Answered step by step

Verified Expert Solution

Question

1 Approved Answer

last question of important assignment. DUE TONIGHT with no exceptions. due in 1 1/2 hours. please keep format. Now calculate the total overhead allocated to

last question of important assignment. DUE TONIGHT with no exceptions. due in 1 1/2 hours. please keep format.

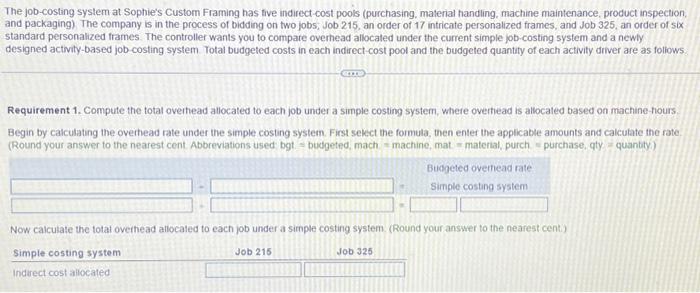

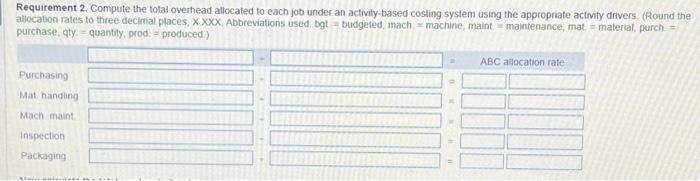

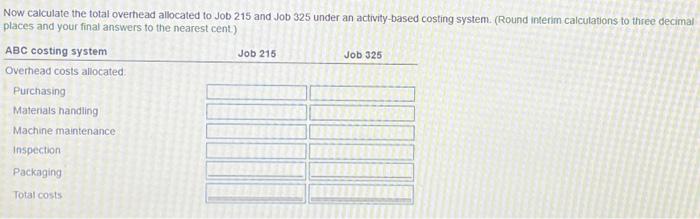

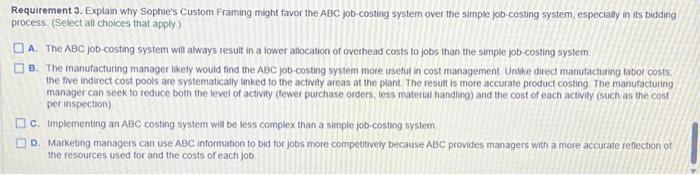

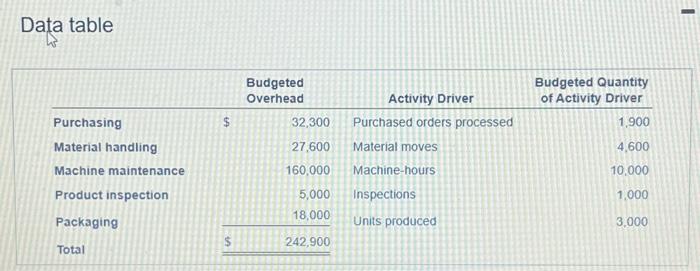

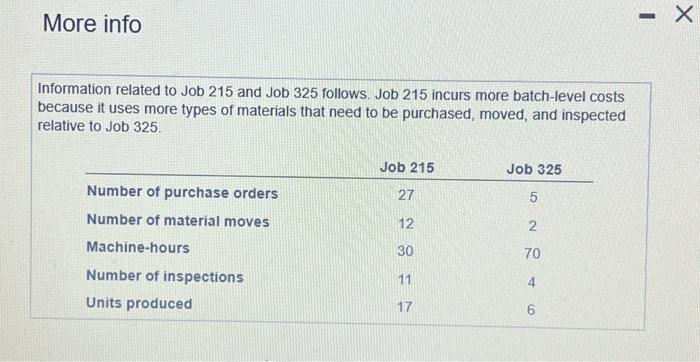

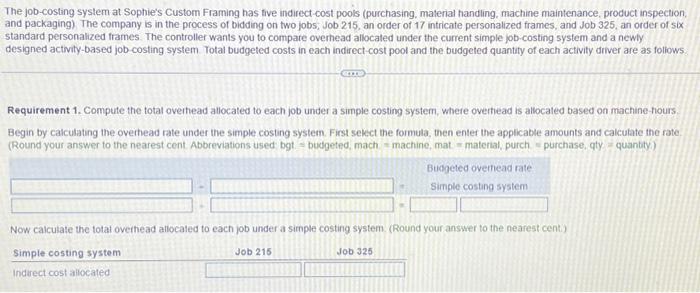

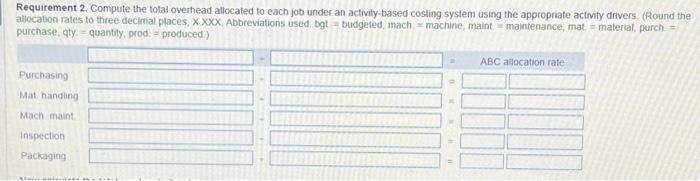

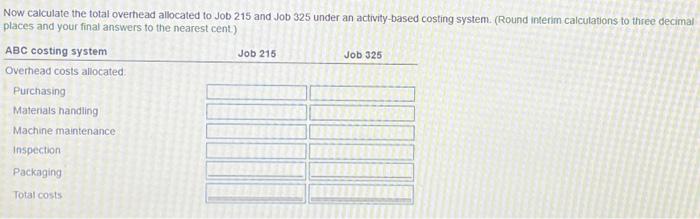

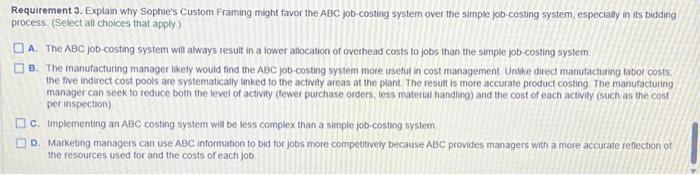

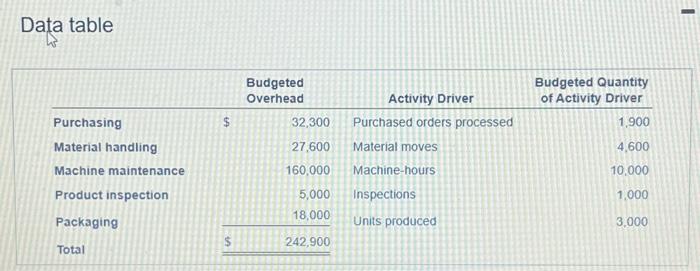

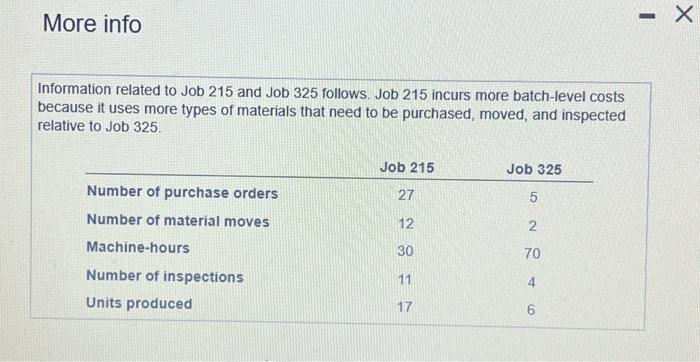

Now calculate the total overhead allocated to Job 215 and Job 325 under an activity-based costing system. (Round interim calculations to three decimal places and your final answers to the nearest cent) More info Information related to Job 215 and Job 325 follows. Job 215 incurs more batch-level costs because it uses more types of materials that need to be purchased, moved, and inspected relative to Job 325 . Requirement 3. Explain why Sophe's Custom Framing might favor the ABC job-costing system over the simple job-costing system, especially in its bidding process: (Select all choices that apply). A. The ABC job-costing system will always result in a fower allocation of overhead costs to jobs than the simple job-costing system. B. The manufacturing manager likely would find the ABC job-costing system more useful in cost management. Untike direct manutacturing iabor costs, the five indirect cost poots are systematically linked to the activity areas at the plant. The result is more accurate product costing The manufacturing manager can seek to reduce both the level of activity (fewer purchase orders, iess material handing) and the cost of each activity (such as the cost per inspection) c. Implementing an ABC costing system will be less complex than a simple job-costing system D. Marketing managers can use ABC information to bid for jobs more competivety because ABC provides managers with a more accurate reflection of the resources used for and the costs of each job. Data table Requirement 2. Compute the total overhead allocated to each job under an activity-based costing system using the appropriate activity drivers. (Round the allocation rates to three decimal places, XXX. Abbreviations used: bgt = budgeted, mach = machine, maint, = maintenance, mat, m material, purch. = purchase, qty = quantty, , rod = produced.) The job-costing system at Sophie's Custom Framing has tive indirect-cost pools (purchasing, material handling, machine maintenance, product inspection, and packaging) The company is in the process of bidding on two jobs; Job 215, an order of 17 intricate personalized frames, and Job 325 , an order of six standard personalized frames. The controller wants you to compare overhead allocated under the current simple job-costing system and a newly designed activity-based job-costing system. Total budgeted costs in each indirect-cost pool and the budgeted quantity of each activity driver are as foliows: Requirement 1. Compute the total overhead allocated to each job under a simple costing system, where overtiead is allocated based on machine- hours. Begin by calculating the oveihead rate under the simple costing system. First sekct the formula, then enter the applicable amounts and calculate the rate. (Round your answer to the nearest cent. Abbreviations used: bgt = budgeted, mach = machine, mat. = material, purch. = purchase, qty = quantity)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started