Question

Lessee Company is a manufacturer of plastic toys. On Jan 1, 2010, the company signed a contract to lease plastic extruding equipment from Lessor Company.

Lessee Company is a manufacturer of plastic toys. On Jan 1, 2010, the company signed a contract to lease plastic extruding equipment from Lessor Company. The lease was for 5 years, commencing immediately on January 1, 2010. The annual lease payment was set at $19,000, and to be made at the beginning of each year.

Under the agreement, Lessee Company guaranteed that the leased equipment would be worth $8,000 when returned. The lessor's rate of return on the leasing arrangement was 8%, and this was known to the lessee.

Lessee Company had a year end of Dec. 31, and followed IFRS.

Required:

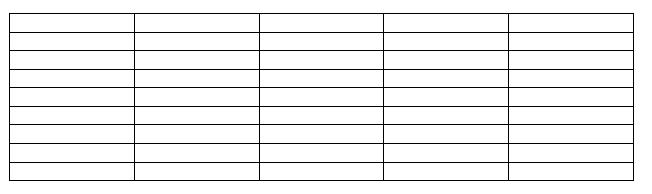

(1) Prepare an amortization table for Lessee Company for the lease

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Theory and Corporate Policy

Authors: Thomas E. Copeland, J. Fred Weston, Kuldeep Shastri

4th edition

321127218, 978-0321179548, 321179544, 978-0321127211

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App