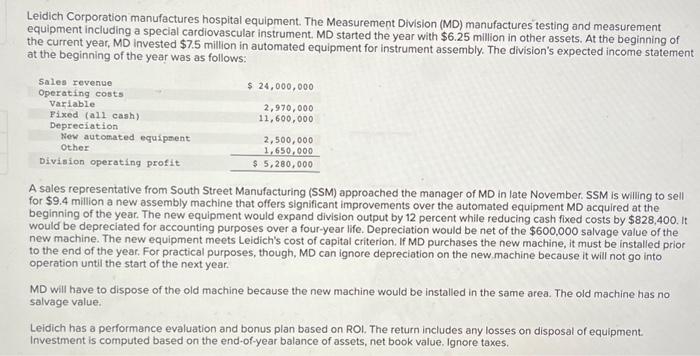

Leidich Corporation manufactures hospital equipment. The Measurement Division (MD) manufactures testing and measurement equipment including a special cardiovascular instrument. MD started the year with $6.25 million in other assets. At the beginning of the current year, MD invested $7.5 million in automated equipment for instrument assembly. The division's expected income statement at the beginning of the year was as follows: A sales representative from South Street Manufacturing (SSM) approached the manager of MD in late November. SSM is willing to sell for $9.4 million a new assembly machine that offers significant improvements over the automated equipment MD acquired at the beginning of the year. The new equipment would expand division output by 12 percent while reducing cash fixed costs by $828,400. It would be depreciated for accounting purposes over a four-year life. Depreciation would be net of the $600,000 salvage value of the new machine. The new equipment meets Leidich's cost of capital criterion, If MD purchases the new machine, it must be installed prior to the end of the year. For practical purposes, though, MD can ignore depreciation on the new machine because it will not go into operation until the start of the next year. MD will have to dispose of the old machine because the new machine would be installed in the same area. The old machine has no salvage value. Leidich has a performance evaluation and bonus plan based on ROI. The return includes any losses on disposal of equipment. Investment is computed based on the end-of-year balance of assets, net book value. Ignore taxes. MD will have to dispose of the old machine because the new machine would be installed in the same area. The old machine has no salvage value. Leidich has a performance evaluation and bonus plan based on ROI. The return includes any losses on disposal of equipment. Investment is computed based on the end-of-year balance of assets, net book value. Ignore taxes. The manager is still assessing the problem of whether to acquire SSM's assembly machine. SSM tells the manager that the new machine could be acquired next year, but it will cost 20 percent more. The salvage value would still be $600,000,0 ther costs or revenue estimates would be apportioned on a month-by-month basis for the time each machine (either the current machine or the machine the manager is considering) is in use. Fractions of months may be ignored. Ignore taxes. Required: Calculate ROI for the coming year assuming that the new equipment is bought at the beginning of the year. Note: Round your final answer to nearest whole percentage