Answered step by step

Verified Expert Solution

Question

1 Approved Answer

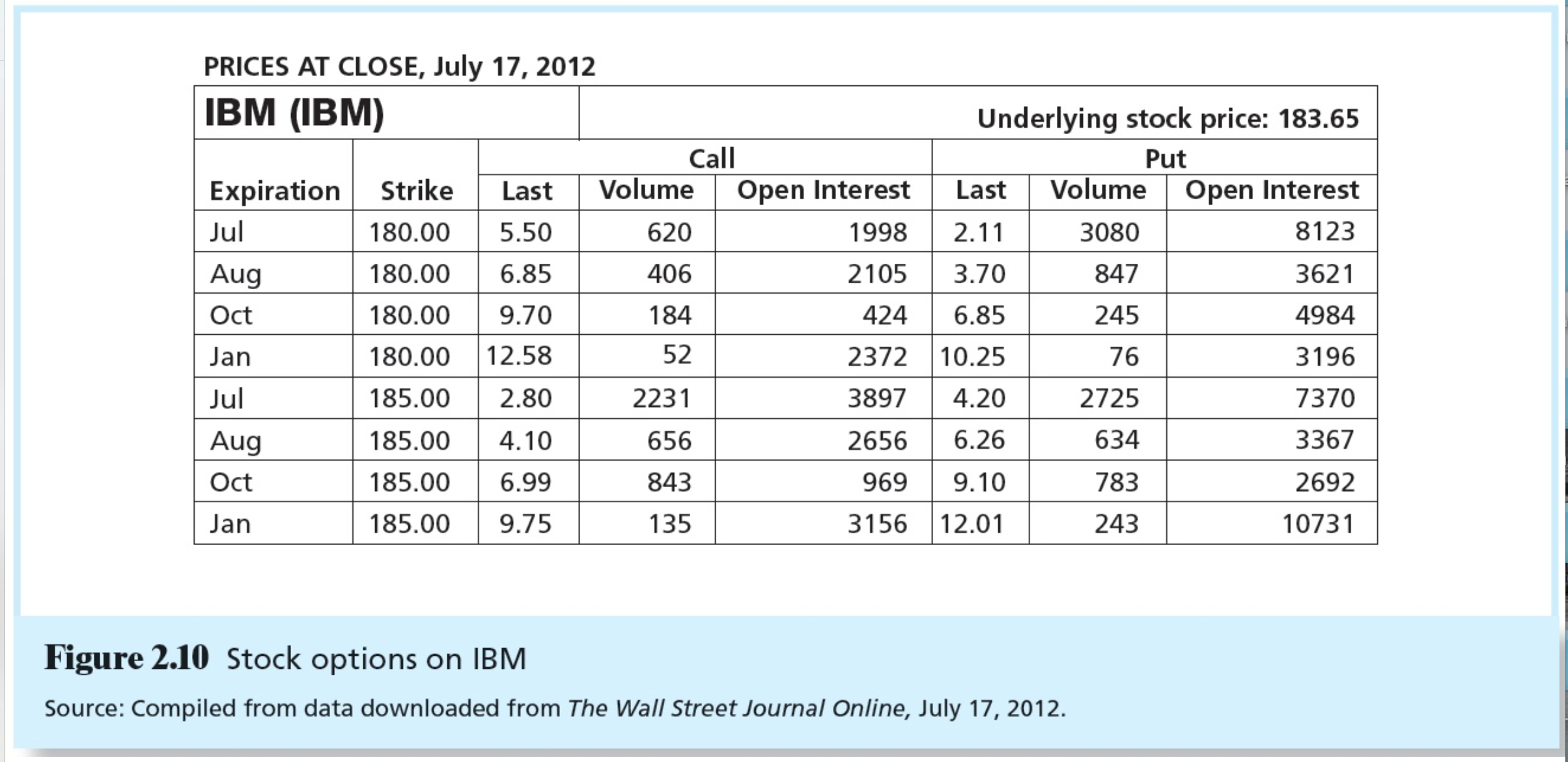

Refer to Figure 2.10 and look at the IBM options. Suppose you buy a October 2013 expiration call option with exercise price $185. b-1. If

|

|

| b-1. | If you had bought the October call with exercise price $180, will you exercise your call? | ||||

|

| b-2. | What is the profit (loss) on your position? (Input the amount as a positive value. Round your answer to 2 decimal places. Omit the "$" sign in your response.) |

| (Click to select)LossProfit | $ |

PRICES AT CLOSE, July 17, 2012 IBM (IBM) Underlying stock price: 183.65 Call Put Jul Aug Oct Jan Jul Aug Oct Jan Expiration Strike Last Volume Open Interest Last Volume Open Interest 8123 3621 4984 3196 7370 3367 2692 10731 180.005.50 180.00 6.85 180.00 9.70 180.00 12.58 185.002.80 185.00 4.10 185.00 6.99 185.009.75 620 406 184 52 2231 656 843 135 19982.11 2105 3.70 424 6.85 2372 10.25 3897 4.20 2656 6.26 969 9.10 3156 12.01 3080 847 245 76 2725 634 783 243 Figure 2.10 Stock options on IBM Source: Compiled from data downloaded from The Wall Street Journal Online, July 17, 2012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

Refer to Figure 2.10 and look at the IBM options. Suppose you buy a October 2013 expiration call option with exercise price $185.

Refer to Figure 2.10 and look at the IBM options. Suppose you buy a October 2013 expiration call option with exercise price $185.