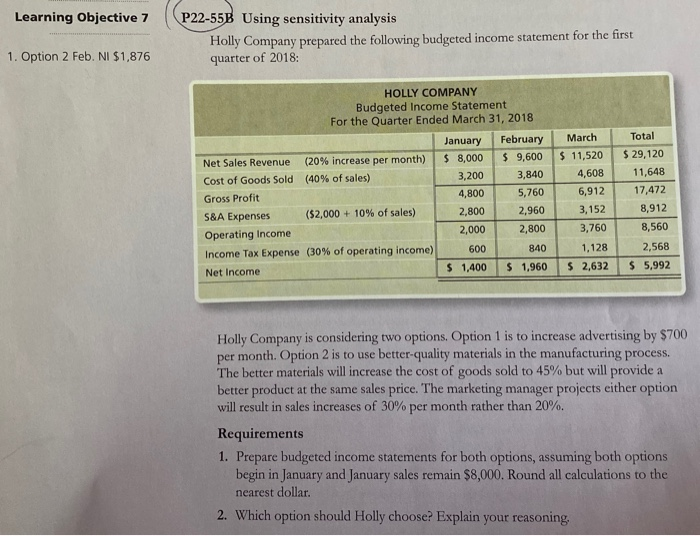

Learning Objective 7 P22-55B Using sensitivity analysis Holly Company prepared the following budgeted income statement for the first quarter of 2018: 1. Option 2 Feb. NI $1,876 HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February Net Sales Revenue (20% increase per month) $ 8,000 $ 9,600 Cost of Goods Sold (40% of sales) 3,200 3,840 Gross Profit 4,800 5,760 S&A Expenses ($2,000 + 10% of sales) 2,800 2,960 Operating Income 2,000 2,800 Income Tax Expense (30% of operating income) 600 840 Net Income $ 1,400 $ 1,960 March $ 11,520 4,608 6,912 3,152 3,760 1,128 $ 2,632 Total $ 29,120 11,648 17,472 8,912 8,560 2,568 $ 5,992 Holly Company is considering two options. Option 1 is to increase advertising by $700 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 45% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 30% per month rather than 20%. Requirements 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. Round all calculations to the nearest dollar 2. Which option should Holly choose? Explain your reasoning, Requirement 1 Option 1: HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Option 2 HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Requirement 2 Learning Objective 7 P22-55B Using sensitivity analysis Holly Company prepared the following budgeted income statement for the first quarter of 2018: 1. Option 2 Feb. NI $1,876 HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February Net Sales Revenue (20% increase per month) $ 8,000 $ 9,600 Cost of Goods Sold (40% of sales) 3,200 3,840 Gross Profit 4,800 5,760 S&A Expenses ($2,000 + 10% of sales) 2,800 2,960 Operating Income 2,000 2,800 Income Tax Expense (30% of operating income) 600 840 Net Income $ 1,400 $ 1,960 March $ 11,520 4,608 6,912 3,152 3,760 1,128 $ 2,632 Total $ 29,120 11,648 17,472 8,912 8,560 2,568 $ 5,992 Holly Company is considering two options. Option 1 is to increase advertising by $700 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 45% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 30% per month rather than 20%. Requirements 1. Prepare budgeted income statements for both options, assuming both options begin in January and January sales remain $8,000. Round all calculations to the nearest dollar 2. Which option should Holly choose? Explain your reasoning, Requirement 1 Option 1: HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Option 2 HOLLY COMPANY Budgeted Income Statement For the Quarter Ended March 31, 2018 January February March Total Requirement 2