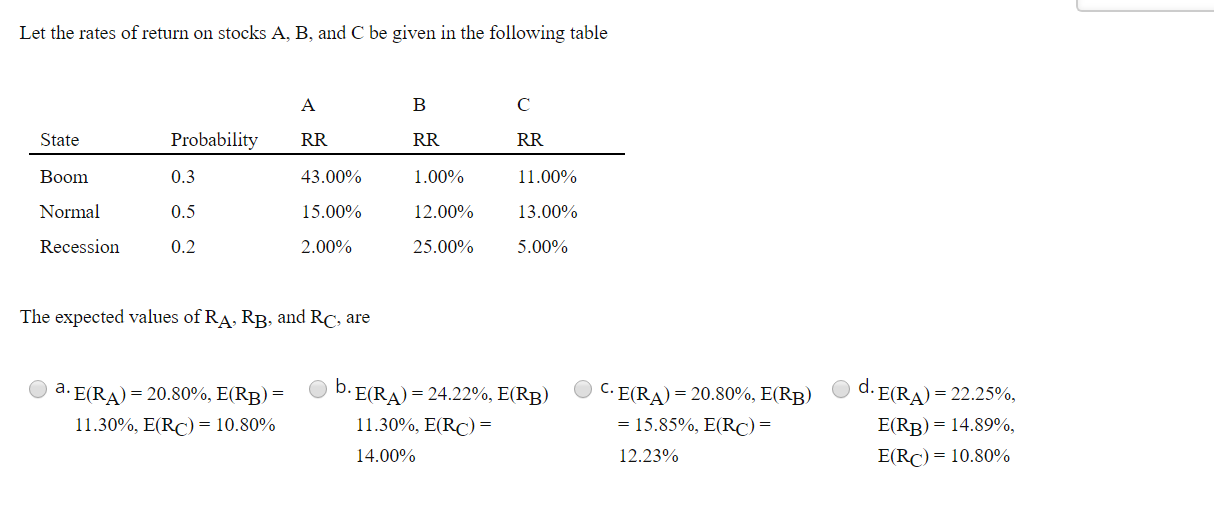

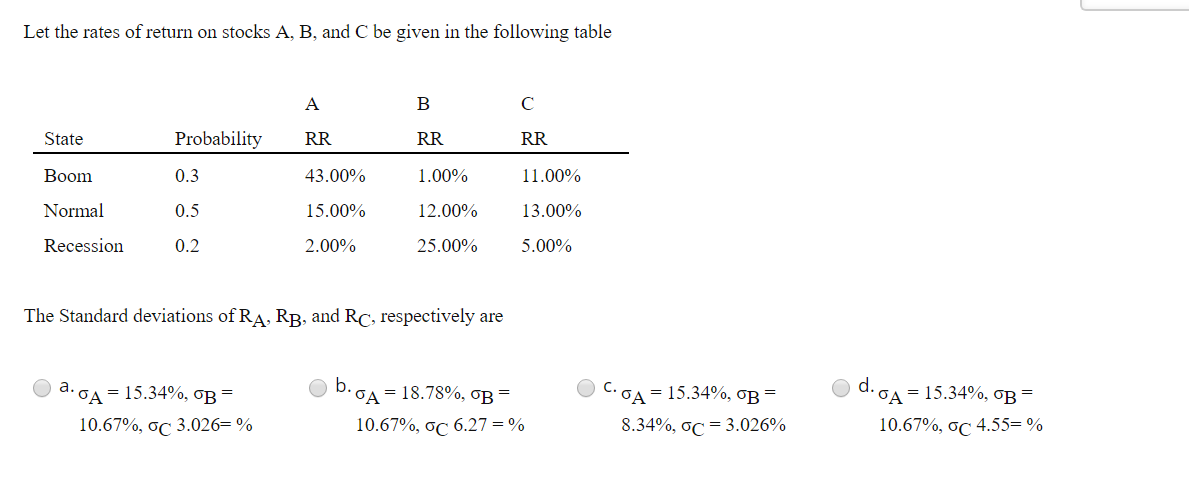

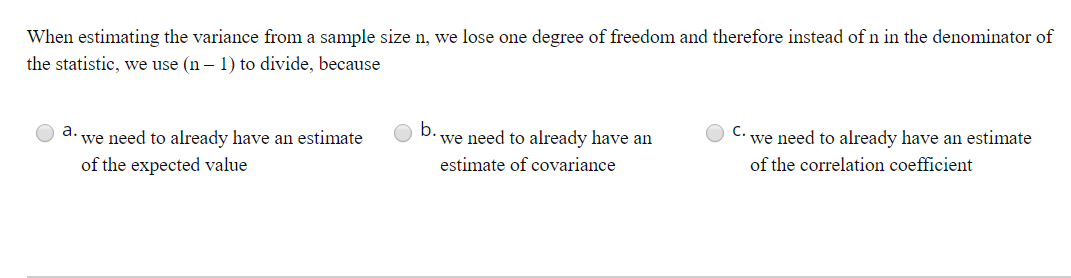

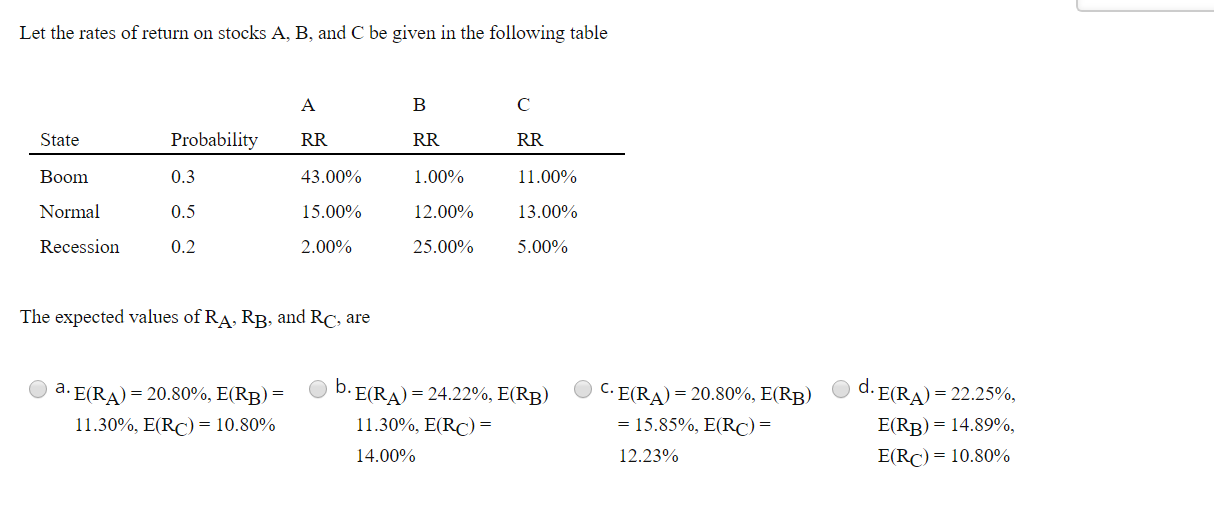

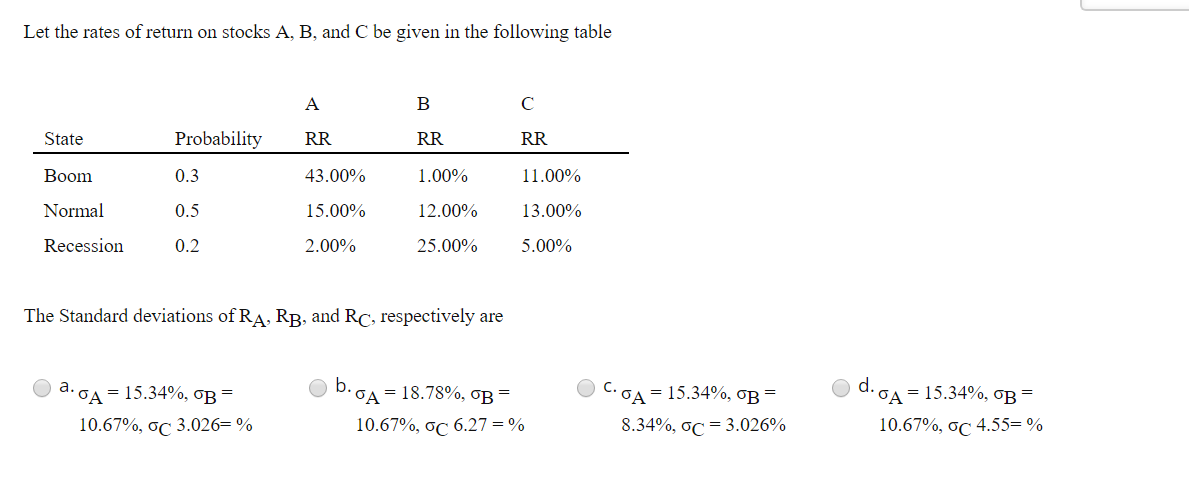

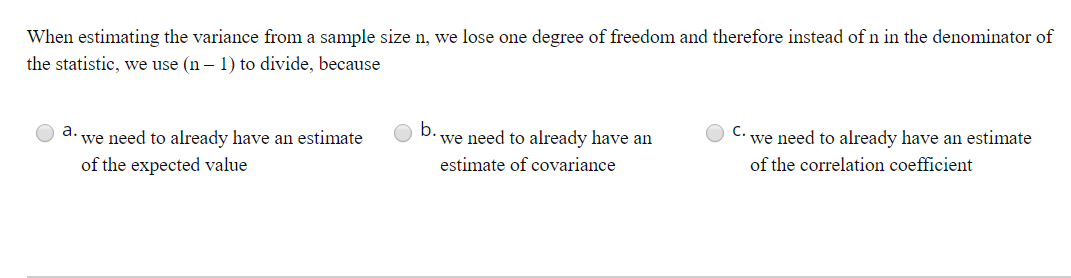

Let the rates of return on stocks A, B, and C be given in the following table Probability State RR RR RR oom 0.3 43.00% 1.00% 11.00% 13.00% Normal 0.5 15.00% 12.00% Recession 5.00% 0.2 2.00% 25.00% The expected values of RA. RB, and RC, are b. d. E(RA 22.25%, . C.E(RA 20.80%, E(RB) E(RA 20.80%, E(RB)= E(RA 24.22%, E(RB) =15.85%, E(RC)= 11.30%, E(RC= E(RB) = 14.89%, 11.30%, E(RC= 10.80% E(RC)= 10.80% 14.00% 12.23% Let the rates of return on stocks A, B, and C be given in the following table B C Probability State RR RR RR Boom 11.00% 0.3 43.00% 1.00% Normal 0.5 15.00% 12.00% 13.00% Recession 5.00% 0.2 2.00% 25.00% The Standard deviations of RA, RB, and Rc, respectively are GA18.78%, OB= O C.GA = 15.34%, oB = OA 15.34%, OB= OA 15.34%, oB 10.67%, oc 3.026= % 10.679%, 6.27% 8.34%, oC 3.026% 10.67%, oC 4.55= % When estimating the variance from a sample size n, we lose one degree of freedom and therefore instead of n in the denominator of the statistic, we use (n - 1) to divide, because a C. we need to already have an we need to already have an estimate we need to already have an estimate of the expected value estimate of covariance of the correlation coefficient Let the rates of return on stocks A, B, and C be given in the following table Probability State RR RR RR oom 0.3 43.00% 1.00% 11.00% 13.00% Normal 0.5 15.00% 12.00% Recession 5.00% 0.2 2.00% 25.00% The expected values of RA. RB, and RC, are b. d. E(RA 22.25%, . C.E(RA 20.80%, E(RB) E(RA 20.80%, E(RB)= E(RA 24.22%, E(RB) =15.85%, E(RC)= 11.30%, E(RC= E(RB) = 14.89%, 11.30%, E(RC= 10.80% E(RC)= 10.80% 14.00% 12.23% Let the rates of return on stocks A, B, and C be given in the following table B C Probability State RR RR RR Boom 11.00% 0.3 43.00% 1.00% Normal 0.5 15.00% 12.00% 13.00% Recession 5.00% 0.2 2.00% 25.00% The Standard deviations of RA, RB, and Rc, respectively are GA18.78%, OB= O C.GA = 15.34%, oB = OA 15.34%, OB= OA 15.34%, oB 10.67%, oc 3.026= % 10.679%, 6.27% 8.34%, oC 3.026% 10.67%, oC 4.55= % When estimating the variance from a sample size n, we lose one degree of freedom and therefore instead of n in the denominator of the statistic, we use (n - 1) to divide, because a C. we need to already have an we need to already have an estimate we need to already have an estimate of the expected value estimate of covariance of the correlation coefficient