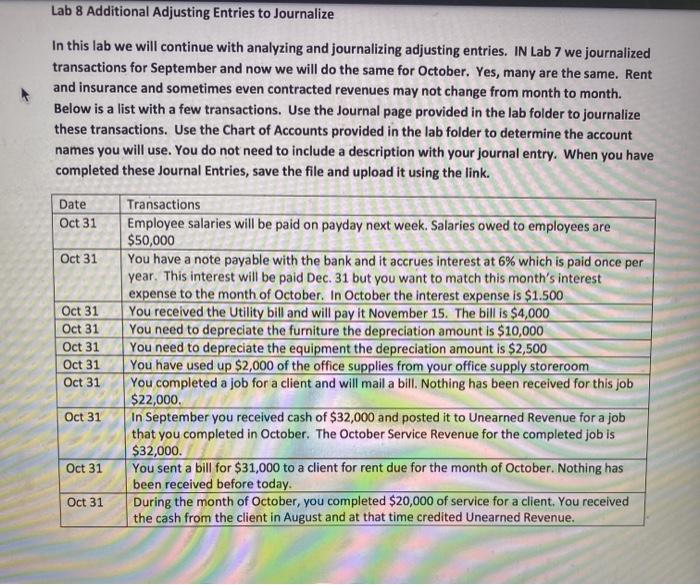

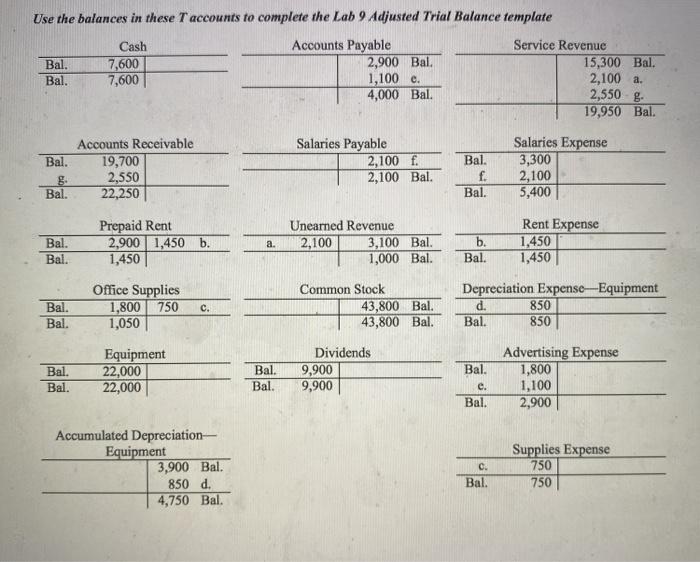

Lab 8 Additional Adjusting Entries to Journalize In this lab we will continue with analyzing and journalizing adjusting entries. IN Lab 7 we journalized transactions for September and now we will do the same for October. Yes, many are the same. Rent and insurance and sometimes even contracted revenues may not change from month to month. Below is a list with a few transactions. Use the Journal page provided in the lab folder to journalize these transactions. Use the Chart of Accounts provided in the lab folder to determine the account names you will use. You do not need to include a description with your journal entry. When you have completed these Journal Entries, save the file and upload it using the link. Date Oct 31 Oct 31 Oct 31 Oct 31 Oct 31 Oct 31 Oct 31 Transactions Employee salaries will be paid on payday next week. Salaries owed to employees are $50,000 You have a note payable with the bank and it accrues interest at 6% which is paid once per year. This interest will be paid Dec. 31 but you want to match this month's interest expense to the month of October. In October the interest expense is $1.500 You received the Utility bill and will pay it November 15. The bill is $4,000 You need to depreciate the furniture the depreciation amount is $10,000 You need to depreciate the equipment the depreciation amount is $2,500 You have used up $2,000 of the office supplies from your office supply storeroom You completed a job for a client and will mail a bill. Nothing has been received for this job $22,000. In September you received cash of $32,000 and posted it to Unearned Revenue for a job that you completed in October. The October Service Revenue for the completed job is $32,000. You sent a bill for $31,000 to a client for rent due for the month of October. Nothing has been received before today. During the month of October, you completed $20,000 of service for a client. You received the cash from the client in August and at that time credited Unearned Revenue. Oct 31 Oct 31 Oct 31 Use the balances in these T accounts to complete the Lab 9 Adjusted Trial Balance template Bal. Bal. Cash 7,600 7,600 Accounts Payable 2,900 Bal. 1,100 e. 4,000 Bal. Service Revenue 15,300 Bal. 2,100 a. 2,550 g. 19,950 Bal. Bal. Accounts Receivable 19,700 2,550 22,250 Salaries Payable 2,100 f. 2,100 Bal. Bal. f. Bal. Salaries Expense 3,300 2,100 5,400 Bal. Prepaid Rent 2,900 1,450 b. 1,450 Bal. Bal. a. Unearned Revenue 2,100 3,100 Bal. 1,000 Bal. b. Bal. Rent Expense 1,450 1,450 Office Supplies 1,800 750 1,050 Bal. Bal. c. Common Stock 43,800 Bal. 43,800 Bal. Depreciation Expense-Equipment d. 850 Bal. 850 Equipment 22,000 22,000 Bal. Bal Bal. Dividends 9,900 9,900 Advertising Expense 1,800 1,100 2,900 Bal. e. Bal. Bal. Accumulated Depreciation- Equipment 3,900 Bal. 850 d. 4,750 Bal. c. Bal. Supplies Expense 750 750