65 12435 129.10 133 80 138.55 143.25 148.00 152.70 157 55 2320 Alberta provincial tax deductions Effective January 1, 2021 Biweekly (26 pay periods a year) Also look up the tax deductions in the federal table CC 10 51.60 53.85 56.25 58.65 Pay From Less than 2330 - 2354 2354.2378 2378 2402 2402 - 2426 2426 - 2450 2450 2474 2474 2498 2498 2522 2522 2546 25462570 CCO 218.75 221.00 223.40 225.80 228.20 230.60 233.00 235.40 237.80 240.20 CC 1 144.25 146.50 148.90 15130 153.70 156.10 158.50 160.90 163.30 165 70 CC 2 138.80 141.05 143.45 145.85 148.25 150.65 153.05 155.45 157.85 160.25 CC 3 127.90 130.15 132.55 134.95 13735 139.75 142.15 144.56 146.96 14935 CC 4 117.00 119.25 121.65 124.05 128.45 128.85 131.25 133.65 136.05 138.45 CC5 106.10 10835 110.75 113.15 115.55 117.95 120.35 122.75 125.15 127.55 CC6 95.20 97 45 99.85 102.25 104.65 107.05 109.45 111.85 11425 116.65 CC7 84.30 88 55 88.95 91.35 93.75 96.15 98.55 100.95 103.35 10575 CCS 73.40 75 65 78.05 30.45 32.85 85.25 87.65 30.05 92.45 85 CC 9 6250 64.75 67.15 69.55 71.95 74.35 76.75 79.15 81.55 83.95 63.45 65.85 68.25 70,65 73.05