Question

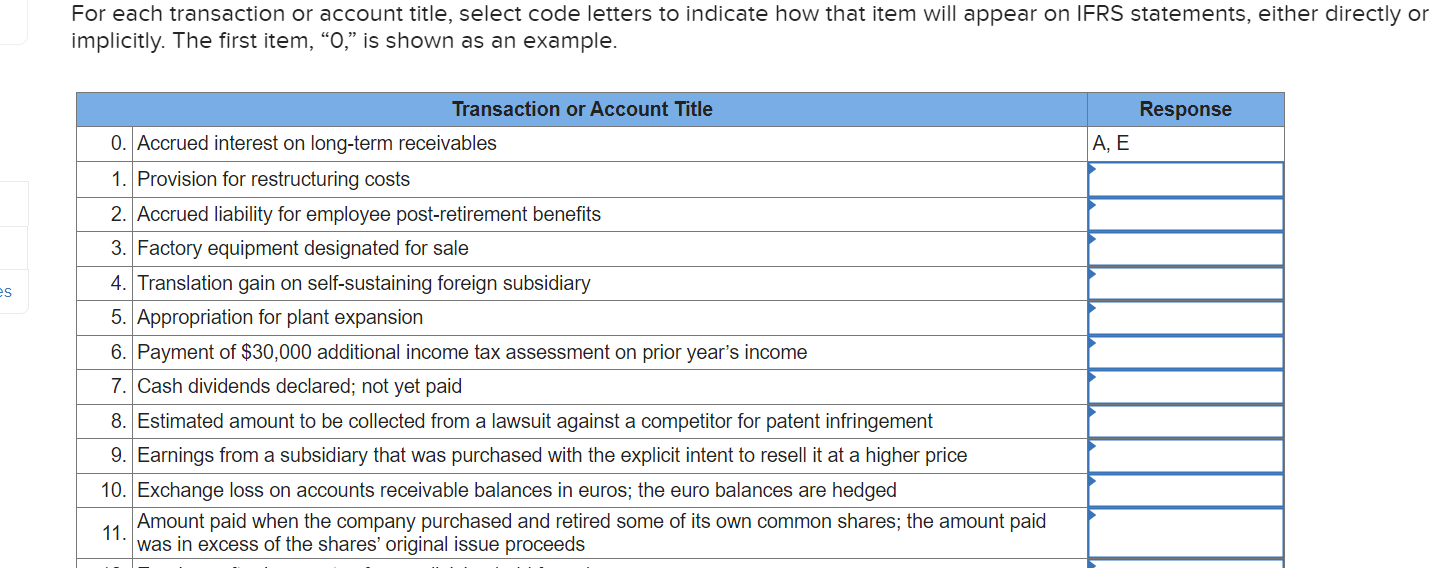

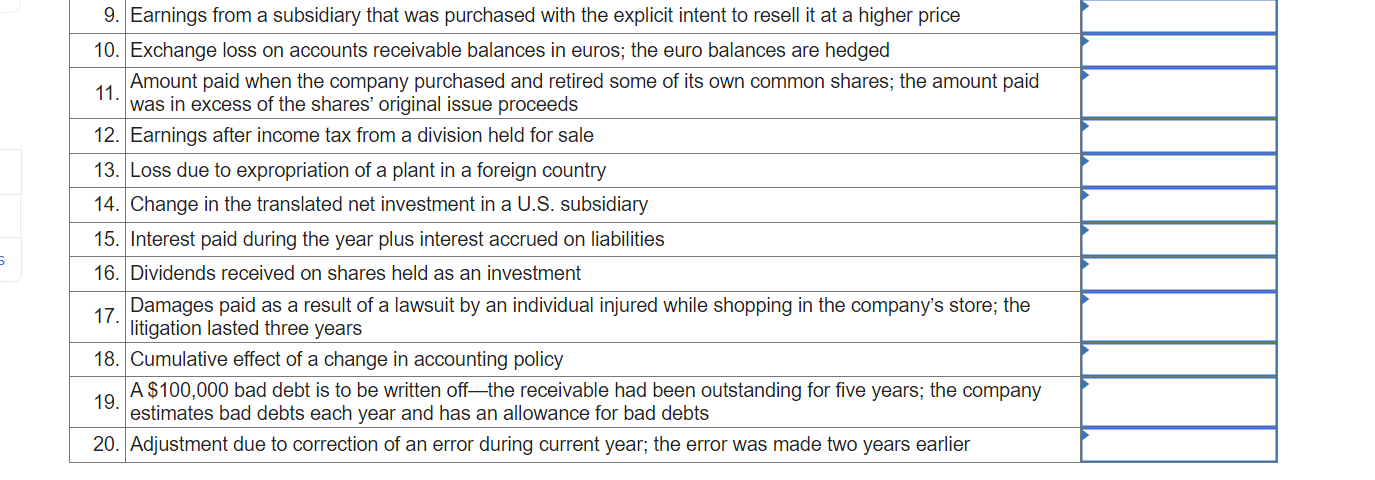

Listed below are some financial statement classifications coded with letters and, below them, selected transactions and/or account titles. Code Financial Statement Classification Statement of Comprehensive

Listed below are some financial statement classifications coded with letters and, below them, selected transactions and/or account titles. Code Financial Statement Classification Statement of Comprehensive Income A Earnings/loss from continuing operations B Earnings/loss from discontinued operations C Other comprehensive income D Earnings per share Statement of Financial Position E Current assets F Noncurrent assets G Current liabilities H Noncurrent liabilities I Shareholders equity Statement of Changes in Shareholders Equity J Beginning balance K An adjustment (addition to or deduction from) beginning balance L Change during the yearretained earnings M Change during the yearinvested capital (not designated as a discontinued operation) N Change during the yearitems of other comprehensive income O Notes to the financial statements Required: For each transaction or account title, select code letters to indicate how that item will appear on IFRS statements, either directly or implicitly. The first item, 0, is shown as an example.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started