Question

Leon Inc. has the following capital structure, which it considers to be optimal: Debt 25% Preferred stock 15 Common equity 60 Leons expected net income

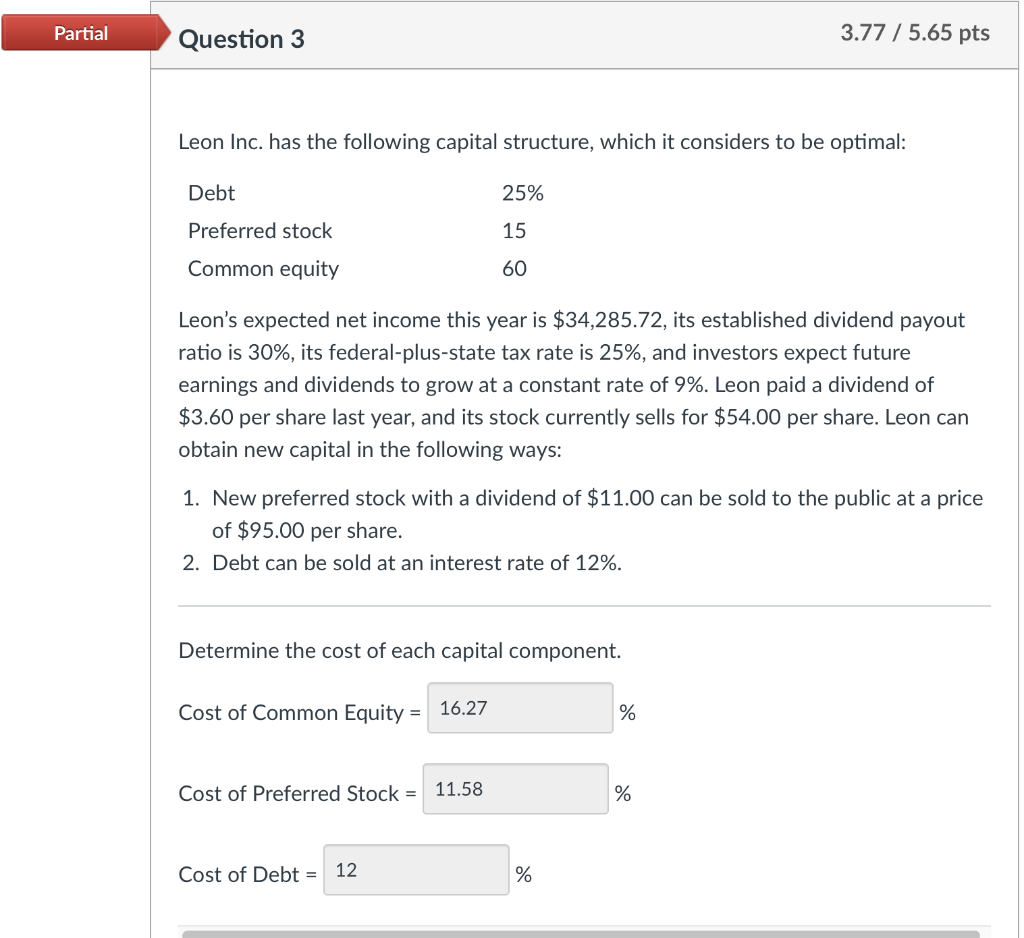

Leon Inc. has the following capital structure, which it considers to be optimal:

| Debt | 25% |

| Preferred stock | 15 |

| Common equity | 60 |

Leons expected net income this year is $34,285.72, its established dividend payout ratio is 30%, its federal-plus-state tax rate is 25%, and investors expect future earnings and dividends to grow at a constant rate of 9%. Leon paid a dividend of $3.60 per share last year, and its stock currently sells for $54.00 per share. Leon can obtain new capital in the following ways:

- New preferred stock with a dividend of $11.00 can be sold to the public at a price of $95.00 per share.

- Debt can be sold at an interest rate of 12%.

Determine the cost of each capital component.

Cost of Common Equity = %

Cost of Preferred Stock = %

Cost of Debt = %

I GOT 2 CORRECT AND 1 INCORRECT. IT DOES NOT TELL ME WHICH ONE. HOWEVER, I BELIEVE IT IS THE LAST ANSWER.

Partial Question 3 3.77 / 5.65 pts Leon Inc. has the following capital structure, which it considers to be optimal: Debt 25% Preferred stock 15 Common equity 60 Leon's expected net income this year is $34,285.72, its established dividend payout ratio is 30%, its federal-plus-state tax rate is 25%, and investors expect future earnings and dividends to grow at a constant rate of 9%. Leon paid a dividend of $3.60 per share last year, and its stock currently sells for $54.00 per share. Leon can obtain new capital in the following ways: 1. New preferred stock with a dividend of $11.00 can be sold to the public at a price of $95.00 per share. 2. Debt can be sold at an interest rate of 12%. Determine the cost of each capital component. Cost of Common Equity = 16.27 % Cost of Preferred Stock = 11.58 % Cost of Debt = 12 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started