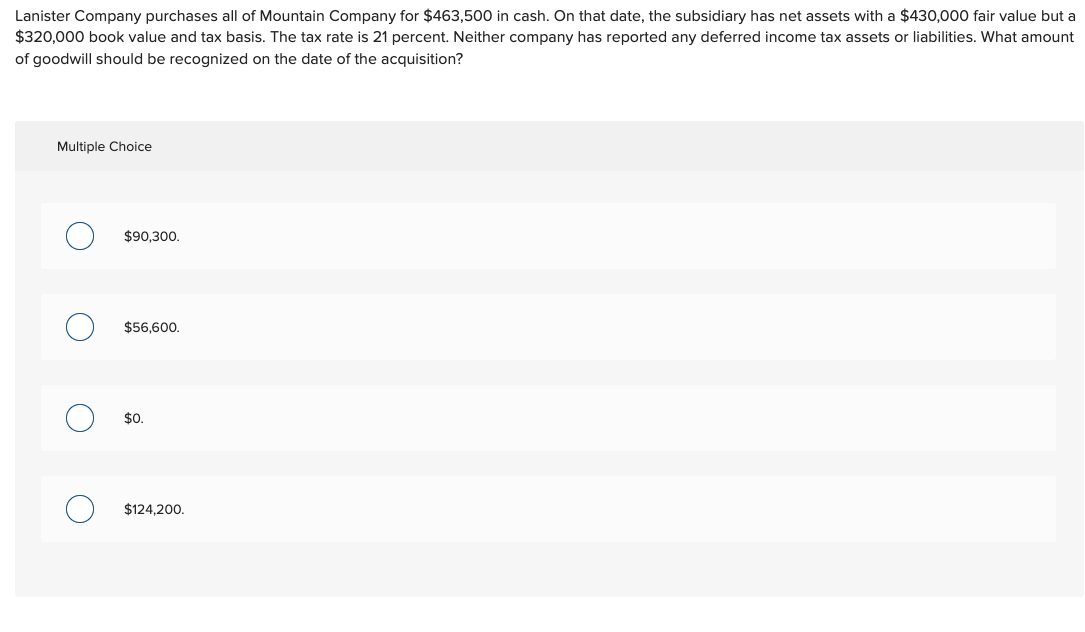

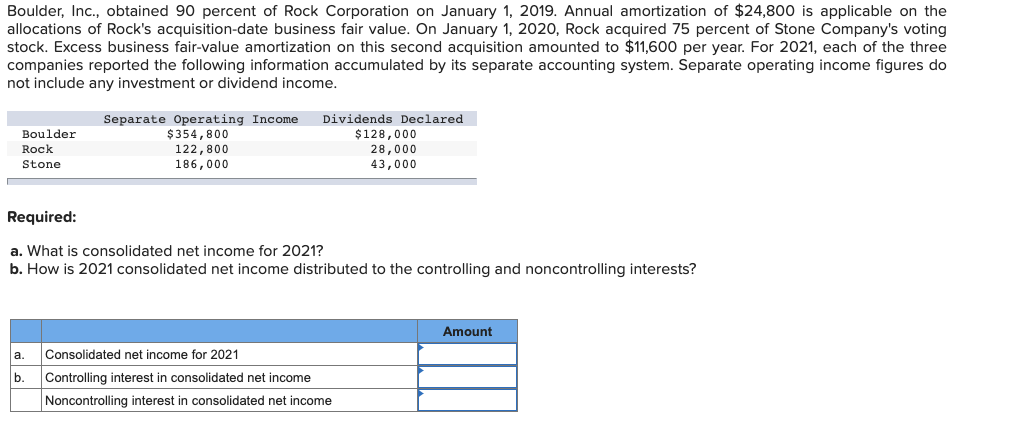

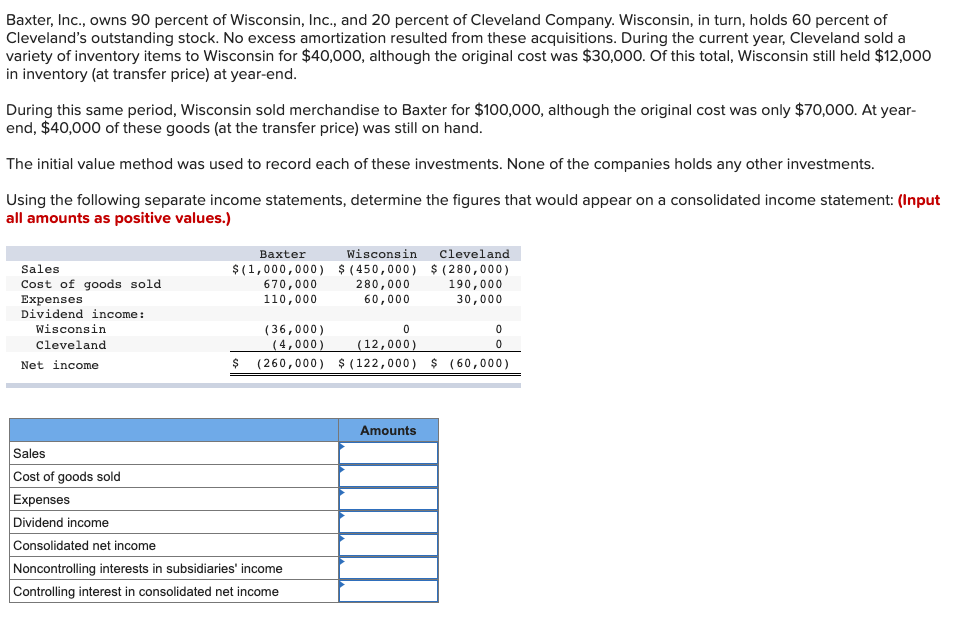

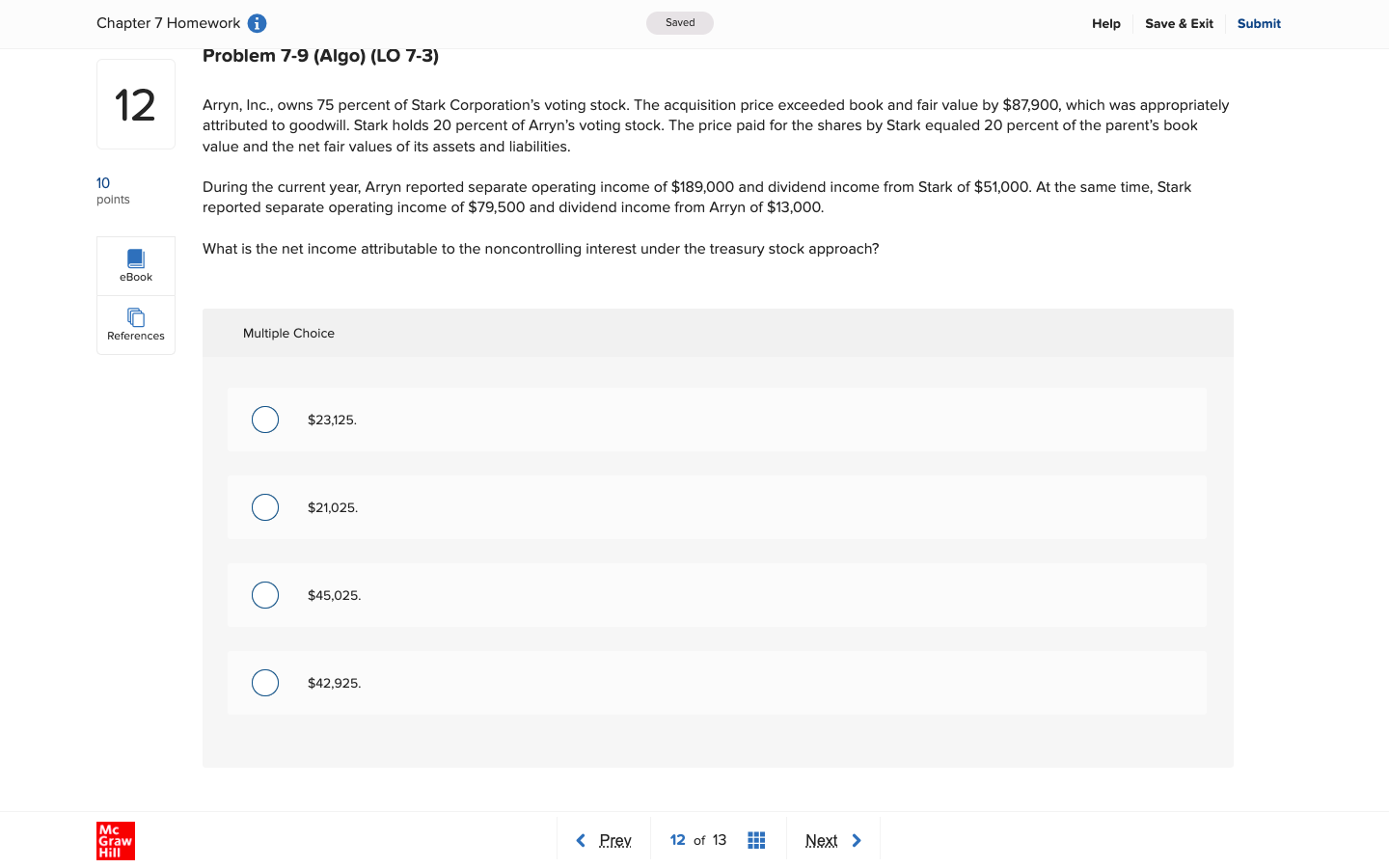

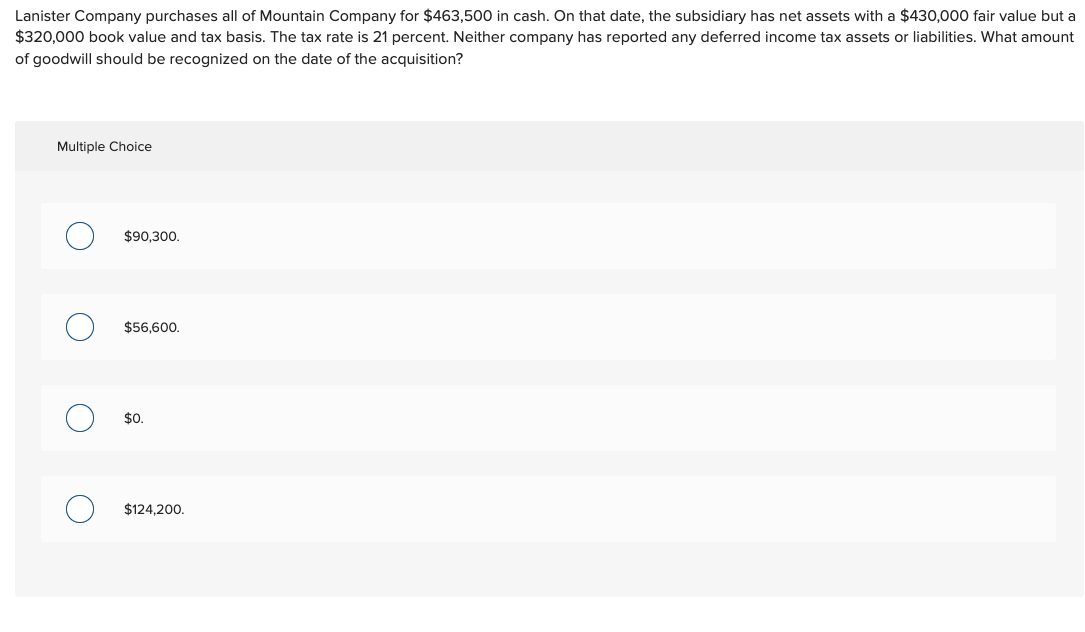

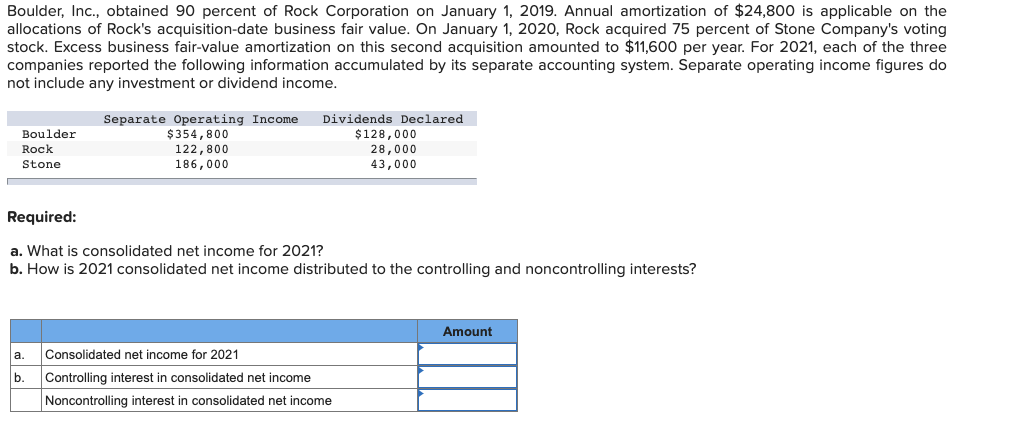

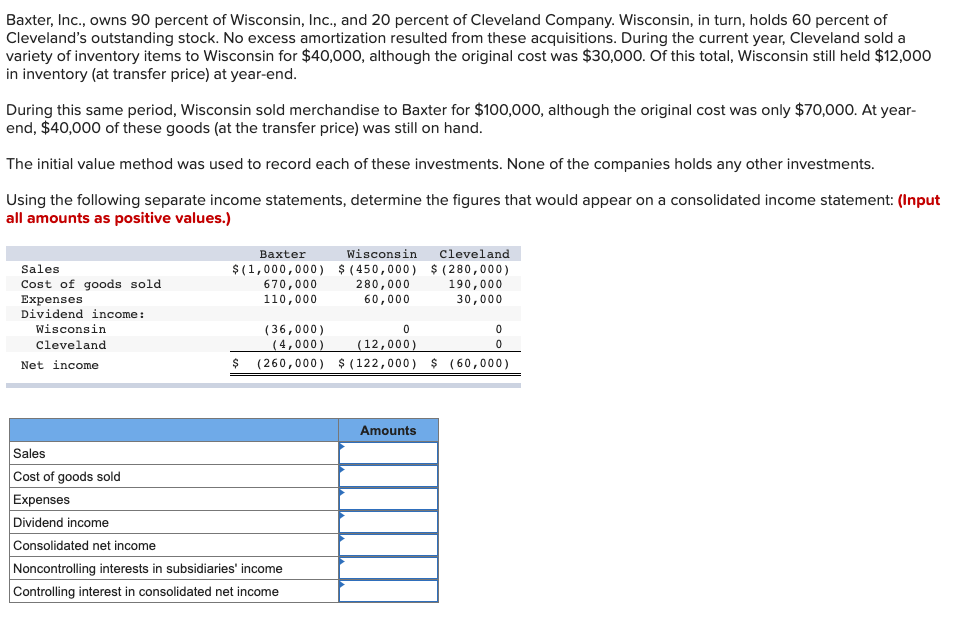

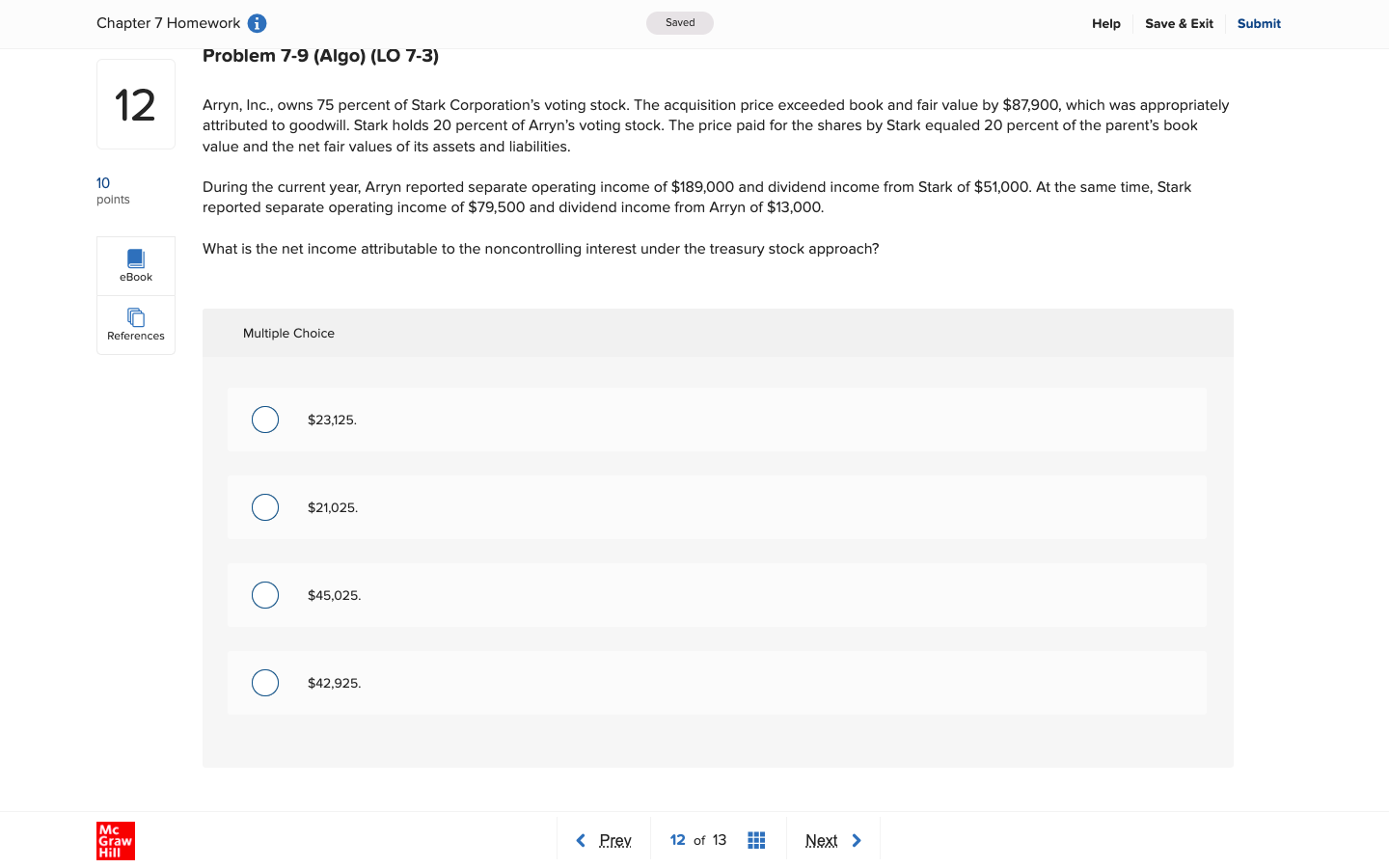

Lanister Company purchases all of Mountain Company for $463,500 in cash. On that date, the subsidiary has net assets with a $430,000 fair value but a $320,000 book value and tax basis. The tax rate is 21 percent. Neither company has reported any deferred income tax assets or liabilities. What amount of goodwill should be recognized on the date of the acquisition? Multiple Choice $90,300. $56,600. $0. O $124,200. Boulder, Inc., obtained 90 percent of Rock Corporation on January 1, 2019. Annual amortization of $24,800 is applicable on the allocations of Rock's acquisition-date business fair value. On January 1, 2020, Rock acquired 75 percent of Stone Company's voting stock. Excess business fair-value amortization on this second acquisition amounted to $11,600 per year. For 2021, each of the three companies reported the following information accumulated by its separate accounting system. Separate operating income figures do not include any investment or dividend income. Boulder Rock Stone Separate Operating Income $354,800 122,800 186,000 Dividends Declared $ 128,000 28,000 43,000 Required: a. What is consolidated net income for 2021? b. How is 2021 consolidated net income distributed to the controlling and noncontrolling interests? Amount a. b. Consolidated net income for 2021 Controlling interest in consolidated net income Noncontrolling interest in consolidated net income Baxter, Inc., owns 90 percent of Wisconsin, Inc., and 20 percent of Cleveland Company. Wisconsin, in turn, holds 60 percent of Cleveland's outstanding stock. No excess amortization resulted from these acquisitions. During the current year, Cleveland sold a variety of inventory items to Wisconsin for $40,000, although the original cost was $30,000. Of this total, Wisconsin still held $12,000 in inventory (at transfer price) at year-end. During this same period, Wisconsin sold merchandise to Baxter for $100,000, although the original cost was only $70,000. At year- end, $40,000 of these goods (at the transfer price) was still on hand. The initial value method was used to record each of these investments. None of the companies holds any other investments. Using the following separate income statements, determine the figures that would appear on a consolidated income statement: (Input all amounts as positive values.) Baxter Wisconsin Cleveland $(1,000,000) $ (450,000) $ (280,000) 670,000 280,000 190,000 110,000 60,000 30,000 Sales Cost of goods sold Expenses Dividend income: Wisconsin Cleveland Net income (36,000) 0 0 (4,000) (12,000) 0 (260,000) $ (122,000) $ (60,000) $ Amounts Sales Cost of goods sold Expenses Dividend income Consolidated net income Noncontrolling interests in subsidiaries' income Controlling interest in consolidated net income Chapter 7 Homework A Saved Help Save & Exit Submit Problem 7-9 (Algo) (LO 7-3) 12 Arryn, Inc., owns 75 percent of Stark Corporation's voting stock. The acquisition price exceeded book and fair value by $87,900, which was appropriately attributed to goodwill. Stark holds 20 percent of Arryn's voting stock. The price paid for the shares by Stark equaled 20 percent of the parent's book value and the net fair values of its assets and liabilities. 10 points During the current year, Arryn reported separate operating income of $189,000 and dividend income from Stark of $51,000. At the same time, Stark reported separate operating income of $79,500 and dividend income from Arryn of $13,000. What is the net income attributable to the noncontrolling interest under the treasury stock approach? eBook References Multiple Choice $23,125. O $21,025. O $45,025. O $42,925. Mc Graw Hill