Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lan, Zaza and Hasdi are partners of trading business which focus on selling children's shoes. They set up a business with the name of

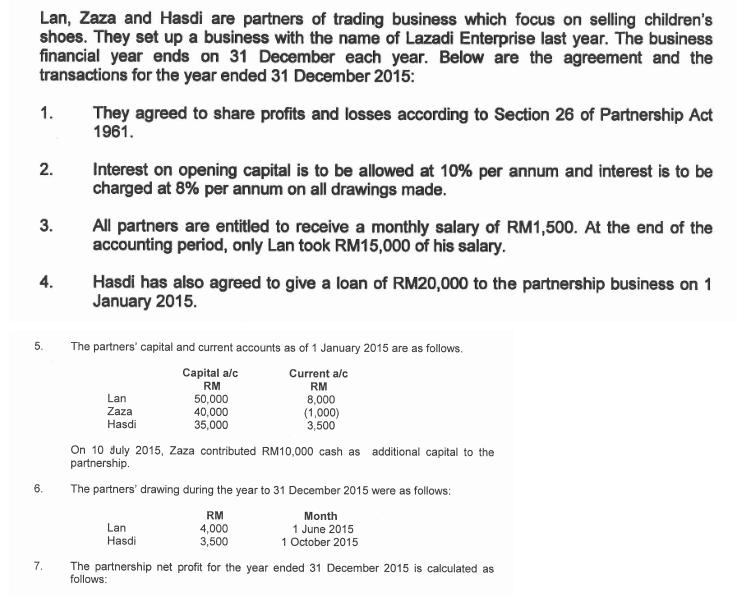

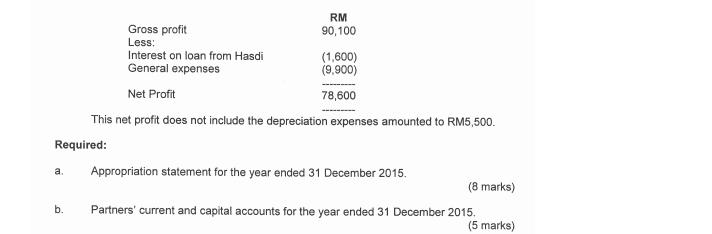

Lan, Zaza and Hasdi are partners of trading business which focus on selling children's shoes. They set up a business with the name of Lazadi Enterprise last year. The business financial year ends on 31 December each year. Below are the agreement and the transactions for the year ended 31 December 2015: 1. 2. 3. 4. 5. 6. 7. They agreed to share profits and losses according to Section 26 of Partnership Act 1961. Interest on opening capital is to be allowed at 10% per annum and interest is to be charged at 8% per annum on all drawings made. All partners are entitled to receive a monthly salary of RM1,500. At the end of the accounting period, only Lan took RM15,000 of his salary. Hasdi has also agreed to give a loan of RM20,000 to the partnership business on 1 January 2015. The partners' capital and current accounts as of 1 January 2015 are as follows. Current a/c RM 8,000 (1,000) 3,500 Lan Zaza Hasdi Capital a/c RM 50,000 40,000 35,000 On 10 July 2015, Zaza contributed RM10,000 cash as additional capital to the partnership. The partners' drawing during the year to 31 December 2015 were as follows: RM Month 4,000 1 June 2015 3,500 1 October 2015 Lan Hasdi The partnership net profit for the year ended 31 December 2015 is calculated as follows: a. Gross profit Less: Interest on loan from Hasdi (1,600) General expenses (9,900) Net Profit 78,600 This net profit does not include the depreciation expenses amounted to RM5,500. Required: b. RM 90,100 Appropriation statement for the year ended 31 December 2015. (8 marks) Partners' current and capital accounts for the year ended 31 December 2015. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started