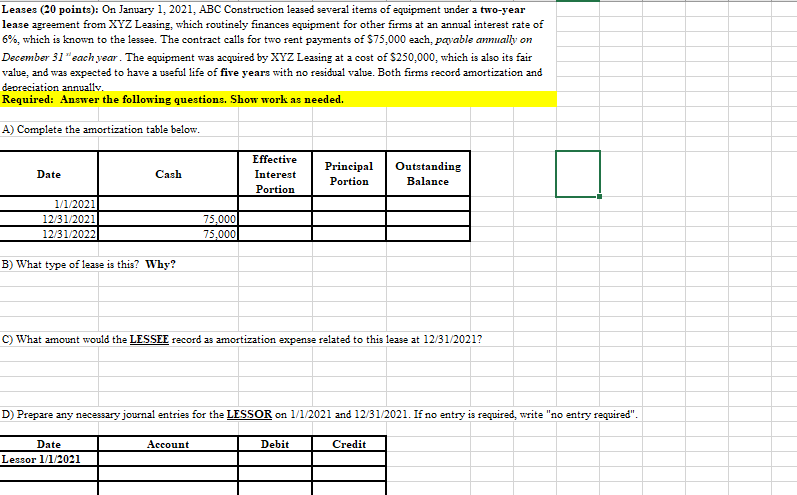

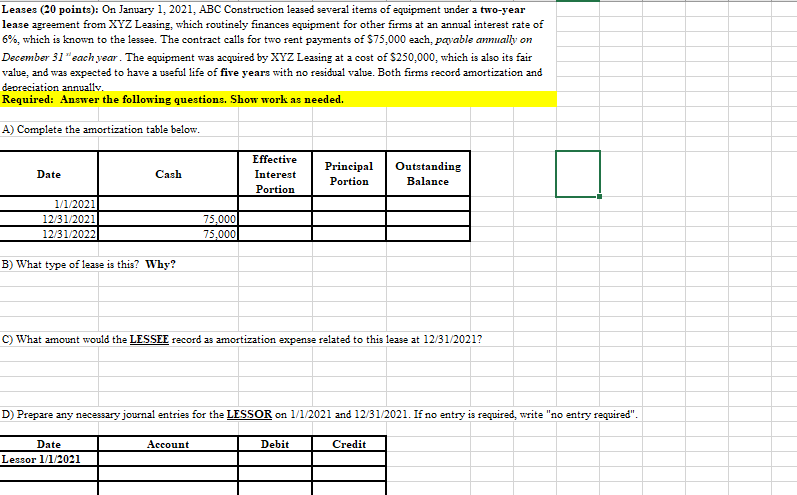

Leases (20 points): On January 1, 2021, ABC Construction leased several items of equipment under a two-year lease agreement from XYZ Leasing, which routinely finances equipment for other firms at an annual interest rate of 6%, which is known to the lessee. The contract calls for two rent payments of $75,000 each, payable annually on December 31 "each year. The equipment was acquired by XYZ Leasing at a cost of $250,000, which is also its fair valve, and was expected to have a useful life of five years with no residual value. Both firms record amortization and depreciation annually. Required: Answer the following questions. Show work as needed. A) Complete the amortization table below. Date Cash Effective Interest Portion Principal Portion Outstanding Balance 1/1/2021 12/31/2021 12/31/20221 75,000 75,000 B) What type of lease is this? Why? C) What amount would the LESSEE record as amortization expense related to this lease at 12/31/2021? D) Prepare any necessary journal entries for the LESSOR on 1/1/2021 and 12/31/2021. If no entry is required, write "no entry required". Account Debit Credit Date Lessor 1/1/2021 Leases (20 points): On January 1, 2021, ABC Construction leased several items of equipment under a two-year lease agreement from XYZ Leasing, which routinely finances equipment for other firms at an annual interest rate of 6%, which is known to the lessee. The contract calls for two rent payments of $75,000 each, payable annually on December 31 "each year. The equipment was acquired by XYZ Leasing at a cost of $250,000, which is also its fair valve, and was expected to have a useful life of five years with no residual value. Both firms record amortization and depreciation annually. Required: Answer the following questions. Show work as needed. A) Complete the amortization table below. Date Cash Effective Interest Portion Principal Portion Outstanding Balance 1/1/2021 12/31/2021 12/31/20221 75,000 75,000 B) What type of lease is this? Why? C) What amount would the LESSEE record as amortization expense related to this lease at 12/31/2021? D) Prepare any necessary journal entries for the LESSOR on 1/1/2021 and 12/31/2021. If no entry is required, write "no entry required". Account Debit Credit Date Lessor 1/1/2021