Answered step by step

Verified Expert Solution

Question

1 Approved Answer

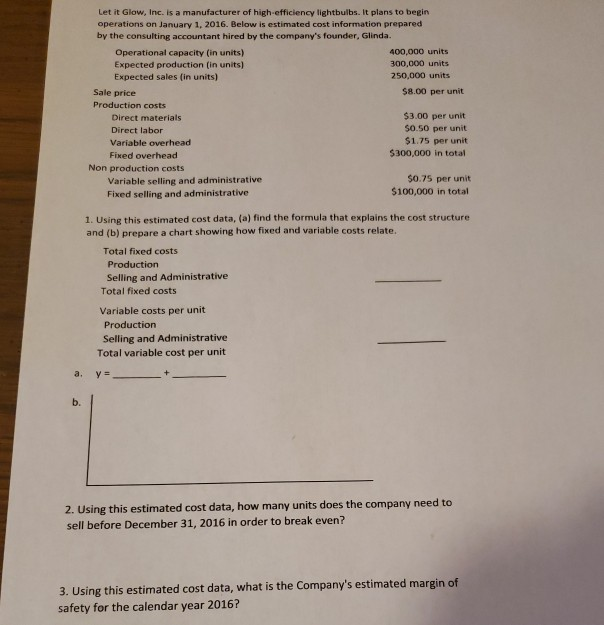

Let it Glow, Inc. is a manufacturer of high-efficiency lightbulbs. It plans to begin operations on January 1, 2016. Below is estimated cost information prepared

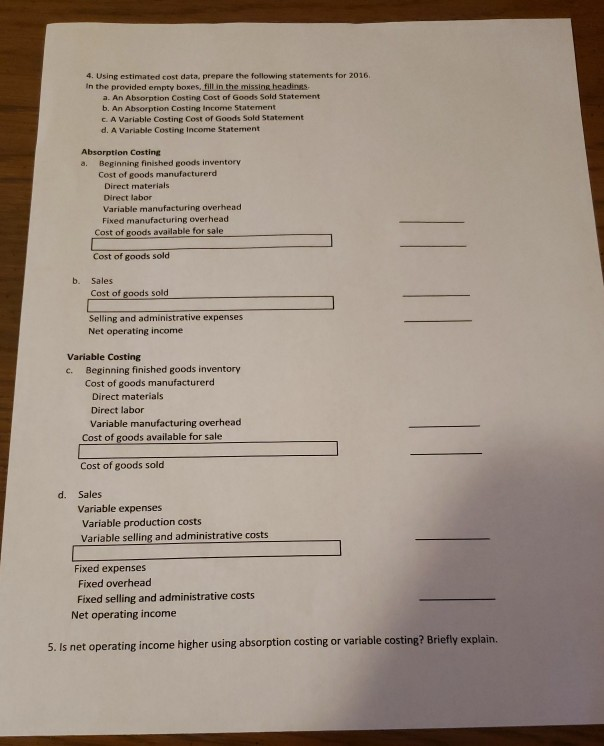

Let it Glow, Inc. is a manufacturer of high-efficiency lightbulbs. It plans to begin operations on January 1, 2016. Below is estimated cost information prepared by the consulting accountant hired by the company's founder, Glinda. Operational capacity (in units) 400,000 units Expected production (in units) 300,000 units Expected sales in units) 250,000 units Sale price $8.00 per unit Production costs Direct materials $3.00 per unit Direct labor $0.50 per unit Variable overhead $1.75 per unit Fixed overhead $300,000 in total Non production costs Variable selling and administrative $0.75 per unit Fixed selling and administrative $100,000 in total 1. Using this estimated cost data, (a) find the formula that explains the cost structure and (b) prepare a chart showing how fixed and variable costs relate. Total fixed costs Production Selling and Administrative Total fixed costs Variable costs per unit Production Selling and Administrative Total variable cost per unit a. y = 2. Using this estimated cost data, how many units does the company need to sell before December 31, 2016 in order to break even? 3. Using this estimated cost data, what is the Company's estimated margin of safety for the calendar year 2016? 4. Using estimated cost data, prepare the following statements for 2016 in the provided empty boxes, fill in the missing headings a. An Absorption Costing Cost of Goods Sold Statement b. An Absorption Costing Income Statement C. A Variable Costine Cost of Goods Sold Statement d. A Variable Costing Income Statement Absorption Costing a. Beginning finished goods inventory Cost of goods manufacturerd Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Cost of goods available for sale Cost of goods sold b. Sales Cost of goods sold Selling and administrative expenses Net operating income Variable Costing c. Beginning finished goods inventory Cost of goods manufacturers Direct materials Direct labor Variable manufacturing overhead Cost of goods available for sale Cost of goods sold d. Sales Variable expenses Variable production costs Variable selling and administrative costs Fixed expenses Fixed overhead Fixed selling and administrative costs Net operating income 5. Is net operating income higher using absorption costing or variable costing? Briefly explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started