Question

Larissa Warren and Dan Ervin have been discussing the future of Port Products. The company has been experiencing fast growth and the future looks like

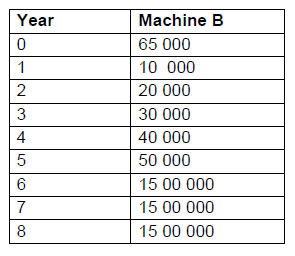

Larissa Warren and Dan Ervin have been discussing the future of Port Products. The company has been experiencing fast growth and the future looks like clear sailing. However, the fast growth means that the companys growth can no longer be funded by internal sources. Port Products wishes to purchase the best of two possible machines to replace its outdated one, each which is expected to satisfy the companys ongoing need for additional aluminium-extrusion capacity. The company plans to use its cost of capital to evaluate each of them. Information regarding expected cash flows from the two machines is as follow: MACHINE A The cost of the new machine is R8,5 million and the company qualifies for a depreciation deduction of 40% of cost in the first year and 20% in each of the subsequent three years. The machine is also expected to reduce operational costs by R180 000 per annum before tax for another four years, when the life of this machine is expected to end. The expected residual value of the machine is R2,1 million in four years time. Due to increased production capacity, the new machine will increase the selling price to R85 per unit and variable cost to R38 per unit. The product line is expected to result in a constant demand of 70 000 units per annum for four years. The tax value of the present machine is R300 000 and its current market value is R410 000. The machine is expected to have a residual value of zero in four years time. The investment in net working capital will amount to R475 000. MACHINE B

The following additional data was availed to Larissa and Dan: Ordinary shares (60%): Ordinary shares are currently trading at R35 per share. The growth rate is expected to be 5% and next years dividend is expected to be R3. Preference shares (20%): The promised annual dividend is R2. The current market price of the share is R30 and flotation costs would amount to R8 per share. Long-term debt (20%): R1 00,00 par value, 10% coupon and ten-year bonds that could be sold for R1 100,00 less 3% for fees. Company tax rate is currently 28%. REQUIRED Advise Larissa and Dan on long-term investment and financing decisions to be taken by the company to increase the shareholders wealth (show all relevant calculations). (32 marks)

\begin{tabular}{|l|l|} \hline Year & Machine B \\ \hline 0 & 65000 \\ \hline 1 & 10000 \\ \hline 2 & 20000 \\ \hline 3 & 30000 \\ \hline 4 & 40000 \\ \hline 5 & 50000 \\ \hline 6 & 1500000 \\ \hline 7 & 1500000 \\ \hline 8 & 1500000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started