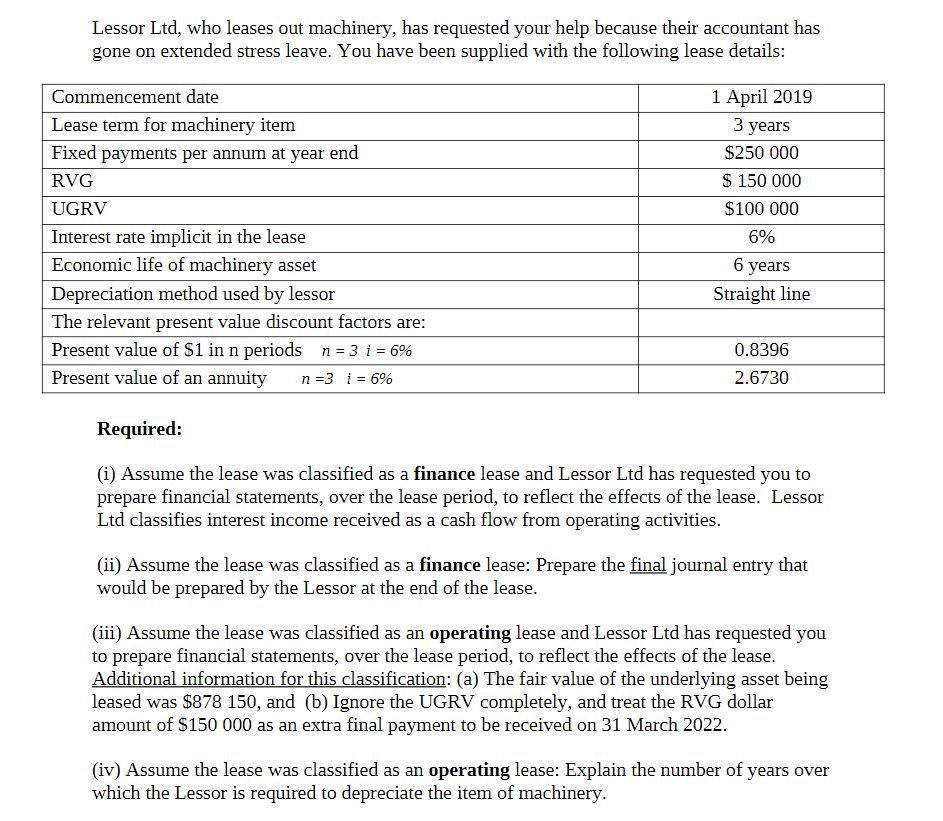

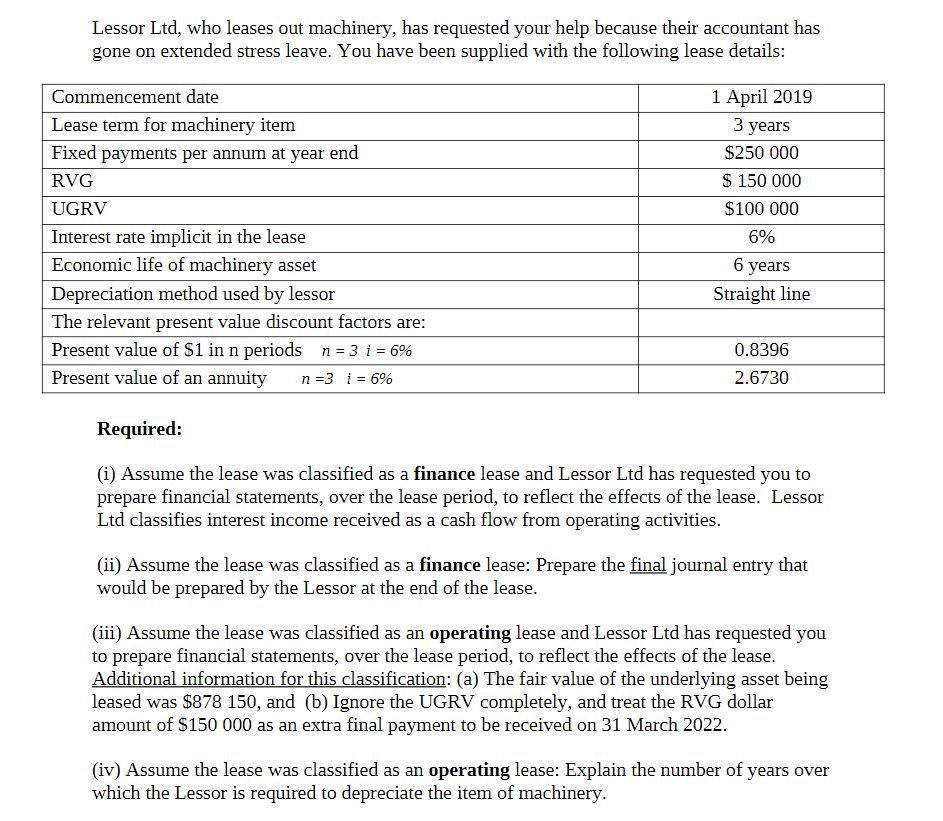

Lessor Ltd, who leases out machinery, has requested your help because their accountant has gone on extended stress leave. You have been supplied with the following lease details: Commencement date Lease term for machinery item Fixed payments per annum at year end RVG UGRV Interest rate implicit in the lease Economic life of machinery asset Depreciation method used by lessor The relevant present value discount factors are: Present value of $1 in n periods n = 3 i = 6% Present value of an annuity n=3 i = 6% 1 April 2019 3 years $250 000 $ 150 000 $100 000 6% 6 years Straight line 0.8396 2.6730 Required: (i) Assume the lease was classified as a finance lease and Lessor Ltd has requested you to prepare financial statements, over the lease period, to reflect the effects of the lease. Lessor Ltd classifies interest income received as a cash flow from operating activities. (ii) Assume the lease was classified as a finance lease: Prepare the final journal entry that would be prepared by the Lessor at the end of the lease. (iii) Assume the lease was classified as an operating lease and Lessor Ltd has requested you to prepare financial statements, over the lease period, to reflect the effects of the lease. Additional information for this classification: (a) The fair value of the underlying asset being leased was $878 150, and (b) Ignore the UGRV completely, and treat the RVG dollar amount of $150 000 as an extra final payment to be received on 31 March 2022. (iv) Assume the lease was classified as an operating lease: Explain the number of years over which the Lessor is required to depreciate the item of machinery. Lessor Ltd, who leases out machinery, has requested your help because their accountant has gone on extended stress leave. You have been supplied with the following lease details: Commencement date Lease term for machinery item Fixed payments per annum at year end RVG UGRV Interest rate implicit in the lease Economic life of machinery asset Depreciation method used by lessor The relevant present value discount factors are: Present value of $1 in n periods n = 3 i = 6% Present value of an annuity n=3 i = 6% 1 April 2019 3 years $250 000 $ 150 000 $100 000 6% 6 years Straight line 0.8396 2.6730 Required: (i) Assume the lease was classified as a finance lease and Lessor Ltd has requested you to prepare financial statements, over the lease period, to reflect the effects of the lease. Lessor Ltd classifies interest income received as a cash flow from operating activities. (ii) Assume the lease was classified as a finance lease: Prepare the final journal entry that would be prepared by the Lessor at the end of the lease. (iii) Assume the lease was classified as an operating lease and Lessor Ltd has requested you to prepare financial statements, over the lease period, to reflect the effects of the lease. Additional information for this classification: (a) The fair value of the underlying asset being leased was $878 150, and (b) Ignore the UGRV completely, and treat the RVG dollar amount of $150 000 as an extra final payment to be received on 31 March 2022. (iv) Assume the lease was classified as an operating lease: Explain the number of years over which the Lessor is required to depreciate the item of machinery