Answered step by step

Verified Expert Solution

Question

1 Approved Answer

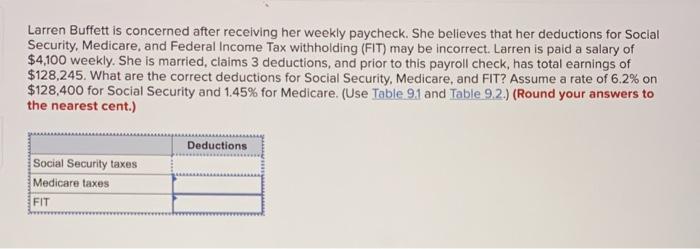

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Socia SecurityMedicare, and Federal Income Tax withholding (FIT) may be

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Socia SecurityMedicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $weekly. She is married, claims 3 deductions, and prior to this payroll check, has total earnings of $128,245. What are the correct deductions for Social Security, Medicare, and FIT? Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare(Use Table 91 and Table 9.2.) (Round your answers to the nearest cent .)

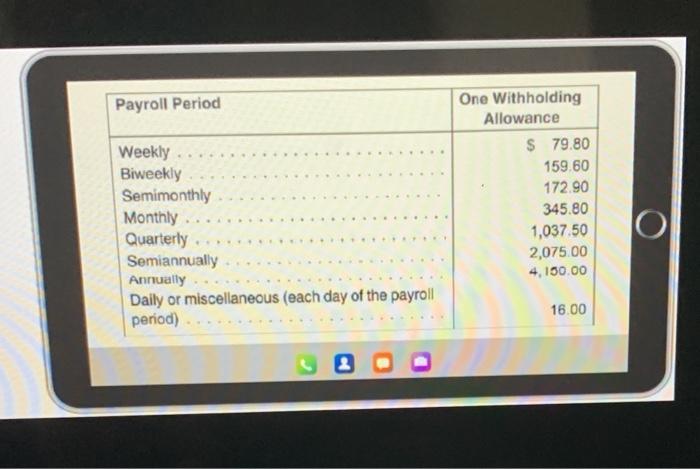

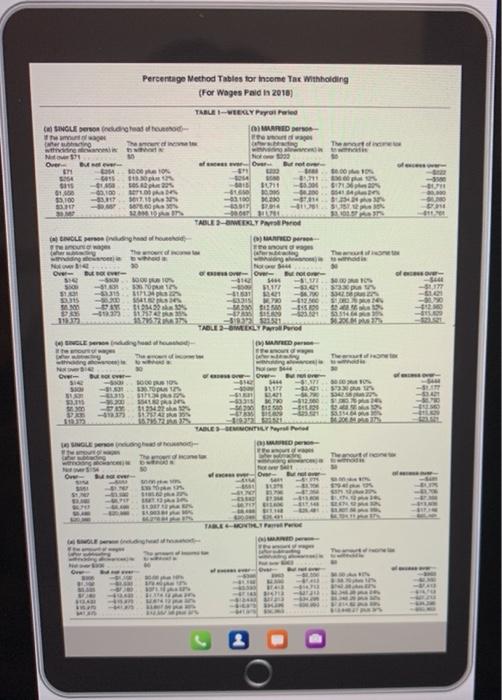

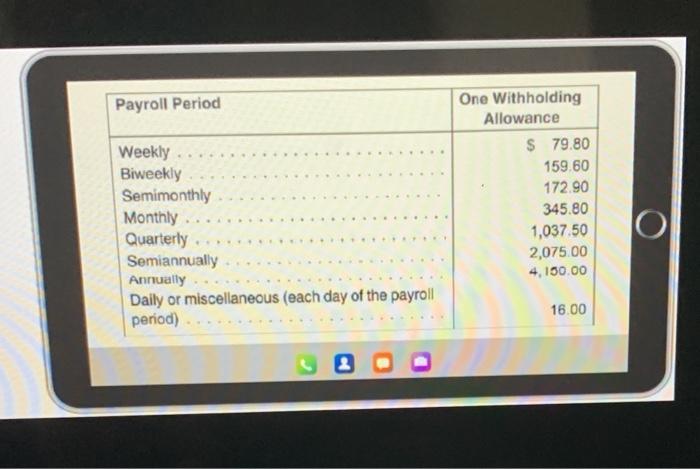

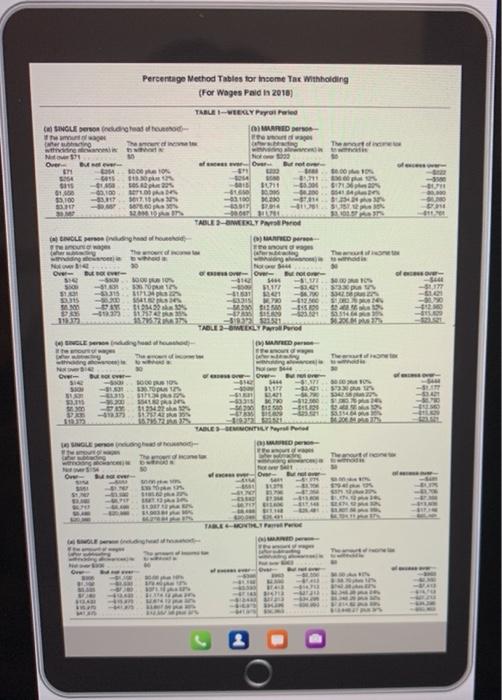

Larren Buffett is concerned after receiving her weekly paycheck. She believes that her deductions for Social Security, Medicare, and Federal Income Tax withholding (FIT) may be incorrect. Larren is paid a salary of $4,100 weekly. She is married, claims 3 deductions, and prior to this payroll check, has total earnings of $128,245. What are the correct deductions for Social Security, Medicare, and FIT? Assume a rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. (Use Table 91 and Table 9.2.) (Round your answers to the nearest cent.) Deductions Social Security taxes Medicare taxes FIT Payroll Period Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 N MS V ... SES . Percentage Method Tables for Income Tax withholding (For Wages Pald in 2010) TRE-VERY Payroll Perled SINGLE pero fred as the MAARID The art wani Our Outure SO 0.00 -601513 - sep20 11711 -0.00 BIT 01.10 69,900 - -0.00 100 - ONA 100 1020 - . - 860 - -30 MAP 19.00 TABLE WEEKLY INGLE who MATED Cews Thu w who Modis Over DEBO INO BOON 10 - -17 -315 -610 -02 --- - - WEID-12. - 1984 BER 113 1125TR 39111 EM TABLE-WEEKLY Prof Edhe MAILED VVS SEEDS EVE -5,17 - 3:20 - SOS VE th 14 SO - SIO - opus - SIN - $1254 Over 4 BRITY 33 SO MOON - 333 - 12 1 OF TAKE MONTHLY ORD INGLE The Then is O IM - - 11 SEN TABELI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started