Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lager has just purchased the Boise Brewery. The brewery is 2 years old and uses absorption costing. It will sell its product to Lucky Lager

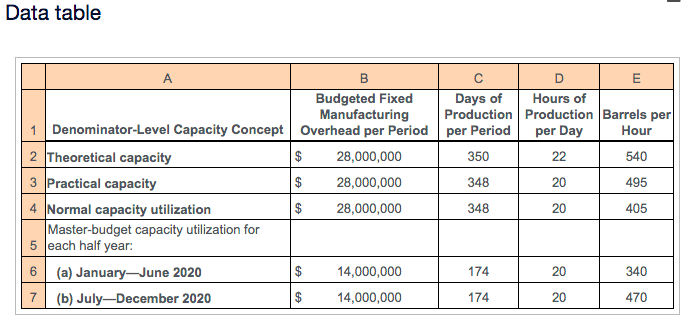

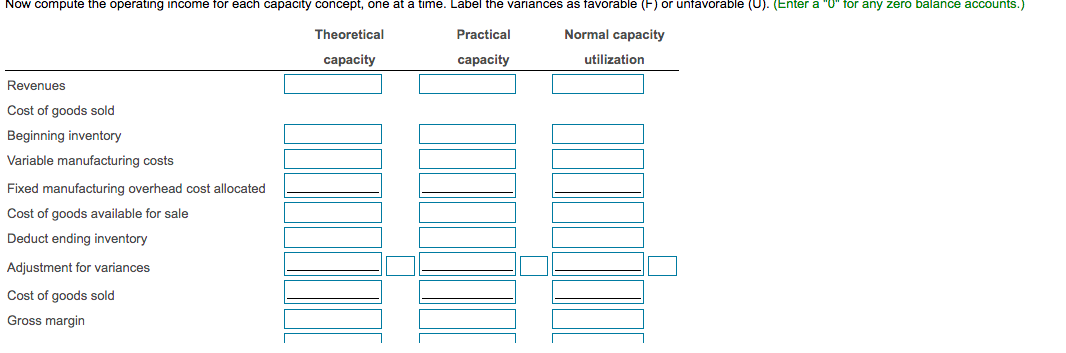

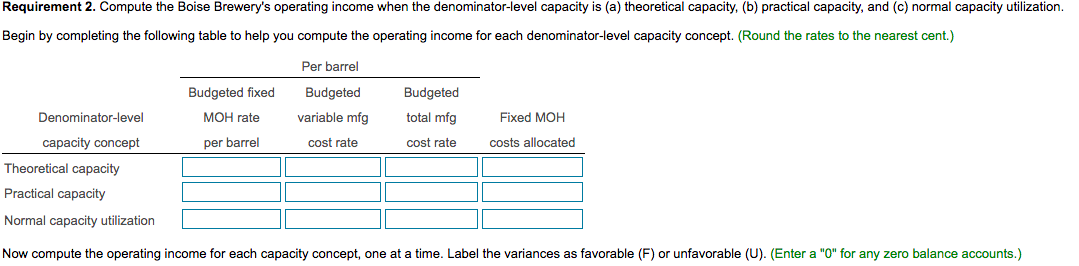

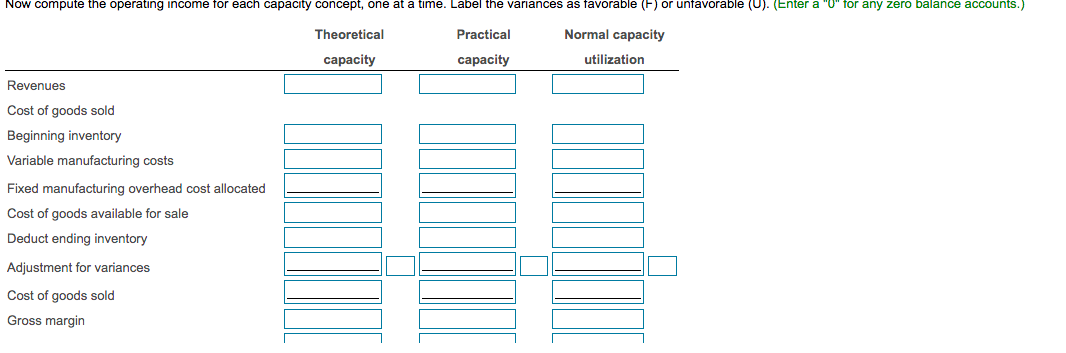

Lager has just purchased the Boise Brewery. The brewery is 2 years old and uses absorption costing. It will "sell" its product to Lucky Lager at $47 per barrel. Peter Bryant, Lucky Lager's controller, obtains the following information about Boise Brewery's capacity and budgeted fixed manufacturing costs for 2020:

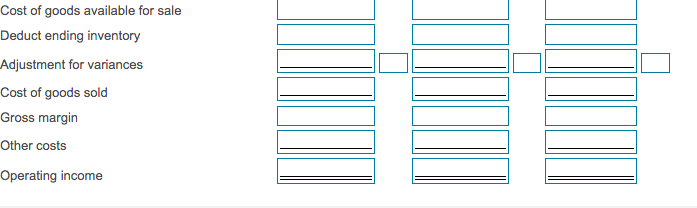

Data table A B D E Budgeted Fixed Days of Hours of Manufacturing Production Production Barrels per 1 Denominator-Level Capacity Concept Overhead per Period per Period per Day Hour 2 Theoretical capacity $ 28,000,000 350 22 540 3 Practical capacity $ 28,000,000 348 20 495 4 Normal capacity utilization $ 28,000,000 348 20 405 Master-budget capacity utilization for 5 each half year: 6 (a) January-June 2020 $ 14,000,000 174 20 340 7 (b) July-December 2020 $ 14,000,000 174 20 470 Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) or unfavorable (U). (Enter a "0" for any zero balance accounts.) Theoretical Practical Normal capacity capacity capacity utilization Revenues Cost of goods sold Beginning inventory Variable manufacturing costs Fixed manufacturing overhead cost allocated Cost of goods available for sale Deduct ending inventory Adjustment for variances Cost of goods sold Gross margin Requirement 2. Compute the Boise Brewery's operating income when the denominator-level capacity is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization. Begin by completing the following table to help you compute the operating income for each denominator-level capacity concept. (Round the rates to the nearest cent.) Per barrel Budgeted fixed MOH rate Budgeted variable mfg Budgeted total mfg Denominator-level Fixed MOH per barrel cost rate cost rate costs allocated capacity concept Theoretical capacity Practical capacity Normal capacity utilization Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) or unfavorable (U). (Enter a "0" for any zero balance accounts.) Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) or unfavorable (U). (Enter a "0" for any zero balance accounts.) Theoretical Practical Normal capacity capacity capacity utilization Revenues Cost of goods sold Beginning inventory Variable manufacturing costs Fixed manufacturing overhead cost allocated Cost of goods available for sale Deduct ending inventory Adjustment for variances Cost of goods sold Gross margin Cost of goods available for sale Deduct ending inventory Adjustment for variances Cost of goods sold Gross margin Other costs Operating income Data table A B D E Budgeted Fixed Days of Hours of Manufacturing Production Production Barrels per 1 Denominator-Level Capacity Concept Overhead per Period per Period per Day Hour 2 Theoretical capacity $ 28,000,000 350 22 540 3 Practical capacity $ 28,000,000 348 20 495 4 Normal capacity utilization $ 28,000,000 348 20 405 Master-budget capacity utilization for 5 each half year: 6 (a) January-June 2020 $ 14,000,000 174 20 340 7 (b) July-December 2020 $ 14,000,000 174 20 470 Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) or unfavorable (U). (Enter a "0" for any zero balance accounts.) Theoretical Practical Normal capacity capacity capacity utilization Revenues Cost of goods sold Beginning inventory Variable manufacturing costs Fixed manufacturing overhead cost allocated Cost of goods available for sale Deduct ending inventory Adjustment for variances Cost of goods sold Gross margin Requirement 2. Compute the Boise Brewery's operating income when the denominator-level capacity is (a) theoretical capacity, (b) practical capacity, and (c) normal capacity utilization. Begin by completing the following table to help you compute the operating income for each denominator-level capacity concept. (Round the rates to the nearest cent.) Per barrel Budgeted fixed MOH rate Budgeted variable mfg Budgeted total mfg Denominator-level Fixed MOH per barrel cost rate cost rate costs allocated capacity concept Theoretical capacity Practical capacity Normal capacity utilization Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) or unfavorable (U). (Enter a "0" for any zero balance accounts.) Now compute the operating income for each capacity concept, one at a time. Label the variances as favorable (F) or unfavorable (U). (Enter a "0" for any zero balance accounts.) Theoretical Practical Normal capacity capacity capacity utilization Revenues Cost of goods sold Beginning inventory Variable manufacturing costs Fixed manufacturing overhead cost allocated Cost of goods available for sale Deduct ending inventory Adjustment for variances Cost of goods sold Gross margin Cost of goods available for sale Deduct ending inventory Adjustment for variances Cost of goods sold Gross margin Other costs Operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started