Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Line 5 worksheet? Note: This problem is for the 2021 tax year. Lance H. and Wanda B. Dean are married and live at 431 Yucca

Line 5 worksheet?

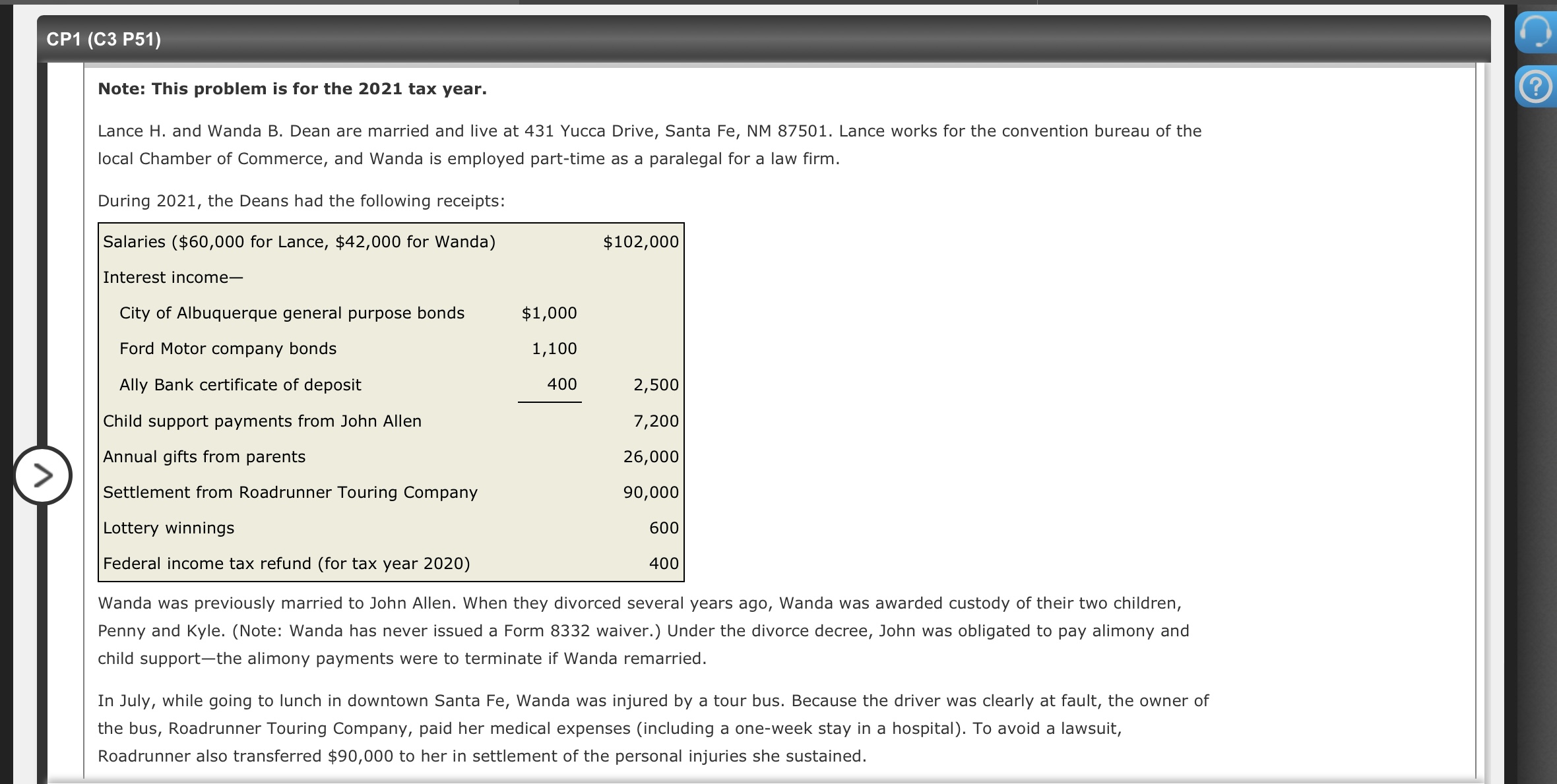

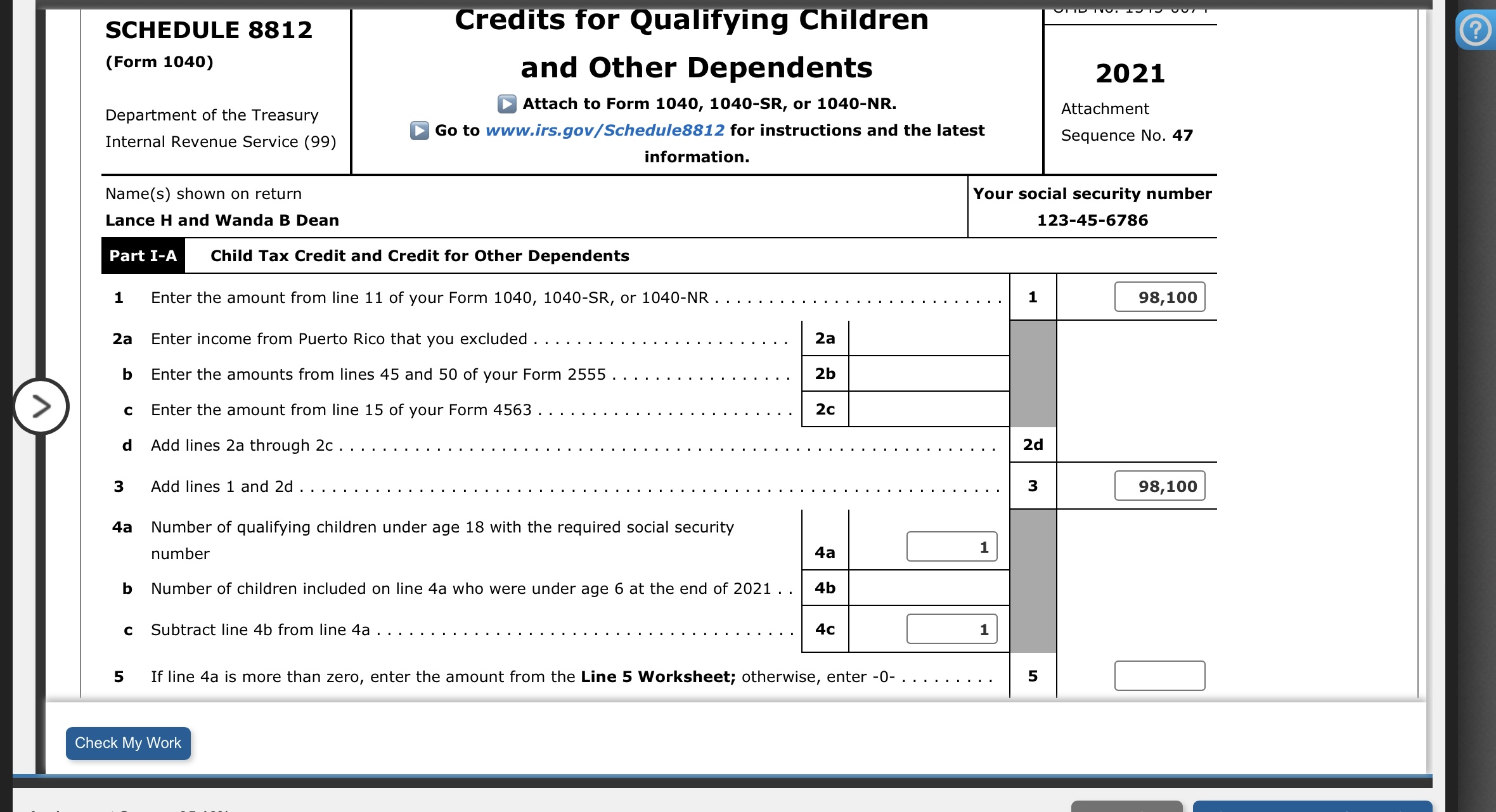

Note: This problem is for the 2021 tax year. Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2021, the Deans had the following receipts: Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John was obligated to pay alimony and child support-the alimony payments were to terminate if Wanda remarried. In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. Because the driver was clearly at fault, the owner of the bus, Roadrunner Touring Company, paid her medical expenses (including a one-week stay in a hospital). To avoid a lawsuit, Roadrunner also transferred $90,000 to her in settlement of the personal injuries she sustained. SCHEDULE 8812 (Form 1040) Department of the Treasury Internal Revenue Service (99) Credits for Qualifying Children and Other Dependents Attach to Form 1040, 1040-SR, or 1040-NR. Go to wWw.irs. gov/Schedule8812 for instructions and the latest information. 2021 Attachment Sequence No. 47 Name(s) shown on return Your social security number Lance H and Wanda B Dean 123456786 Part I-A Child Tax Credit and Credit for Other Dependents 1 Enter the amount from line 11 of your Form 1040, 1040-SR, or 1040-NR 2a Enter income from Puerto Rico that you excluded. b Enter the amounts from lines 45 and 50 of your Form 2555 C Enter the amount from line 15 of your Form 4563 d Add lines 2 a through 2 c 3 Add lines 1 and 2d 4a Number of qualifying children under age 18 with the required social security number b Number of children included on line 4a who were under age 6 at the end of 2021 . . c Subtract line 4b from line 4a \begin{tabular}{|c|c|} \hline 2a & \\ \hline 2b & \\ \hline 2c & \\ \hline \end{tabular} 5 If line 4a is more than zero, enter the amount from the Line 5 Worksheet; otherwise, enter - 0- . . . . . . . 5 Check My WorkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started