Lake Trolley Company is considering whether to lease or buy a new trolley that costs $25,000. The trolley can be depreciated straight line over an

Lake Trolley Company is considering whether to lease or buy a new trolley that costs $25,000. The trolley can be depreciated straight line over an eight- year period to an estimated residual value of $5,000. Lake Trolley’s cost of eight-year secured debt is 12%. Its required return for the project is 16% after tax and 20% pretax. National Trolley Leasing Corporation has offered to lease the trolley to Lake Trolley in return for annual payments of $5,000 payable at the end of each year.

Calculate the net advantage to leasing, assuming Lake Trolley’s tax rate is 40%. Should Lake Trolley lease, or borrow and buy?

Calculate the net advantage to leasing, assuming Lake Trolley’s tax rate is zero. Should Lake Trolley lease, or borrow and buy?

How would your answers to parts b and c change if the residual value at the end of eight years is $500, but the trolley is is depreciated to $5,000? Calculate it with Tax rate=40% and then with a Tax rate of 0%.

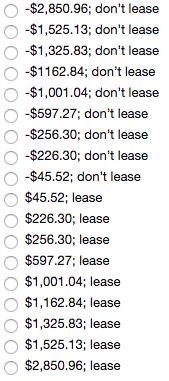

Possible answers for all parts:

-$2,850.96; don't lease -$1,525.13; don't lease -$1,325.83; don't lease -$1162.84; don't lease -$1,001.04; don't lease -$597.27; don't lease -$256.30; don't lease -$226.30; don't lease -$45.52; don't lease $45.52; lease $226.30; lease $256.30; lease $597.27; lease $1,001.04; lease $1,162.84; lease $1,325.83; lease $1,525.13; lease $2,850.96; lease

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Year 0 1 2 3 4 5 6 7 8 Outlay 25000 Payment 5000 5000 5000 5000 5000 5000 5000 5000 Tax Credit 2000 2000 2000 2000 2000 2000 2000 2000 Dep Tax Credit ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started