Question

1. List the Reportable Segments for Campbell Soup Company. The reportable segments are developed using the management approach. A company reports segments based on how

1. List the Reportable Segments for Campbell Soup Company. The reportable segments are developed using the management approach. A company reports segments based on how the company is managed. If your company has more than one reportable segment, are the segments product-based or geography-based?

2. What is the name of the Independent Auditor that audited the financial statements and produced the Report on Internal Control over Financial Reporting? Why is an independent audit critical to confidence in financial reporting?

3. Accounts Receivable:

- What is the total amount of outstanding Accounts Receivable at the end of the most recent year?

- How much of this does the company not expect to collect?

- What is the percent of projected uncollectible accounts to Accounts Receivable?

- How do the Balance Sheet and Income Statement change when a credit is ultimately written off?

4. Property, Plant, and Equipment:

Property, Plant and Equipment — Property, plant and equipment are recorded at historical cost and are depreciated over estimated useful lives using the straight-line method. Buildings and machinery and equipment are depreciated over periods not exceeding 45 years and 20 years, respectively. Assets are evaluated for impairment when conditions indicate that the carrying value may not be recoverable. Such conditions include significant adverse changes in business climate or a plan of disposal. Repairs and maintenance are charged to expense as incurred.

- What is the Gross PPE for the company, and what does it represent?

- Calculate the percent depreciated for the company’s Property and Equipment.

- Why is this percent depreciated of interest to financial statement readers?

5. Inventory:

- What is the inventory costing method used by the company?

- If there is a Lifo reserve, state how much it is and what it means for the company’s inventory cost.

- How much of the inventory consists of finished products?

6. Income Tax

- What is the effective tax rate for your company?

- What amount of tax is payable based on the tax return?

We also recorded impairment charges on goodwill and intangible assets included in Noncurrent assets of discontinued operations. See Note 3 for additional information. The estimates of future cash flows used in determining the fair value of goodwill and intangible assets involve significant management judgment and are based upon assumptions about expected future operating performance, economic conditions, market conditions and cost of capital. Inherent in estimating the future cash flows are uncertainties beyond our control, such as changes in capital markets. The actual cash flows could differ materially from management’s estimates due to changes in business conditions, operating performance and economic conditions.

7. Goodwill and Intangible Assets:

- How much does the company report in Intangible Assets and Goodwill?

- What percent of total assets do they each comprise?

- Except for Discontinued Operations, were any of these deemed impaired last year? If so, how much was the total loss?

- Were there impairment charges included in the loss from discontinued operations? If so, how much was the impairment loss?

- Note 4 from 10k Did the company have an acquisition last year? If so, what was the amount of Goodwill generated? If there is more than one acquisition, just pick one.

8. Pension and Post-employment benefits:note 11 pg 60-66

- What is the funded status of the pension plan (over/under and by how much)?

- How do actual returns on plan assets affect the funding status of the plan?

- How much did the company contribute to its pension plan in the most recent year?

- Why are defined benefit pension liabilities included in a chapter about off-balance sheet liabilities?

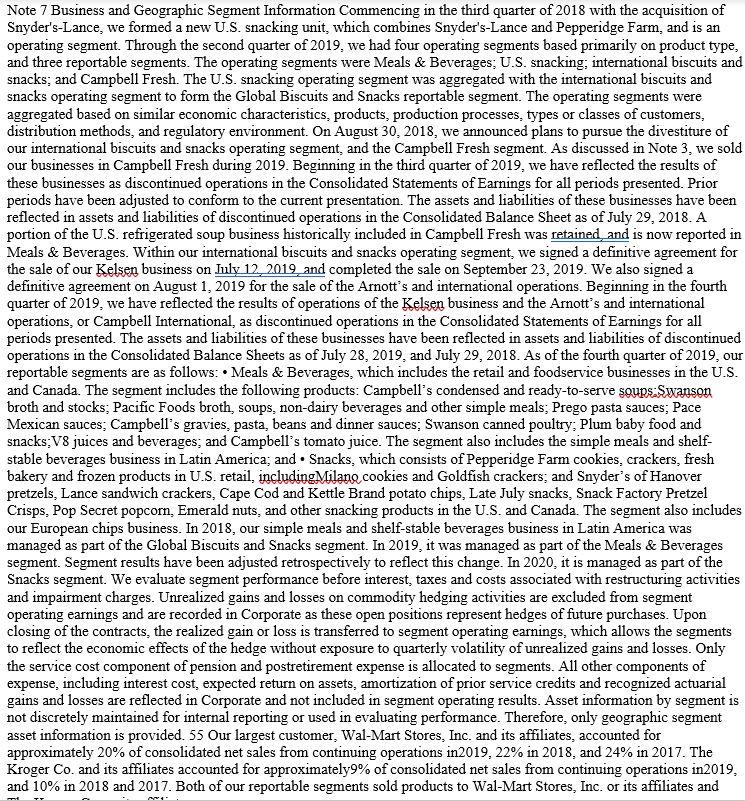

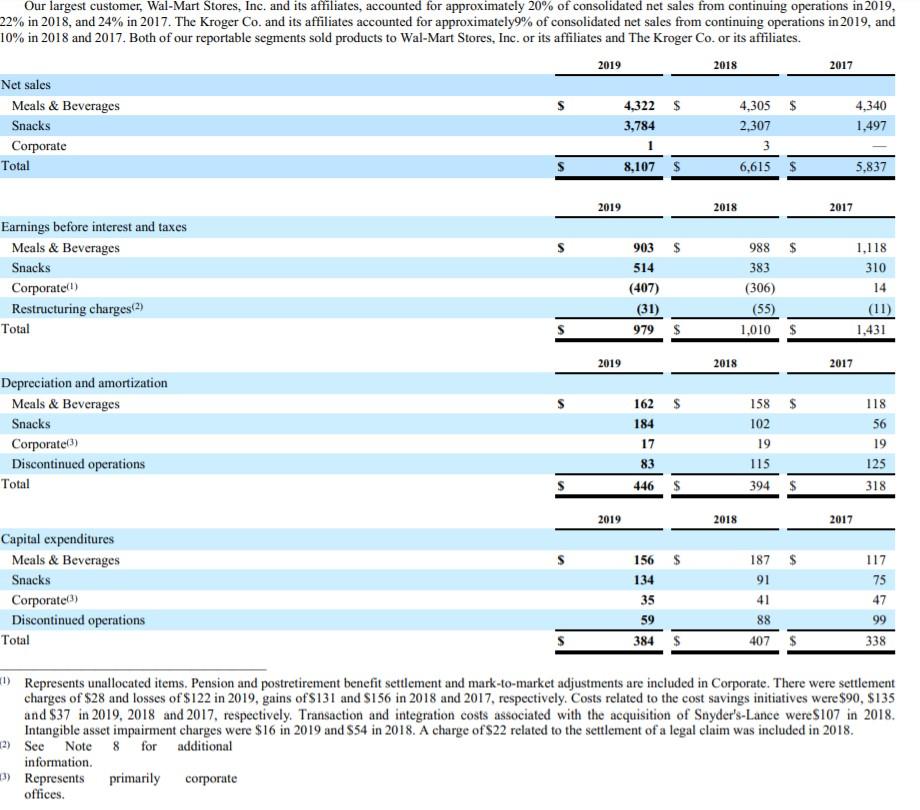

Note 7 Business and Geographic Segment Information Commencing in the third quarter of 2018 with the acquisition of Snyder's-Lance, we formed a new U.S. snacking unit, which combines Snyder's-Lance and Pepperidge Farm, and is an operating segment. Through the second quarter of 2019, we had four operating segments based primarily on product type, and three reportable segments. The operating segments were Meals & Beverages; U.S. snacking; international biscuits and snacks; and Campbell Fresh. The U.S. snacking operating segment was aggregated with the international biscuits and snacks operating segment to form the Global Biscuits and Snacks reportable segment. The operating segments were aggregated based on similar economic characteristics, products, production processes, types or classes of customers, distribution methods, and regulatory environment. On August 30, 2018, we announced plans to pursue the divestiture of our international biscuits and snacks operating segment, and the Campbell Fresh segment. As discussed in Note 3, we sold our businesses in Campbell Fresh during 2019. Beginning in the third quarter of 2019, we have reflected the results of these businesses as discontinued operations in the Consolidated Statements of Earnings for all periods presented. Prior periods have been adjusted to conform to the current presentation. The assets and liabilities of these businesses have been reflected in assets and liabilities of discontinued operations in the Consolidated Balance Sheet as of July 29, 2018. A portion of the U.S. refrigerated soup business historically included in Campbell Fresh was retained, and is now reported in Meals & Beverages. Within our international biscuits and snacks operating segment, we signed a definitive agreement for the sale of our Kelsen business on July 12, 2019, and completed the sale on September 23, 2019. We also signed a definitive agreement on August 1, 2019 for the sale of the Arnott's and international operations. Beginning in the fourth quarter of 2019, we have reflected the results of operations of the Kelsen business and the Arnott's and international operations, or Campbell International, as discontinued operations in the Consolidated Statements of Earnings for all periods presented. The assets and liabilities of these businesses have been reflected in assets and liabilities of discontinued operations in the Consolidated Balance Sheets as of July 28, 2019, and July 29, 2018. As of the fourth quarter of 2019, our reportable segments are as follows: Meals & Beverages, which includes the retail and foodservice businesses in the U.S. and Canada. The segment includes the following products: Campbell's condensed and ready-to-serve soups:Swanson broth and stocks; Pacific Foods broth, soups, non-dairy beverages and other simple meals; Prego pasta sauces; Pace Mexican sauces; Campbell's gravies, pasta, beans and dinner sauces; Swanson canned poultry; Plum baby food and snacks; V8 juices and beverages; and Campbell's tomato juice. The segment also includes the simple meals and shelf- stable beverages business in Latin America; and Snacks, which consists of Pepperidge Farm cookies, crackers, fresh bakery and frozen products in U.S. retail, includingMilano cookies and Goldfish crackers; and Snyder's of Hanover pretzels, Lance sandwich crackers, Cape Cod and Kettle Brand potato chips, Late July snacks, Snack Factory Pretzel Crisps, Pop Secret popcorn, Emerald nuts, and other snacking products in the U.S. and Canada. The segment also includes our European chips business. In 2018, our simple meals and shelf-stable beverages business in Latin America was managed as part of the Global Biscuits and Snacks segment. In 2019, it was managed as part of the Meals & Beverages segment. Segment results have been adjusted retrospectively to reflect this change. In 2020, it is managed as part of the Snacks segment. We evaluate segment performance before interest, taxes and costs associated with restructuring activities and impairment charges. Unrealized gains and losses on commodity hedging activities are excluded from segment operating earnings and are recorded in Corporate as these open positions represent hedges of future purchases. Upon closing of the contracts, the realized gain or loss is transferred to segment operating earnings, which allows the segments to reflect the economic effects of the hedge without exposure to quarterly volatility of unrealized gains and losses. Only the service cost component of pension and postretirement expense is allocated to segments. All other components of expense, including interest cost, expected return on assets, amortization of prior service credits and recognized actuarial gains and losses are reflected in Corporate and not included in segment operating results. Asset information by segment is not discretely maintained for internal reporting or used in evaluating performance. Therefore, only geographic segment asset information is provided. 55 Our largest customer, Wal-Mart Stores, Inc. and its affiliates, accounted for approximately 20% of consolidated net sales from continuing operations in2019, 22% in 2018, and 24% in 2017. The Kroger Co. and its affiliates accounted for approximately 9% of consolidated net sales from continuing operations in 2019, and 10% in 2018 and 2017. Both of our reportable segments sold products to Wal-Mart Stores, Inc. or its affiliates and mi

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Campbell Soup Company has four reportable segments US Simple Meals US Beverages International Simple Meals and International Beverages The segments are productbased as they are organized around the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started