Answered step by step

Verified Expert Solution

Question

1 Approved Answer

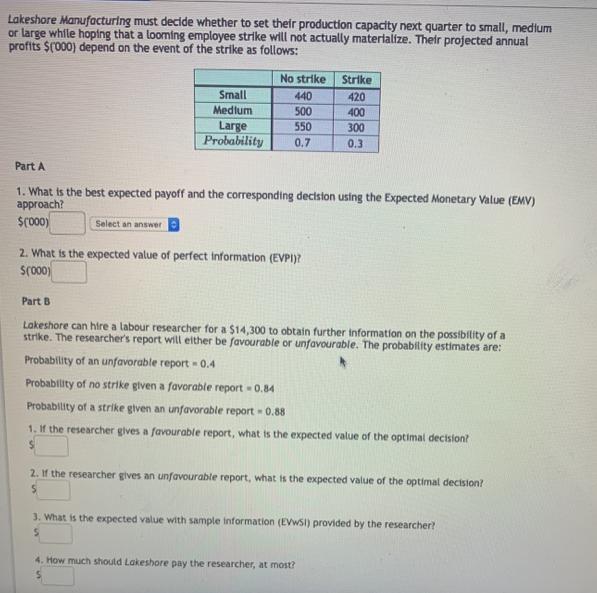

Lakeshore Manufacturing must decide whether to set their production capacity next quarter to small, medium or large while hoping that a looming employee strike

Lakeshore Manufacturing must decide whether to set their production capacity next quarter to small, medium or large while hoping that a looming employee strike will not actually materialize. Their projected annual profits $('000) depend on the event of the strike as follows: No strike 440 500 Large 550 Probability 0.7 Select an answer Small Medium Part A 1. What is the best expected payoff and the corresponding decision using the Expected Monetary Value (EMV) approach? $(000) 2. What is the expected value of perfect information (EVPI)? $(000) Strike 420 400 300 0.3 Part B Lakeshore can hire a labour researcher for a $14,300 to obtain further information on the possibility of a strike. The researcher's report will either be favourable or unfavourable. The probability estimates are: Probability of an unfavorable report -0.4 Probability of no strike given a favorable report - 0.84 Probability of a strike given an unfavorable report - 0.88 1. If the researcher gives a favourable report, what is the expected value of the optimal decision? 2. If the researcher gives an unfavourable report, what is the expected value of the optimal decision? 3. What is the expected value with sample information (EVWSI) provided by the researcher? S 4. How much should Lakeshore pay the researcher, at most? 5. Based on the EVSI, should Lakeshore pay $14,300 for the sample information? Select an answer 6. What is the efficiency of the sample information? Round % to 1 decimal place.

Step by Step Solution

★★★★★

3.55 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Part A 1 To calculate the best expected payoff using the Expected Monetary Value EMV approach we multiply the payoffs by their respective probabilities and sum them up for each decision Then we select ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started